Region:Global

Author(s):Dev

Product Code:KRAC0491

Pages:80

Published On:August 2025

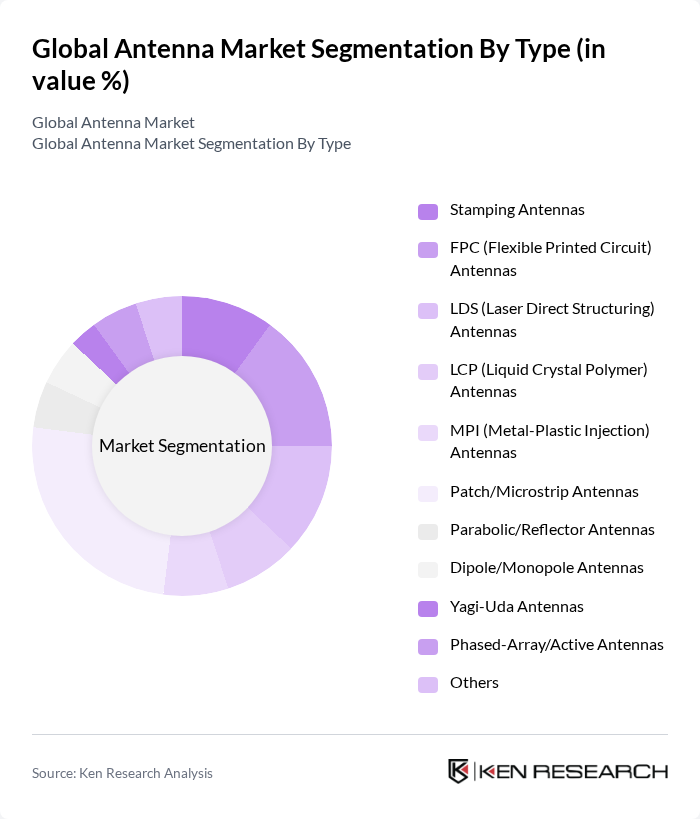

By Type:The market is segmented into various types of antennas, including Stamping Antennas, FPC (Flexible Printed Circuit) Antennas, LDS (Laser Direct Structuring) Antennas, LCP (Liquid Crystal Polymer) Antennas, MPI (Metal-Plastic Injection) Antennas, Patch/Microstrip Antennas, Parabolic/Reflector Antennas, Dipole/Monopole Antennas, Yagi-Uda Antennas, Phased-Array/Active Antennas, and Others. Among these, Patch/Microstrip Antennas are widely used across mobile devices and IoT due to their compact size, low profile, and ease of integration; meanwhile, phased?array/active antennas are increasingly adopted in 5G base stations and radar owing to beamforming and MIMO requirements.

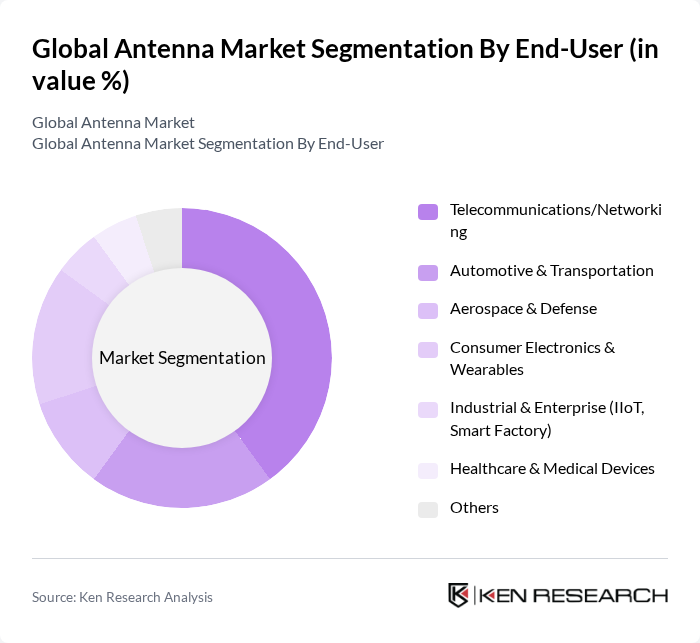

By End-User:The market is segmented by end-users, including Telecommunications/Networking, Automotive & Transportation, Aerospace & Defense, Consumer Electronics & Wearables, Industrial & Enterprise (IIoT, Smart Factory), Healthcare & Medical Devices, and Others. The Telecommunications/Networking segment leads due to sustained 5G deployments, densification with small cells, and upgrades to Wi?Fi and private networks; strong contributions also come from automotive telematics, V2X, and defense radar/satcom.

The Global Antenna Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amphenol Corporation, TE Connectivity Ltd., Laird Connectivity, PCTEL, Inc., Antenova Ltd., Molex (a Koch company), Qualcomm Technologies, Inc., Qorvo, Inc., Skyworks Solutions, Inc., Cobham Advanced Electronic Solutions (CAES), Kathrein SE (Kathrein Mobile Communication), CommScope Holding Company, Inc., Huawei Technologies Co., Ltd., Rohde & Schwarz GmbH & Co. KG, L3Harris Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antenna market is poised for significant transformation, driven by technological advancements and evolving consumer needs. As 5G technology continues to expand, the demand for innovative antenna solutions will increase, particularly in urban areas where connectivity is paramount. Additionally, the integration of antennas into consumer electronics will become more prevalent, enhancing device functionality. Companies that invest in sustainable materials and advanced manufacturing processes will likely gain a competitive edge, positioning themselves favorably in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Stamping Antennas FPC (Flexible Printed Circuit) Antennas LDS (Laser Direct Structuring) Antennas LCP (Liquid Crystal Polymer) Antennas MPI (Metal-Plastic Injection) Antennas Patch/Microstrip Antennas Parabolic/Reflector Antennas Dipole/Monopole Antennas Yagi-Uda Antennas Phased-Array/Active Antennas Others |

| By End-User | Telecommunications/Networking Automotive & Transportation Aerospace & Defense Consumer Electronics & Wearables Industrial & Enterprise (IIoT, Smart Factory) Healthcare & Medical Devices Others |

| By Application | Cellular Communications (4G/5G) Wi?Fi/WLAN & WiMAX Satellite Communications (SATCOM) Radar & Navigation RFID/NFC & Asset Tracking GNSS/GPS Others |

| By Frequency Range | LF/VLF (?300 kHz) HF (3–30 MHz) VHF (30–300 MHz) UHF (300–1000 MHz) SHF (1–30 GHz) EHF/mmWave (30–300 GHz) Others |

| By Distribution Channel | Direct/OEM Sales Online (Company Web, Marketplaces) Distributors/Channel Partners Value-Added Resellers (VARs) Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price Premium Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cellular Antenna Deployment | 150 | Network Engineers, Project Managers |

| Satellite Communication Systems | 100 | Satellite Operations Managers, Technical Directors |

| Wi-Fi Infrastructure Development | 80 | IT Managers, Network Administrators |

| IoT Antenna Applications | 70 | Product Development Engineers, IoT Specialists |

| Automotive Antenna Integration | 60 | Automotive Engineers, R&D Managers |

The Global Antenna Market is valued at approximately USD 25 billion, driven by factors such as increasing wireless data consumption, the proliferation of IoT devices, and the rollout of 5G technology, which necessitates advanced antenna solutions.