Region:Global

Author(s):Geetanshi

Product Code:KRAB0011

Pages:100

Published On:August 2025

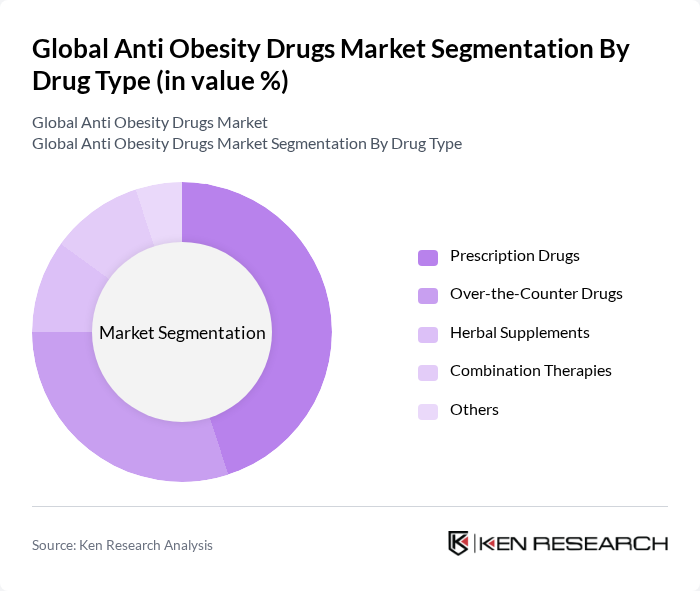

By Drug Type:The market is segmented into various drug types, including Prescription Drugs, Over-the-Counter Drugs, Herbal Supplements, Combination Therapies, and Others. Prescription drugs are currently the leading segment due to their proven clinical effectiveness and the growing trend of healthcare professionals prescribing these medications for weight management. Over-the-counter drugs are also gaining traction as consumers seek more accessible and self-managed solutions for obesity management. Herbal supplements and combination therapies are increasingly being explored, particularly in markets with high consumer interest in alternative and adjunctive therapies.

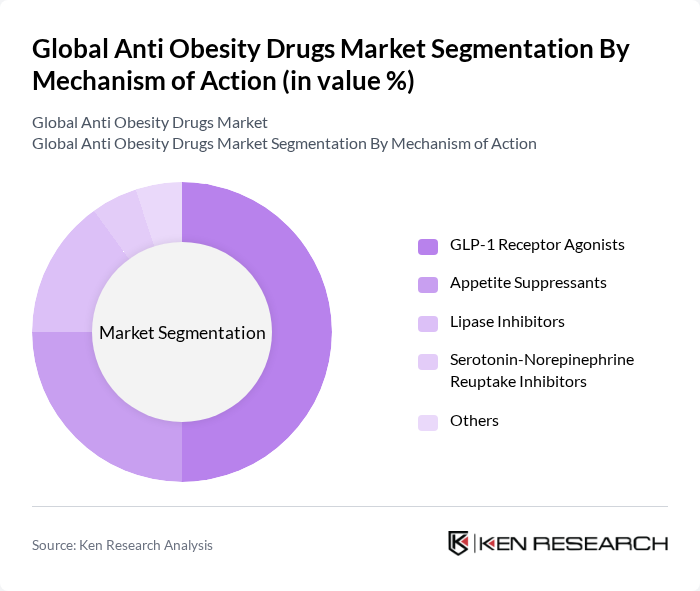

By Mechanism of Action:The market is categorized based on the mechanism of action into GLP-1 Receptor Agonists, Appetite Suppressants, Lipase Inhibitors, Serotonin-Norepinephrine Reuptake Inhibitors, and Others. GLP-1 Receptor Agonists are leading the market due to their dual action of promoting weight loss and improving glycemic control, making them a preferred choice among healthcare providers and patients. Appetite suppressants and lipase inhibitors remain important, but the rapid adoption of GLP-1 therapies is reshaping the competitive landscape.

The Global Anti Obesity Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novo Nordisk A/S, Eli Lilly and Company, Pfizer Inc., GlaxoSmithKline plc, Sanofi S.A., Amgen Inc., AstraZeneca plc, Merck & Co., Inc., Takeda Pharmaceutical Company Limited, Boehringer Ingelheim GmbH, Rhythm Pharmaceuticals, Inc., Currax Pharmaceuticals LLC, Gelesis Holdings, Inc., VIVUS LLC, Arena Pharmaceuticals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anti-obesity drugs market appears promising, driven by ongoing innovations in drug formulations and a growing emphasis on personalized medicine. As healthcare providers increasingly adopt tailored treatment plans, the demand for effective anti-obesity solutions is expected to rise. Additionally, the integration of digital health technologies will facilitate better patient engagement and adherence, further enhancing treatment outcomes and market growth in future.

| Segment | Sub-Segments |

|---|---|

| By Drug Type | Prescription Drugs Over-the-Counter Drugs Herbal Supplements Combination Therapies Others |

| By Mechanism of Action | GLP-1 Receptor Agonists Appetite Suppressants Lipase Inhibitors Serotonin-Norepinephrine Reuptake Inhibitors Others |

| By End-User | Hospitals Clinics Homecare Settings Pharmacies |

| By Distribution Channel | Retail Pharmacies Hospital Pharmacies Online Pharmacies Direct Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Age Group | Children Adolescents Adults Seniors |

| By Gender | Male Female |

| By Treatment Duration | Short-term Treatment Long-term Treatment Maintenance Therapy |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 120 | Endocrinologists, General Practitioners |

| Pharmaceutical Sales Representatives | 80 | Sales Managers, Territory Representatives |

| Patients Using Anti-Obesity Drugs | 140 | Individuals on prescribed weight-loss medications |

| Health Insurance Providers | 60 | Policy Analysts, Claims Managers |

| Regulatory Experts | 40 | Compliance Officers, Regulatory Affairs Specialists |

The Global Anti Obesity Drugs Market is valued at approximately USD 26 billion, reflecting a significant increase driven by the rising prevalence of obesity and advancements in drug formulations, particularly new-generation GLP-1 receptor agonists.