Region:Global

Author(s):Dev

Product Code:KRAD0439

Pages:96

Published On:August 2025

By Type:The market is segmented into various types of treatments, including oral iron therapies, parenteral/intravenous iron, erythropoiesis-stimulating agents, hypoxia-inducible factor prolyl hydroxylase inhibitors, vitamin B12 and folate supplements, blood transfusions, and others. Among these, oral iron therapies are the most widely used due to their ease of administration and cost-effectiveness, making them a preferred choice for patients with iron-deficiency anemia.

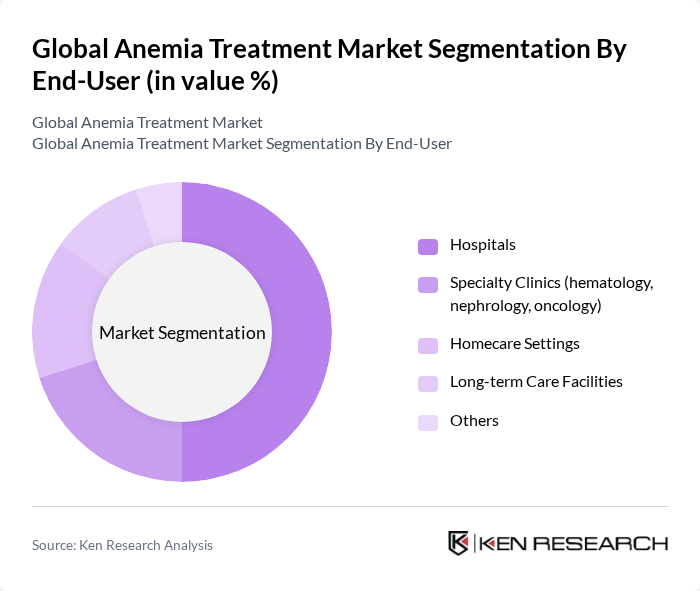

By End-User:The end-user segmentation includes hospitals, specialty clinics, homecare settings, long-term care facilities, and others. Hospitals are the leading end-users due to their capacity to provide comprehensive care and access to advanced treatment options, which are essential for managing severe cases of anemia.

The Global Anemia Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Novartis AG, Pfizer Inc., F. Hoffmann-La Roche Ltd, Sanofi S.A., Takeda Pharmaceutical Company Limited, Bayer AG, GSK plc, Merck & Co., Inc. (MSD), AstraZeneca plc, CSL Vifor (formerly Vifor Pharma AG), Daiichi Sankyo Company, Limited, Akebia Therapeutics, Inc., FibroGen, Inc., Astellas Pharma Inc., Otsuka Pharmaceutical Co., Ltd., Pharmacosmos A/S, AMAG Pharmaceuticals, Inc. (Feraheme brand; legacy/asset owner context), Zydus Lifesciences Limited, Dr. Reddy’s Laboratories Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of anemia treatment inis poised for significant transformation, driven by technological advancements and increased healthcare investments. The integration of telemedicine and AI in diagnosis is expected to enhance patient access and treatment efficacy. Furthermore, a growing emphasis on preventive healthcare will likely shift focus towards early intervention strategies, improving overall health outcomes. As healthcare systems adapt, the market is set to evolve, presenting new avenues for growth and innovation in anemia management.

| Segment | Sub-Segments |

|---|---|

| By Type | Oral Iron Therapies (e.g., ferrous sulfate, ferrous fumarate, polysaccharide iron complex) Parenteral/Intravenous Iron (e.g., ferric carboxymaltose, iron sucrose, ferumoxytol) Erythropoiesis-Stimulating Agents (epoetin alfa, darbepoetin alfa, biosimilars) Hypoxia-Inducible Factor Prolyl Hydroxylase Inhibitors (HIF-PHIs; e.g., roxadustat, daprodustat, vadadustat) Vitamin B12 (cyanocobalamin, hydroxocobalamin) and Folate Supplements Blood and Blood Component Transfusion Others (adjuncts such as L-carnitine, vitamin C co-therapy) |

| By End-User | Hospitals Specialty Clinics (hematology, nephrology, oncology) Homecare Settings Long-term Care Facilities Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Drug Stores Online Pharmacies Direct/Institutional Sales & Tenders Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients |

| By Severity of Anemia | Mild Anemia Moderate Anemia Severe Anemia |

| By Treatment Setting | Inpatient Treatment Outpatient Treatment Emergency Treatment Others |

| By Etiology | Iron-Deficiency Anemia Anemia of Chronic Kidney Disease Anemia of Chronic Disease/Inflammation Hemolytic and Sickle Cell Disease–Related Anemia Megaloblastic Anemia (Vitamin B12/Folate Deficiency) Chemotherapy-Induced Anemia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hematology Clinics | 100 | Hematologists, Clinic Managers |

| Pharmaceutical Companies | 80 | Product Managers, R&D Directors |

| Hospitals and Healthcare Systems | 120 | Healthcare Administrators, Treatment Coordinators |

| Patient Advocacy Groups | 60 | Advocacy Leaders, Patient Outreach Coordinators |

| Regulatory Bodies | 50 | Regulatory Affairs Specialists, Policy Analysts |

The Global Anemia Treatment Market is valued at approximately USD 12.6 billion, reflecting a significant growth driven by the increasing prevalence of anemia, particularly in developing regions, and advancements in treatment options.