Region:Global

Author(s):Dev

Product Code:KRAC0528

Pages:100

Published On:August 2025

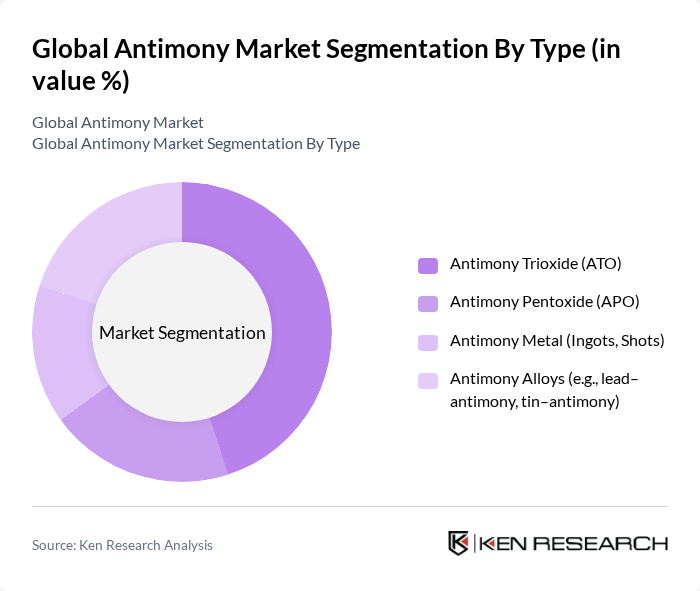

By Type:The antimony market is segmented into various types, including Antimony Trioxide (ATO), Antimony Pentoxide (APO), Antimony Metal (Ingots, Shots), and Antimony Alloys (e.g., lead–antimony, tin–antimony). Among these, Antimony Trioxide (ATO) is the most dominant segment due to its extensive use as a flame retardant in plastics, textiles, and electronics. The increasing regulatory focus on fire safety and the growing demand for lightweight materials in various applications have further solidified ATO's market leadership.

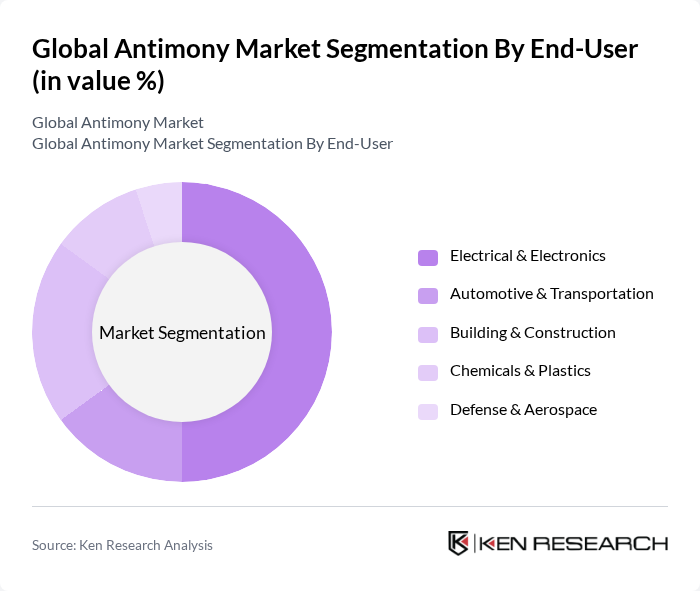

By End-User:The antimony market is segmented by end-user industries, including Electrical & Electronics, Automotive & Transportation, Building & Construction, Chemicals & Plastics, and Defense & Aerospace. The Electrical & Electronics segment holds the largest share, driven by the increasing demand for flame retardants in electronic devices and components. The rapid growth of the electronics sector, coupled with stringent fire safety regulations, has made this segment a key driver of market growth.

The Global Antimony Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hunan Gold Corporation (Hunan Gold Group Co., Ltd.), Guangxi China Tin Group Co., Ltd. (China Tin), China Minmetals Corporation, Yunnan Muli Antimony Industry Co., Ltd., United States Antimony Corporation, Mandalay Resources (Costerfield Mine, Australia), Perpetua Resources (Stibnite Gold Project, Idaho), Tri-Star Resources (Strategic & Precious Metals Processing LLC, Oman), Suzuhiro Chemical Co., Ltd. (Japan), Campine NV (Belgium), AMG Antimony (AMG Critical Materials N.V.), Nihon Seiko Co., Ltd., Amspec Chemical Corporation, NYACOL Nano Technologies, Inc., Huachang Antimony Industry contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antimony market appears promising, driven by technological advancements and a growing emphasis on sustainability. Innovations in antimony production processes are expected to enhance efficiency and reduce environmental impact, aligning with global sustainability goals. Additionally, the increasing focus on supply chain transparency will encourage responsible sourcing practices, fostering consumer trust and compliance with regulatory standards. As industries adapt to these trends, the demand for antimony is likely to remain robust, supporting its critical role in various applications.

| Segment | Sub-Segments |

|---|---|

| By Type | Antimony Trioxide (ATO) Antimony Pentoxide (APO) Antimony Metal (Ingots, Shots) Antimony Alloys (e.g., lead–antimony, tin–antimony) |

| By End-User | Electrical & Electronics Automotive & Transportation Building & Construction Chemicals & Plastics Defense & Aerospace |

| By Application | Flame-Retardant Synergists (primarily ATO) Lead-Acid Batteries (lead–antimony alloys) Alloys & Metallurgy (bearing metals, solder, pewter) Plastics, Rubber, and Textiles Additives Glass & Ceramics (decolorizing/fining agents) Catalysts and Chemicals (including PET and polymerization) |

| By Distribution Channel | Direct (Producer-to-OEM) Distributors/Traders Online/Exchange Platforms Contract/Long-term Offtake Agreements |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Mechanism | Benchmark-Linked (e.g., Asian Metal index) Formula/Cost-Plus Contracts Spot Pricing Long-term Fixed/Indexed Contracts |

| By Source | Primary (Mine Concentrates) Secondary/Recycled (battery/alloy scrap, trioxide recovery) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electronics Manufacturing | 90 | Product Managers, Supply Chain Analysts |

| Battery Production | 80 | Operations Managers, R&D Engineers |

| Flame Retardant Applications | 70 | Quality Control Managers, Product Development Specialists |

| Mining and Processing | 90 | Mining Engineers, Operations Directors |

| Regulatory and Compliance | 60 | Compliance Officers, Environmental Managers |

The Global Antimony Market is valued at approximately USD 2.2 billion, driven by increasing demand for flame retardants in industries such as electronics and construction, alongside rising awareness of fire safety regulations and sustainable materials.