Region:Global

Author(s):Shubham

Product Code:KRAD0659

Pages:97

Published On:August 2025

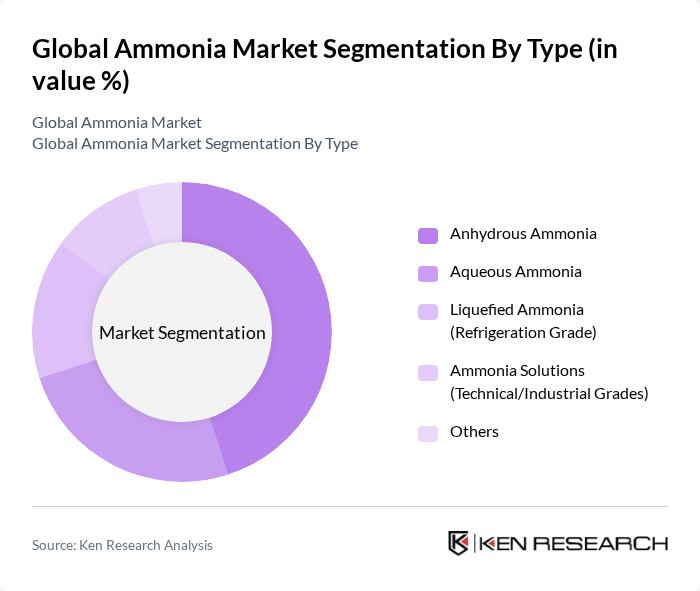

By Type:The ammonia market is segmented into various types, including Anhydrous Ammonia, Aqueous Ammonia, Liquefied Ammonia (Refrigeration Grade), Ammonia Solutions (Technical/Industrial Grades), and Others. Among these,Anhydrous Ammoniais the leading sub-segment due to its widespread use in agriculture as a nitrogen fertilizer; fertilizer applications account for the bulk of ammonia consumption globally. Its high nitrogen content and efficiency in promoting crop growth make it a preferred choice for farmers.Aqueous Ammoniais significant in industrial applications such as NOx control, water treatment, and chemical processing, benefitting from handling advantages in certain use cases .

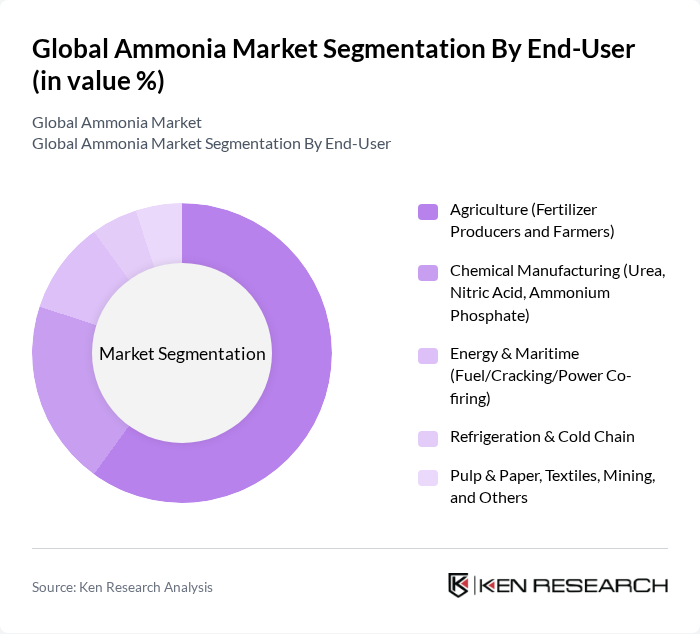

By End-User:The ammonia market is segmented by end-users, including Agriculture (Fertilizer Producers and Farmers), Chemical Manufacturing (Urea, Nitric Acid, Ammonium Phosphate), Energy & Maritime (Fuel/Cracking/Power Co-firing), Refrigeration & Cold Chain, and Pulp & Paper, Textiles, Mining, and Others. TheAgriculturesegment dominates the market, as fertilizers remain the primary outlet for ammonia demand worldwide. TheChemical Manufacturingsector also plays a significant role, using ammonia to produce urea, nitric acid, ammonium phosphate, and other downstream products. EmergingEnergy & Maritimeuses, including ammonia as a hydrogen carrier and potential marine fuel, are gaining attention with pilot projects and policy support in key regions .

The Global Ammonia Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, CF Industries Holdings, Inc., Nutrien Ltd., OCI Global N.V., BASF SE, Air Products and Chemicals, Inc., KBR, Inc., Mitsubishi Gas Chemical Company, Inc., SABIC (Saudi Basic Industries Corporation), QatarEnergy (QAFCO – Qatar Fertiliser Company), Linde plc, Acron Group, EuroChem Group AG, Koch Fertilizer, LLC (Koch Ag & Energy Solutions), Togliattiazot (PJSC TOAZ) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ammonia market appears promising, driven by a growing emphasis on sustainable practices and innovations in production technologies. As industries increasingly adopt green ammonia solutions, the market is likely to witness a shift towards environmentally friendly production methods. Additionally, the integration of ammonia in renewable energy storage systems is expected to gain traction, providing new avenues for growth. Overall, the ammonia market is poised for transformation, aligning with global sustainability goals and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Anhydrous Ammonia Aqueous Ammonia Liquefied Ammonia (Refrigeration Grade) Ammonia Solutions (Technical/Industrial Grades) Others |

| By End-User | Agriculture (Fertilizer Producers and Farmers) Chemical Manufacturing (Urea, Nitric Acid, Ammonium Phosphate) Energy & Maritime (Fuel/Cracking/Power Co-firing) Refrigeration & Cold Chain Pulp & Paper, Textiles, Mining, and Others |

| By Application | Fertilizers (Urea, Ammonium Nitrate, Ammonium Sulfate, MAP/DAP) Industrial Chemicals (Nitric Acid, Caprolactam, Acrylonitrile) Refrigeration (R717) Water and Wastewater Treatment Energy Carrier & Fuel (Blue/Green Ammonia, e-Ammonia) |

| By Distribution Channel | Direct Offtake Contracts (Producers to Industrial Buyers) Traders & Distributors (Bulk, Tank, Rail, Barge) Spot Market/Exchanges EPC/Utility Partnerships (for Energy Projects) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Production Process | Haber-Bosch (Natural Gas/Coal Feedstock) Blue Ammonia (Haber-Bosch with CCS) Green Ammonia (Electrolysis + Haber-Bosch) Emerging Routes (SOEC, Plasma, Electrochemical) Others |

| By Pricing Basis | Contract (Linked to Gas/Coal and Freight Indices) Spot (FOB/CFR Benchmarks) Premiums for Low-Carbon Certification Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Ammonia Usage | 120 | Farm Managers, Agronomists |

| Industrial Ammonia Applications | 100 | Production Supervisors, Chemical Engineers |

| Ammonia Supply Chain Dynamics | 80 | Logistics Coordinators, Supply Chain Analysts |

| Environmental Impact Assessments | 70 | Environmental Scientists, Policy Analysts |

| Market Trends and Innovations | 90 | Market Analysts, R&D Managers |

The Global Ammonia Market is valued at approximately USD 83 billion, reflecting sustained demand primarily from fertilizers and industrial applications. This valuation aligns with various industry trackers that indicate a stable market following recent price normalization.