Region:Global

Author(s):Dev

Product Code:KRAB0430

Pages:99

Published On:August 2025

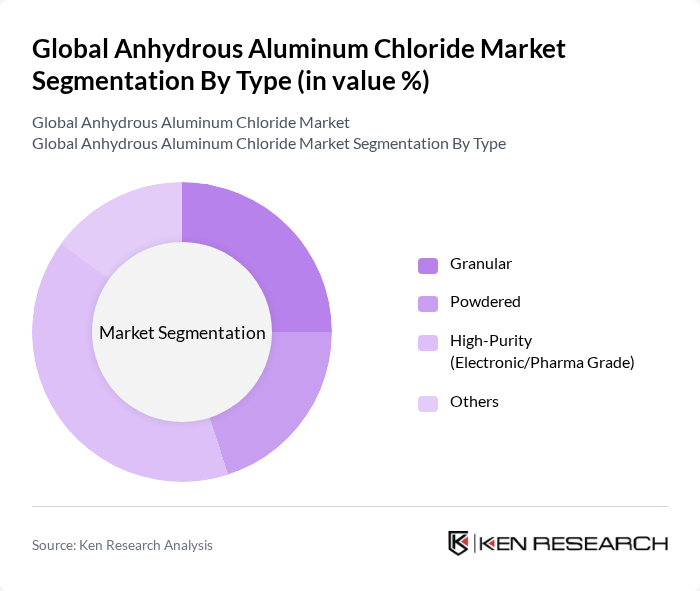

By Type:

The market is segmented into four types: Granular, Powdered, High-Purity (Electronic/Pharma Grade), and Others. Among these, the High-Purity (Electronic/Pharma Grade) segment is currently dominating the market due to the increasing demand for high-quality aluminum chloride in pharmaceuticals and electronics. The stringent quality requirements in these sectors drive manufacturers to focus on high-purity products, leading to a significant market share for this sub-segment.

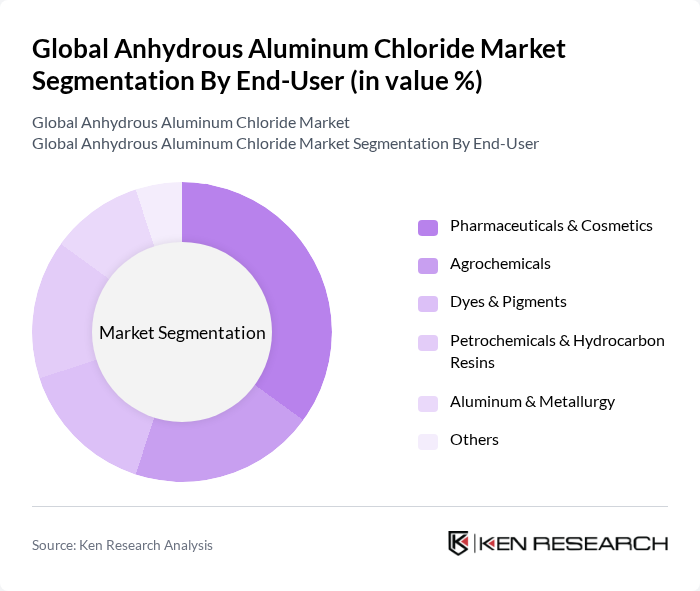

By End-User:

The end-user segments include Pharmaceuticals & Cosmetics, Agrochemicals, Dyes & Pigments, Petrochemicals & Hydrocarbon Resins, Aluminum & Metallurgy, and Others. The Pharmaceuticals & Cosmetics segment is leading the market, driven by the growing demand for high-purity aluminum chloride in drug formulation and cosmetic products. This trend is fueled by increasing consumer awareness regarding health and beauty, which propels the demand for quality ingredients in these sectors.

The Global Anhydrous Aluminum Chloride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aditya Birla Chemicals, BASF SE, Gujarat Alkalies and Chemicals Limited (GACL), DCM Shriram Ltd., Kanto Denka Kogyo Co., Ltd., Tanfac Industries Limited, Nippon Light Metal Co., Ltd., Jiangshan Chemical Co., Ltd., Hubei Jusheng Technology Co., Ltd., Shandong Xinfa Aluminum Group Co., Ltd., Syrgis Performance Products (Vanchlor Company, Inc.), UPRA CHEM Pvt. Ltd., Seabert Chemicals Pvt. Ltd., Real MetalChem Private Limited, GFS Chemicals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anhydrous aluminum chloride market appears promising, driven by increasing demand across various sectors, particularly water treatment and pharmaceuticals. As industries strive for sustainable practices, innovations in production methods are likely to emerge, enhancing efficiency and reducing environmental impact. Additionally, the ongoing digital transformation in supply chains will facilitate better resource management and operational efficiency, positioning the market for robust growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Granular Powdered High-Purity (Electronic/Pharma Grade) Others |

| By End-User | Pharmaceuticals & Cosmetics Agrochemicals Dyes & Pigments Petrochemicals & Hydrocarbon Resins Aluminum & Metallurgy Others |

| By Application | Friedel–Crafts Catalysts (Alkylation/Acylation) Dyes & Pigments Synthesis Pharmaceuticals Intermediates Pesticides & Specialty Chemicals Electrolytic Aluminum and Fumed Alumina Others |

| By Distribution Channel | Direct Sales (Producers to End-Users) Authorized Distributors Online/Spot Market Platforms Others |

| By Packaging Type | Bulk Packaging (Drums, Super Sacks) Small Packaging (Bottles, Bags) Moisture-Proof/Custom Packaging Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 100 | R&D Managers, Quality Control Analysts |

| Cosmetic Industry Usage | 80 | Product Development Managers, Regulatory Affairs Specialists |

| Water Treatment Facilities | 70 | Environmental Engineers, Operations Supervisors |

| Food Processing Sector | 60 | Food Safety Managers, Procurement Officers |

| Industrial Manufacturing | 90 | Production Managers, Supply Chain Coordinators |

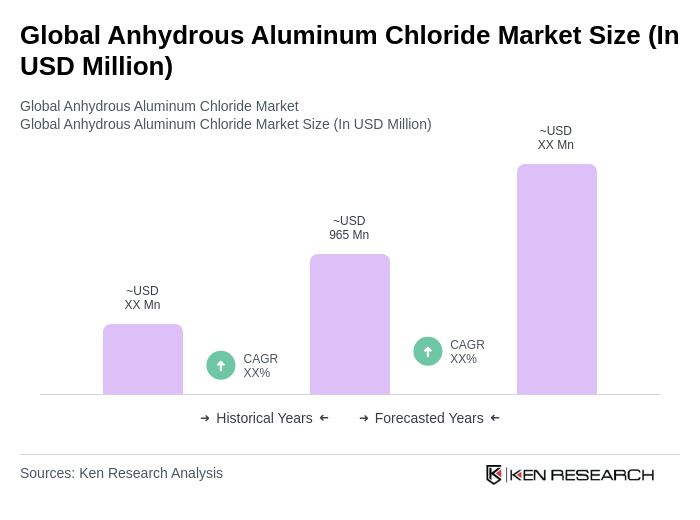

The Global Anhydrous Aluminum Chloride Market is valued at approximately USD 965 million, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by increasing demand across various industries, including pharmaceuticals and petrochemicals.