Region:Global

Author(s):Shubham

Product Code:KRAB0788

Pages:99

Published On:August 2025

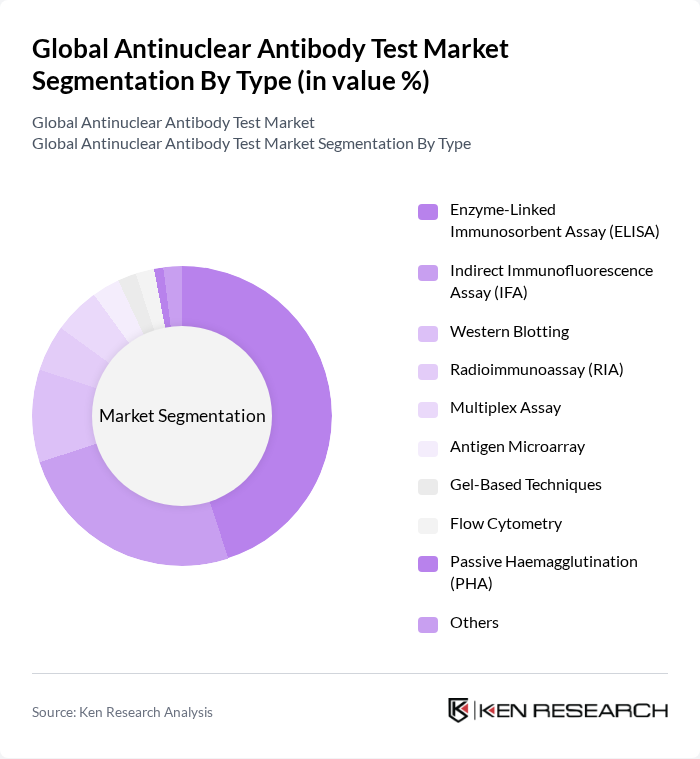

By Type:The market is segmented into various types of testing methodologies, each catering to different diagnostic needs. The dominant sub-segment is the Enzyme-Linked Immunosorbent Assay (ELISA), which is widely used due to its high sensitivity and specificity. Other methods like Indirect Immunofluorescence Assay (IFA) and Western Blotting are also significant but are often used in conjunction with ELISA for confirmatory testing. The choice of method often depends on the clinical context and the specific autoimmune condition being investigated. Multiplex assays and antigen microarrays are gaining traction for their ability to simultaneously detect multiple autoantibodies, improving diagnostic efficiency , .

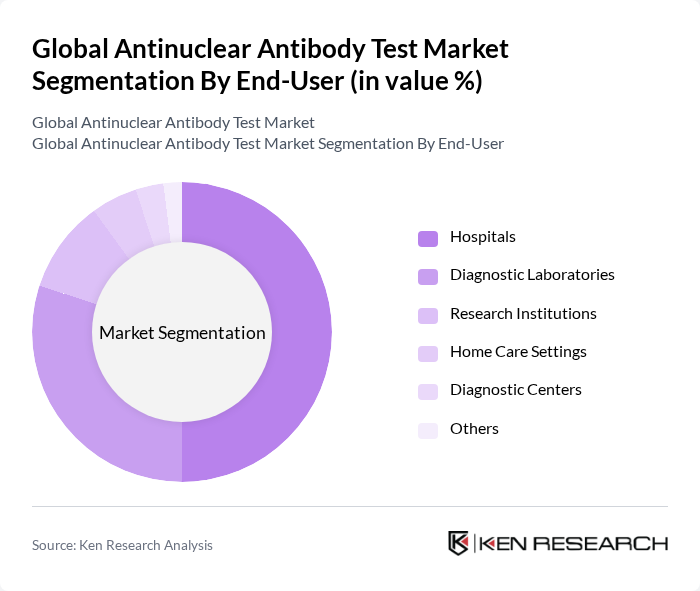

By End-User:The end-user segment includes various healthcare settings where antinuclear antibody tests are performed. Hospitals are the leading end-users due to their comprehensive diagnostic capabilities and access to advanced testing technologies. Diagnostic laboratories and research institutions also play a crucial role, particularly in specialized testing and research on autoimmune diseases. The increasing trend towards home care settings is emerging, driven by the demand for convenient and accessible testing options. Diagnostic centers are expanding their service portfolios to include ANA testing, reflecting the growing demand for early and accurate autoimmune diagnostics , .

The Global Antinuclear Antibody Test Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Thermo Fisher Scientific Inc., Siemens Healthineers, Roche Diagnostics, Bio-Rad Laboratories, Inc., Ortho Clinical Diagnostics, Quest Diagnostics Incorporated, Hologic, Inc., Beckman Coulter, Inc., Fujirebio Inc., EUROIMMUN Medizinische Labordiagnostika AG, Inova Diagnostics, Inc., Meridian Bioscience, Inc., Grifols, S.A., Antibodies Incorporated, BioSystems S.A., Trinity Biotech plc, Immuno Concepts N.A., Ltd., Erba Diagnostics, Inc., ZEUS Scientific, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the antinuclear antibody test market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As personalized medicine gains traction, the demand for tailored diagnostic solutions will likely rise. Additionally, the integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency. With a growing emphasis on preventive healthcare, the market is poised for expansion, particularly in regions where access to testing is improving through innovative healthcare delivery models.

| Segment | Sub-Segments |

|---|---|

| By Type | Enzyme-Linked Immunosorbent Assay (ELISA) Indirect Immunofluorescence Assay (IFA) Western Blotting Radioimmunoassay (RIA) Multiplex Assay Antigen Microarray Gel-Based Techniques Flow Cytometry Passive Haemagglutination (PHA) Others |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Home Care Settings Diagnostic Centers Others |

| By Application | Systemic Lupus Erythematosus (SLE) Rheumatoid Arthritis Sjögren's Syndrome Scleroderma Mixed Connective Tissue Disease Infectious Diseases Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Sales Third Party Distributor Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sample Type | Blood Samples Serum Samples Plasma Samples |

| By Pricing Range | Low Range Mid Range High Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 100 | Laboratory Managers, Diagnostic Technologists |

| Healthcare Providers | 80 | Rheumatologists, General Practitioners |

| Patient Advocacy Groups | 60 | Patient Representatives, Community Health Workers |

| Medical Device Manufacturers | 50 | Product Managers, Regulatory Affairs Specialists |

| Health Insurance Companies | 40 | Policy Analysts, Claims Managers |

The Global Antinuclear Antibody Test Market is valued at approximately USD 3 billion, reflecting a significant growth driven by the rising prevalence of autoimmune diseases and advancements in diagnostic technologies.