Region:Global

Author(s):Shubham

Product Code:KRAA2715

Pages:81

Published On:August 2025

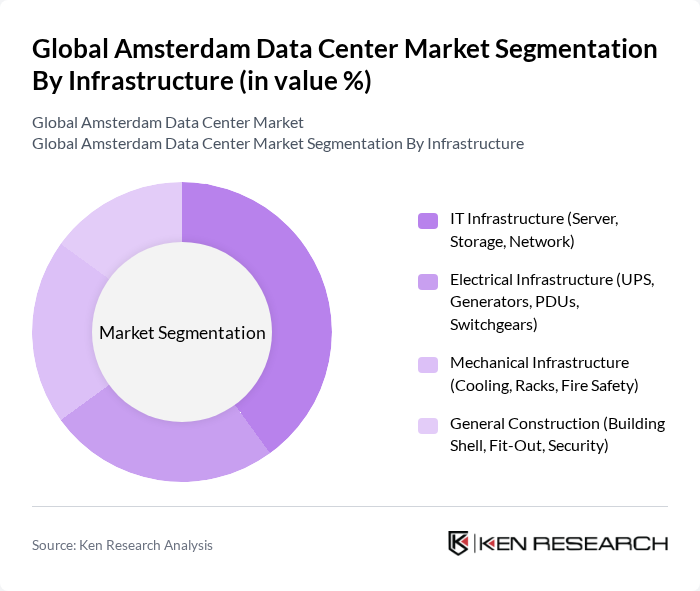

By Infrastructure:The infrastructure segment of the data center market includes various components essential for the operation of data centers. Key subsegments include IT Infrastructure (Server, Storage, Network), Electrical Infrastructure (UPS, Generators, PDUs, Switchgears), Mechanical Infrastructure (Cooling, Racks, Fire Safety), and General Construction (Building Shell, Fit-Out, Security). Among these, IT Infrastructure remains the most dominant due to the increasing reliance on cloud computing, artificial intelligence, and advanced data analytics, which drive demand for high-performance server and storage solutions .

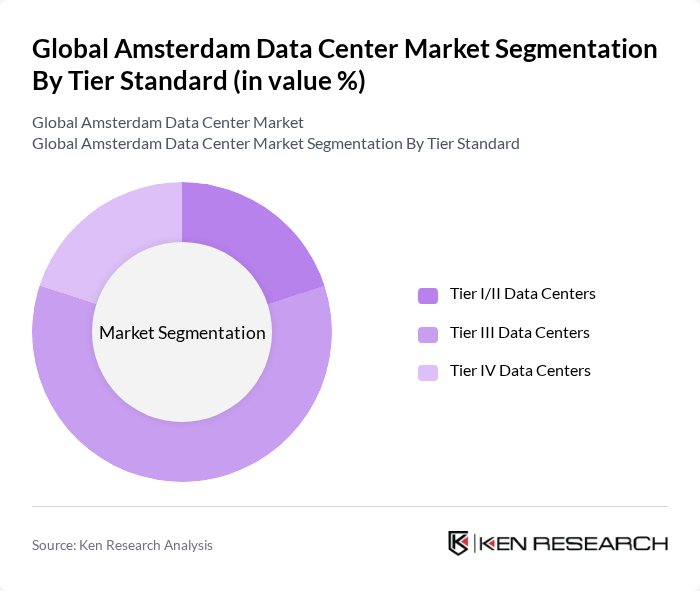

By Tier Standard:The tier standard segment categorizes data centers based on their design and operational reliability. The subsegments include Tier I/II Data Centers, Tier III Data Centers, and Tier IV Data Centers. Tier III Data Centers continue to dominate the market due to their optimal balance of cost, operational efficiency, and reliability, making them the preferred choice for enterprises requiring high availability and redundancy .

The Global Amsterdam Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Digital Realty Trust, Inc., Interxion (Digital Realty), NTT Global Data Centers EMEA B.V., Global Switch Holdings Limited, NorthC Datacenters, EdgeConneX, Inc., Iron Mountain Incorporated, Bytesnet B.V., Microsoft Azure, Amazon Web Services, Inc., Google Cloud Platform, OVHcloud, Switch Datacenters Amsterdam B.V., Dataplace B.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Amsterdam data center market appears promising, driven by technological advancements and increasing digitalization. As businesses continue to adopt cloud solutions and edge computing, data centers will need to evolve to meet these demands. The integration of renewable energy sources and advanced cooling technologies will become essential to address sustainability concerns. Furthermore, strategic partnerships with tech firms will enhance service offerings, positioning Amsterdam as a leading data center hub in Europe, fostering innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Infrastructure | IT Infrastructure (Server, Storage, Network) Electrical Infrastructure (UPS, Generators, PDUs, Switchgears) Mechanical Infrastructure (Cooling, Racks, Fire Safety) General Construction (Building Shell, Fit-Out, Security) |

| By Tier Standard | Tier I/II Data Centers Tier III Data Centers Tier IV Data Centers |

| By Industry Vertical | IT and Telecommunications Financial Services Healthcare Government Retail & E-commerce Others |

| By Data Center Size | Hyperscale Data Centers Colocation Data Centers Edge Data Centers Modular Data Centers |

| By Geography | Amsterdam Rotterdam Zwolle Groningen Almere Hengelo Eindhoven Eemshaven Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 60 | Data Center Managers, IT Directors |

| Hyperscale Data Centers | 50 | Cloud Architects, Operations Managers |

| Energy Efficiency Initiatives | 40 | Sustainability Officers, Facility Engineers |

| Managed Hosting Solutions | 45 | Product Managers, Sales Directors |

| Data Security Compliance | 55 | Compliance Officers, Risk Management Executives |

The Global Amsterdam Data Center Market is valued at approximately USD 1.7 billion, driven by increasing demand for cloud services, data storage, and digital content proliferation, reinforcing Amsterdam's significance in the European data center landscape.