Region:Global

Author(s):Geetanshi

Product Code:KRAD0025

Pages:100

Published On:August 2025

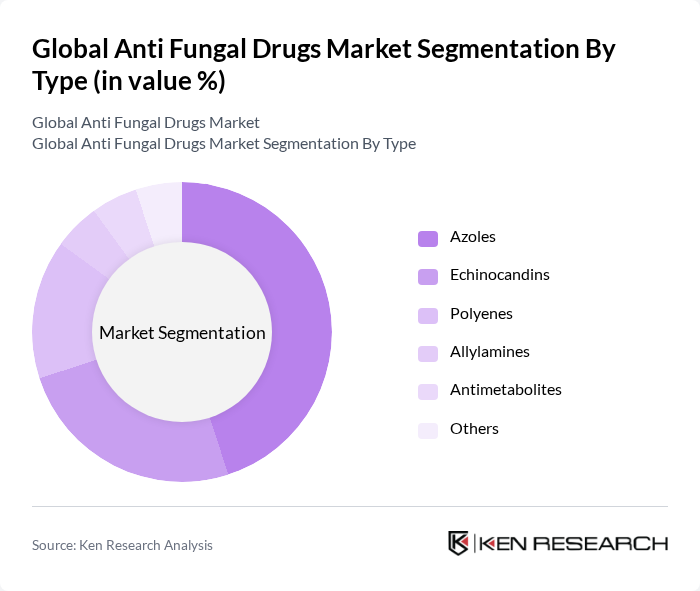

By Type:The antifungal drugs market is segmented into Azoles, Echinocandins, Polyenes, Allylamines, Antimetabolites, and Others. Azoles are the most widely used due to their broad-spectrum activity and effectiveness against various fungal infections. Echinocandins are increasingly preferred for their favorable safety profile and efficacy against resistant strains. The demand for these drugs is driven by the rising incidence of both superficial and invasive fungal infections, the emergence of drug-resistant fungi, and the need for effective and safe treatment options .

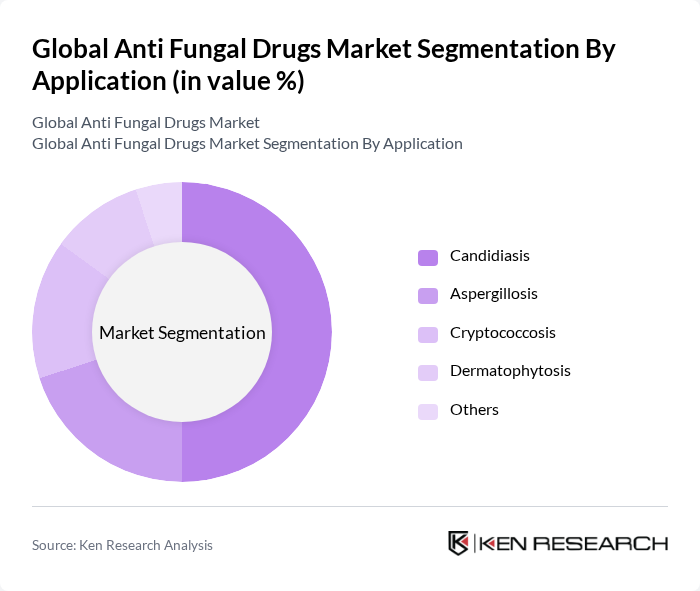

By Application:The antifungal drugs market is also segmented by application, including Candidiasis, Aspergillosis, Cryptococcosis, Dermatophytosis, and Others. Candidiasis remains the leading application segment due to the high prevalence of Candida infections, particularly among immunocompromised and hospitalized patients. Aspergillosis is a significant concern in patients with underlying lung diseases and weakened immune systems. Increased awareness, improved diagnostic capabilities, and the need for effective therapies are driving the growth of these segments .

The Global Anti Fungal Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Gilead Sciences, Inc., Astellas Pharma Inc., Novartis AG, Johnson & Johnson, Bristol-Myers Squibb Company, GlaxoSmithKline plc, Sanofi S.A., AbbVie Inc., F. Hoffmann-La Roche Ltd, Eli Lilly and Company, Bayer AG, Amgen Inc., Takeda Pharmaceutical Company Limited, Glenmark Pharmaceuticals Ltd., Cipla Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., F2G Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the antifungal drugs market is poised for significant transformation, driven by ongoing research and technological advancements. The focus on personalized medicine is expected to enhance treatment efficacy, while the rise of combination therapies will address drug resistance challenges. Additionally, increased collaboration between pharmaceutical companies and research institutions will foster innovation, leading to the development of novel antifungal agents. These trends will shape the market landscape, ensuring better patient outcomes and expanding access to effective treatments.

| Segment | Sub-Segments |

|---|---|

| By Type | Azoles Echinocandins Polyenes Allylamines Antimetabolites Others |

| By Application | Candidiasis Aspergillosis Cryptococcosis Dermatophytosis Others |

| By Route of Administration | Oral Intravenous Topical Others |

| By Dosage Form | Tablet Ointment Cream Powder Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Hospitals Specialty Clinics Homecare Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Pharmacists | 100 | Pharmacy Directors, Clinical Pharmacists |

| Infectious Disease Specialists | 60 | Consultants, Attending Physicians |

| Pharmaceutical Sales Representatives | 50 | Sales Managers, Territory Representatives |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Specialists |

| Clinical Trial Investigators | 40 | Research Coordinators, Principal Investigators |

The Global Anti Fungal Drugs Market is valued at approximately USD 16 billion, driven by the increasing prevalence of fungal infections, advancements in drug formulations, and a growing geriatric population susceptible to infections.