Region:Global

Author(s):Dev

Product Code:KRAB0659

Pages:93

Published On:August 2025

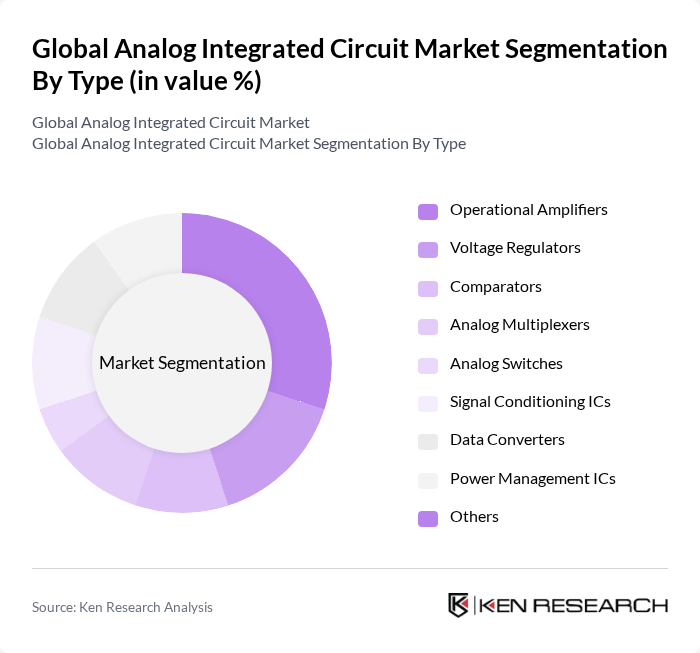

By Type:The analog integrated circuit market is segmented into various types, including operational amplifiers, voltage regulators, comparators, analog multiplexers, analog switches, signal conditioning ICs, data converters, power management ICs, and others. Among these, operational amplifiers and power management ICs are leading the market due to their extensive applications in consumer electronics, automotive, and industrial sectors. The demand for energy-efficient solutions and the integration of analog ICs in smart devices, wearables, and automotive safety systems are driving the growth of power management ICs, while operational amplifiers remain essential for signal processing and conditioning in a wide range of electronic devices .

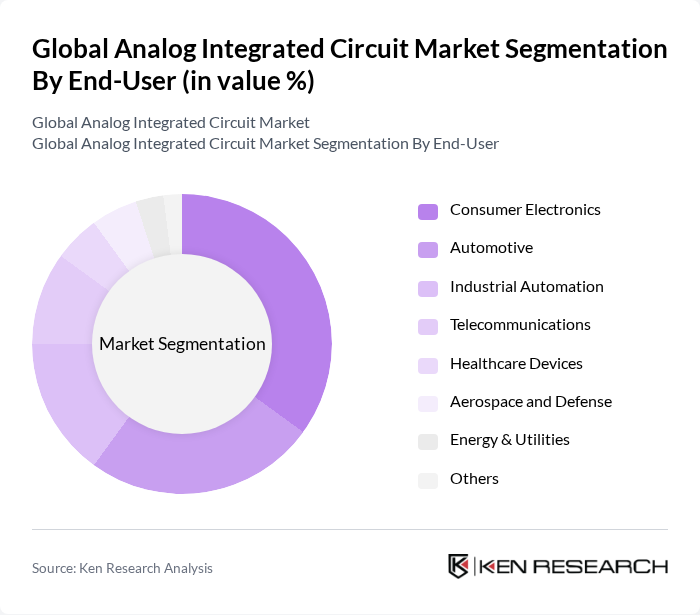

By End-User:The market is also segmented by end-user applications, including consumer electronics, automotive, industrial automation, telecommunications, healthcare devices, aerospace and defense, energy & utilities, and others. The consumer electronics segment holds a significant share due to the increasing adoption of smart devices, wearables, and connected home products. The automotive sector is also witnessing substantial growth, driven by the demand for advanced driver-assistance systems (ADAS), electric vehicles (EVs), and in-vehicle infotainment, all of which require sophisticated analog solutions. Industrial automation and telecommunications are expanding rapidly with the integration of IoT and 5G technologies, further boosting analog IC adoption .

The Global Analog Integrated Circuit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Incorporated, Analog Devices, Inc., STMicroelectronics N.V., NXP Semiconductors N.V., Infineon Technologies AG, ON Semiconductor Corporation, Maxim Integrated Products, Inc., Microchip Technology Incorporated, Renesas Electronics Corporation, Broadcom Inc., Skyworks Solutions, Inc., Qualcomm Incorporated, Semtech Corporation, MediaTek Inc., Taiwan Semiconductor Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the analog integrated circuit market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of AI and machine learning into consumer electronics and automotive systems is expected to enhance the functionality of analog components. Additionally, the push for energy-efficient solutions will likely lead to innovations in analog design, fostering growth. As emerging markets continue to develop, the demand for analog solutions will expand, creating new opportunities for manufacturers and investors alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Operational Amplifiers Voltage Regulators Comparators Analog Multiplexers Analog Switches Signal Conditioning ICs Data Converters Power Management ICs Others |

| By End-User | Consumer Electronics Automotive Industrial Automation Telecommunications Healthcare Devices Aerospace and Defense Energy & Utilities Others |

| By Application | Signal Processing Power Management Data Conversion Sensing Communication Audio & Video Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Value-Added Resellers Others |

| By Component | Resistors Capacitors Inductors Diodes Transistors Integrated Circuits (ICs) Others |

| By Price Range | Low Price Mid Price High Price Premium Price |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Applications | 150 | Product Managers, Design Engineers |

| Automotive Electronics Integration | 100 | Automotive Engineers, Procurement Managers |

| Industrial Automation Solutions | 80 | Operations Managers, Technical Directors |

| Telecommunications Equipment | 60 | Network Engineers, Product Development Leads |

| Healthcare Devices | 40 | Biomedical Engineers, Regulatory Affairs Specialists |

The Global Analog Integrated Circuit Market is valued at approximately USD 76 billion, driven by the increasing demand for consumer electronics, automotive applications, and industrial automation, among other factors.