Region:Global

Author(s):Dev

Product Code:KRAA9560

Pages:80

Published On:November 2025

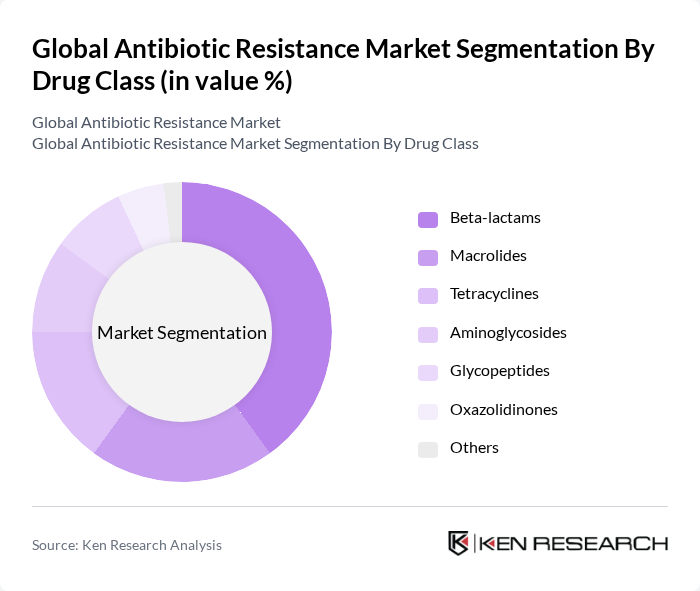

By Drug Class:This segmentation includes various classes of antibiotics that are used to combat resistant bacterial infections. The major subsegments are Beta-lactams, Macrolides, Tetracyclines, Aminoglycosides, Glycopeptides, Oxazolidinones, and Others. Among these,Beta-lactams remain the most widely useddue to their effectiveness against a broad range of bacteria and their established history in clinical use. Recent market trends show increasing demand for oxazolidinones and glycopeptides, driven by the rise of multidrug-resistant pathogens and the need for novel therapies.

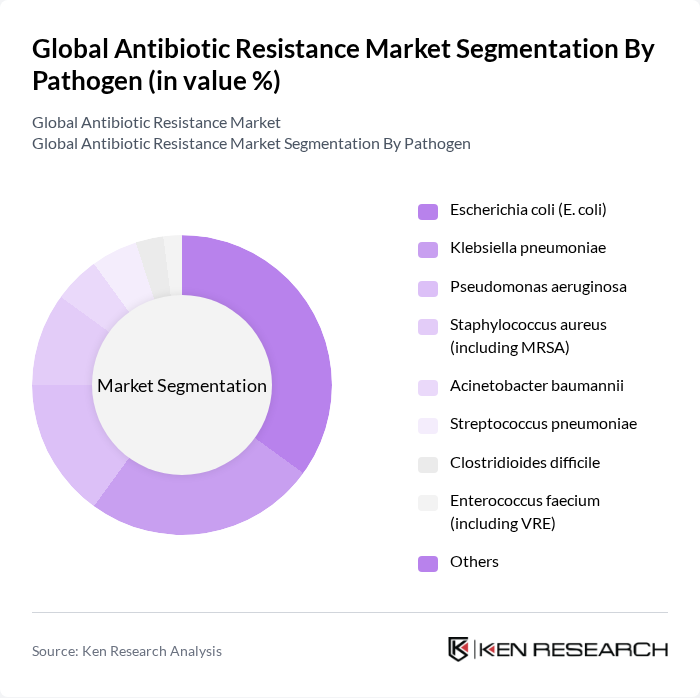

By Pathogen:This segmentation focuses on the specific pathogens that are responsible for antibiotic-resistant infections. The key subsegments include Escherichia coli (E. coli), Klebsiella pneumoniae, Pseudomonas aeruginosa, Staphylococcus aureus (including MRSA), Acinetobacter baumannii, Streptococcus pneumoniae, Clostridioides difficile, Enterococcus faecium (including VRE), and Others.E. coli is the leading pathogendue to its prevalence in urinary tract infections and its increasing resistance to multiple antibiotics. Rising rates of multidrug-resistant Klebsiella pneumoniae and Acinetobacter baumannii are also driving market demand for novel therapeutics.

The Global Antibiotic Resistance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Roche Holding AG, GlaxoSmithKline plc, Novartis AG, AstraZeneca plc, Sanofi S.A., Eli Lilly and Company, Bayer AG, AbbVie Inc., Shionogi & Co., Ltd., Basilea Pharmaceutica Ltd., Paratek Pharmaceuticals, Inc., Melinta Therapeutics, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antibiotic resistance market is poised for transformation, driven by a combination of technological advancements and increased collaboration among stakeholders. As personalized medicine gains traction, tailored antibiotic therapies are expected to emerge, enhancing treatment efficacy. Additionally, the rise of telemedicine and remote diagnostics will facilitate quicker identification of infections, further supporting the development of targeted therapies. These trends indicate a proactive approach to combating antibiotic resistance, fostering innovation and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Beta-lactams Macrolides Tetracyclines Aminoglycosides Glycopeptides Oxazolidinones Others |

| By Pathogen | Escherichia coli (E. coli) Klebsiella pneumoniae Pseudomonas aeruginosa Staphylococcus aureus (including MRSA) Acinetobacter baumannii Streptococcus pneumoniae Clostridioides difficile Enterococcus faecium (including VRE) Others |

| By Disease/Indication | Complicated Urinary Tract Infections (CUTI) Clostridioides difficile Infection (CDI) Acute Bacterial Skin and Skin Structure Infections (ABSSSI) Hospital-Acquired and Ventilator-Associated Bacterial Pneumonia (HABP/VABP) Community-Acquired Bacterial Pneumonia (CABP) Complicated Intra-Abdominal Infection (cIAI) Bloodstream Infection (BSI) Others |

| By Mechanism of Action | Cell Wall Synthesis Inhibitors Protein Synthesis Inhibitors RNA Synthesis Inhibitors DNA Synthesis Inhibitors Others |

| By End-User | Hospitals Outpatient Clinics Long-term Care Facilities Home Healthcare Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Development | 100 | R&D Managers, Clinical Trial Coordinators |

| Healthcare Providers | 90 | Infectious Disease Physicians, Pharmacists |

| Regulatory Affairs | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Public Health Organizations | 50 | Public Health Officials, Epidemiologists |

| Antibiotic Stewardship Programs | 40 | Program Coordinators, Healthcare Administrators |

The Global Antibiotic Resistance Market is valued at approximately USD 9.1 billion, reflecting a significant increase driven by the rising prevalence of antibiotic-resistant infections and the urgent need for new antibiotic development.