Region:Global

Author(s):Dev

Product Code:KRAC0342

Pages:85

Published On:August 2025

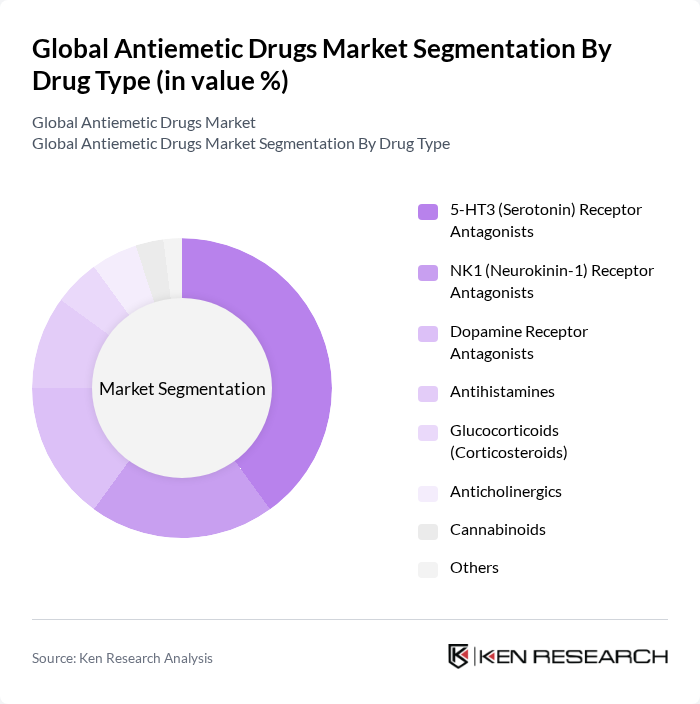

By Drug Type:The antiemetic drugs market can be segmented into various drug types, including 5-HT3 (Serotonin) Receptor Antagonists, NK1 (Neurokinin-1) Receptor Antagonists, Dopamine Receptor Antagonists, Antihistamines, Glucocorticoids (Corticosteroids), Anticholinergics, Cannabinoids, and Others. Among these, 5-HT3 receptor antagonists are the most widely used due to their effectiveness in treating chemotherapy-induced nausea and vomiting (CINV), which is a significant concern for cancer patients undergoing treatment. The adoption of combination therapies, particularly those involving 5-HT3 and NK1 receptor antagonists, is also increasing as clinical guidelines evolve to optimize antiemetic efficacy .

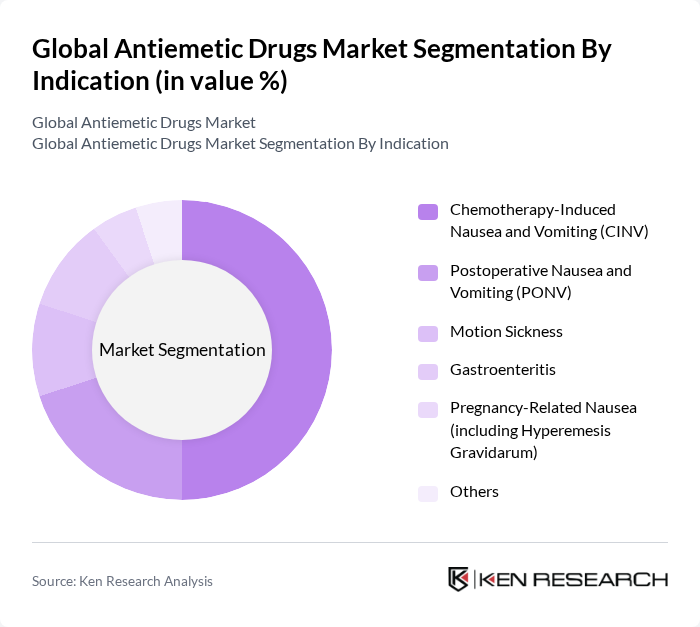

By Indication:The market can also be segmented based on indications, including Chemotherapy-Induced Nausea and Vomiting (CINV), Postoperative Nausea and Vomiting (PONV), Motion Sickness, Gastroenteritis, Pregnancy-Related Nausea (including Hyperemesis Gravidarum), and Others. CINV remains the leading indication due to the increasing number of cancer patients and the side effects associated with chemotherapy treatments. The prevalence of gastrointestinal disorders and the growing awareness of antiemetic therapies for postoperative and motion sickness indications further support market growth .

The Global Antiemetic Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Merck & Co., Inc., GlaxoSmithKline plc, Johnson & Johnson, Novartis AG, Roche Holding AG, Sanofi S.A., Teva Pharmaceutical Industries Ltd., Amgen Inc., Astellas Pharma Inc., Eli Lilly and Company, Bayer AG, AbbVie Inc., Hikma Pharmaceuticals PLC, Mallinckrodt Pharmaceuticals, Cipla Limited, Dr. Reddy's Laboratories Ltd., Sun Pharmaceutical Industries Ltd., Mylan N.V. (now part of Viatris Inc.), Fresenius Kabi AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antiemetic drugs market appears promising, driven by ongoing advancements in drug formulations and the increasing integration of digital health solutions. As healthcare providers adopt telemedicine for treatment delivery, patient access to antiemetic therapies is expected to improve significantly. Furthermore, the focus on personalized medicine will likely lead to tailored treatment options, enhancing efficacy and patient satisfaction. These trends indicate a dynamic market landscape poised for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Drug Type | HT3 (Serotonin) Receptor Antagonists NK1 (Neurokinin-1) Receptor Antagonists Dopamine Receptor Antagonists Antihistamines Glucocorticoids (Corticosteroids) Anticholinergics Cannabinoids Others |

| By Indication | Chemotherapy-Induced Nausea and Vomiting (CINV) Postoperative Nausea and Vomiting (PONV) Motion Sickness Gastroenteritis Pregnancy-Related Nausea (including Hyperemesis Gravidarum) Others |

| By Route of Administration | Oral Parenteral (including Intravenous and Injectable) Transdermal Rectal Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Hospitals Clinics Homecare Settings Ambulatory Surgical Centers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics | 100 | Oncologists, Nurse Practitioners |

| Gastroenterology Practices | 60 | Gastroenterologists, Clinical Pharmacists |

| Pharmacy Chains | 70 | Pharmacy Managers, Inventory Specialists |

| Hospital Procurement Departments | 50 | Procurement Officers, Supply Chain Managers |

| Patient Advocacy Groups | 40 | Patient Representatives, Healthcare Advocates |

The Global Antiemetic Drugs Market is valued at approximately USD 8.4 billion, driven by the increasing prevalence of nausea and vomiting associated with various medical conditions, including chemotherapy and postoperative recovery.