Region:Global

Author(s):Rebecca

Product Code:KRAD0234

Pages:86

Published On:August 2025

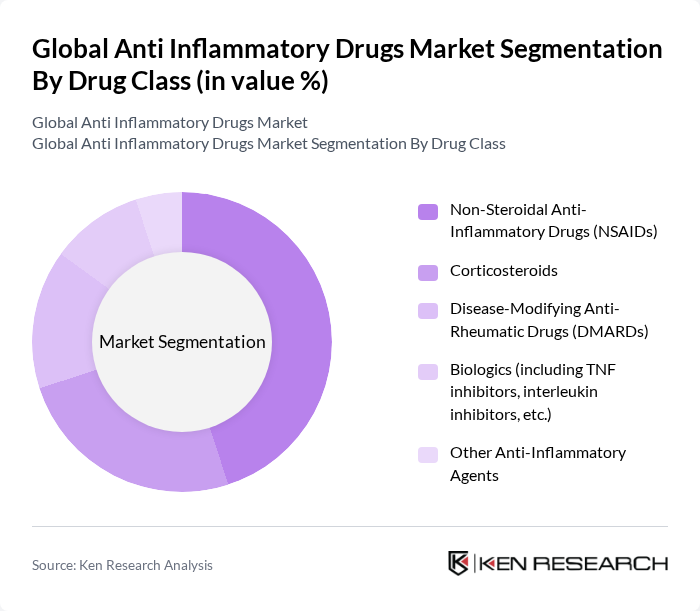

By Drug Class:The anti-inflammatory drugs market is segmented into various drug classes, including Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), Corticosteroids, Disease-Modifying Anti-Rheumatic Drugs (DMARDs), Biologics (including TNF inhibitors, interleukin inhibitors, etc.), and Other Anti-Inflammatory Agents. Among these, NSAIDs hold the largest market share due to their widespread use for pain relief and inflammation management in conditions like arthritis and musculoskeletal disorders. The increasing preference for over-the-counter NSAIDs for self-medication, along with the continued development of safer NSAID formulations, further boosts their market share .

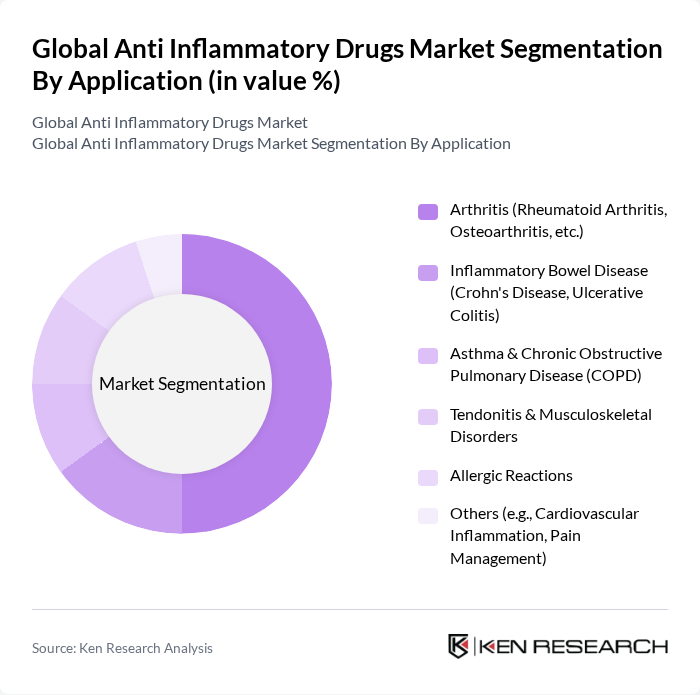

By Application:The applications of anti-inflammatory drugs include Arthritis (Rheumatoid Arthritis, Osteoarthritis, etc.), Inflammatory Bowel Disease (Crohn's Disease, Ulcerative Colitis), Asthma & Chronic Obstructive Pulmonary Disease (COPD), Tendonitis & Musculoskeletal Disorders, Allergic Reactions, and Others (e.g., Cardiovascular Inflammation, Pain Management). The arthritis segment holds the largest share due to the high prevalence of arthritis among the aging population and the increasing demand for effective pain management solutions. Additionally, the market is witnessing a rise in the use of anti-inflammatory drugs for chronic respiratory and gastrointestinal disorders, reflecting broader therapeutic adoption .

The Global Anti Inflammatory Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Novartis AG, Merck & Co., Inc., AbbVie Inc., GlaxoSmithKline plc, Amgen Inc., Sanofi S.A., Bristol-Myers Squibb Company, Takeda Pharmaceutical Company Limited, Astellas Pharma Inc., Gilead Sciences, Inc., Eli Lilly and Company, Bayer AG, Teva Pharmaceutical Industries Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anti-inflammatory drugs market appears promising, driven by ongoing research and technological advancements. The integration of digital health solutions is expected to enhance treatment adherence and patient monitoring. Furthermore, the shift towards personalized medicine will likely lead to more effective therapies tailored to individual patient needs. As the market evolves, collaborations between pharmaceutical companies and tech firms will foster innovation, ensuring the development of safer and more effective anti-inflammatory treatments.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) Corticosteroids Disease-Modifying Anti-Rheumatic Drugs (DMARDs) Biologics (including TNF inhibitors, interleukin inhibitors, etc.) Other Anti-Inflammatory Agents |

| By Application | Arthritis (Rheumatoid Arthritis, Osteoarthritis, etc.) Inflammatory Bowel Disease (Crohn's Disease, Ulcerative Colitis) Asthma & Chronic Obstructive Pulmonary Disease (COPD) Tendonitis & Musculoskeletal Disorders Allergic Reactions Others (e.g., Cardiovascular Inflammation, Pain Management) |

| By Route of Administration | Oral Injectable Inhalation Topical Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Hospitals Clinics Homecare Settings Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rheumatology Clinics | 100 | Rheumatologists, Nurse Practitioners |

| Pharmacy Chains | 70 | Pharmacists, Pharmacy Managers |

| Patient Advocacy Groups | 50 | Patient Representatives, Healthcare Advocates |

| Healthcare Providers | 90 | General Practitioners, Specialists |

| Clinical Research Organizations | 60 | Clinical Researchers, Data Analysts |

The Global Anti Inflammatory Drugs Market is valued at approximately USD 130 billion, driven by the increasing prevalence of chronic inflammatory diseases, an aging population, and advancements in drug formulations.