Region:Global

Author(s):Rebecca

Product Code:KRAA2130

Pages:84

Published On:August 2025

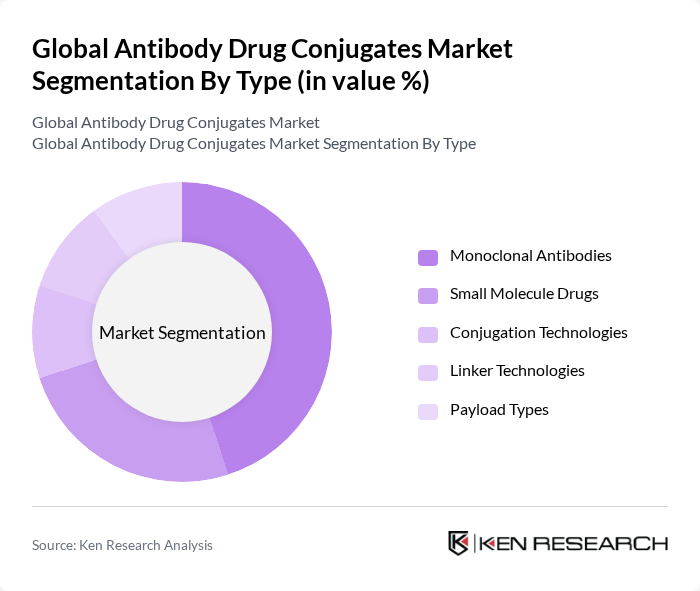

By Type:The market is segmented into various types, including Monoclonal Antibodies, Small Molecule Drugs, Conjugation Technologies, Linker Technologies, and Payload Types. Among these, Monoclonal Antibodies are leading the market due to their specificity and effectiveness in targeting cancer cells, which has resulted in a significant increase in their adoption in clinical settings. The demand for personalized medicine is also driving the growth of this segment, as these therapies can be tailored to individual patient profiles. The integration of advanced conjugation and linker technologies is further enhancing the stability and efficacy of antibody drug conjugates .

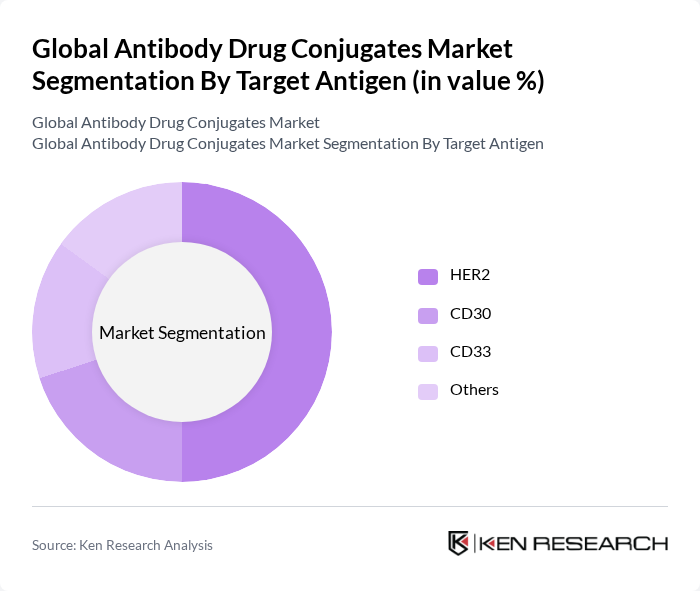

By Target Antigen:The market is categorized by target antigens, including HER2, CD30, CD33, and others. The HER2-targeted therapies are particularly dominant due to their established efficacy in treating breast cancer, which is one of the most common cancers globally. The success of drugs like trastuzumab and the approval of newer HER2-targeted ADCs have paved the way for further innovations in this segment, making it a focal point for research and development in antibody-drug conjugates .

The Global Antibody Drug Conjugates Market is characterized by a dynamic mix of regional and international players. Leading participants such as Genentech, Inc., Seagen Inc., ImmunoGen, Inc., AstraZeneca PLC, Takeda Pharmaceutical Company Limited, Pfizer Inc., Merck & Co., Inc., Bayer AG, Gilead Sciences, Inc., Novartis AG, Roche Holding AG, Amgen Inc., Daiichi Sankyo Company, Limited, AbbVie Inc., ADC Therapeutics SA, Astellas Pharma Inc., GlaxoSmithKline plc, Mersana Therapeutics, Inc., Sutro Biopharma, Inc., Zymeworks Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antibody-drug conjugates market appears promising, driven by ongoing advancements in technology and increasing demand for targeted therapies. As the prevalence of cancer continues to rise, the need for innovative treatment options will likely expand. Additionally, the growing focus on personalized medicine is expected to enhance the development of tailored ADC therapies, improving patient outcomes. Collaborations between pharmaceutical companies and research institutions will further accelerate innovation, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Small Molecule Drugs Conjugation Technologies Linker Technologies Payload Types |

| By Target Antigen | HER2 CD30 CD33 Others |

| By Application | Breast Cancer Hematological Cancers (Leukemia, Lymphoma, Myeloma) Lung Cancer Other Solid Tumors Others |

| By End-User | Hospitals Research Institutions Pharmaceutical & Biotechnology Companies Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Stage of Development | Approved Phase III Phase II Phase I Preclinical |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Specialists | 60 | Medical Oncologists, Hematologists |

| Pharmaceutical Executives | 40 | CEOs, R&D Directors |

| Clinical Trial Coordinators | 40 | Clinical Research Associates, Trial Managers |

| Regulatory Affairs Professionals | 40 | Regulatory Managers, Compliance Officers |

| Healthcare Payers | 40 | Health Insurance Analysts, Pharmacy Benefit Managers |

The Global Antibody Drug Conjugates Market is valued at approximately USD 11.8 billion, reflecting significant growth driven by the increasing prevalence of cancer and the demand for targeted therapies that minimize side effects compared to traditional chemotherapy.