Region:Global

Author(s):Rebecca

Product Code:KRAA2149

Pages:96

Published On:August 2025

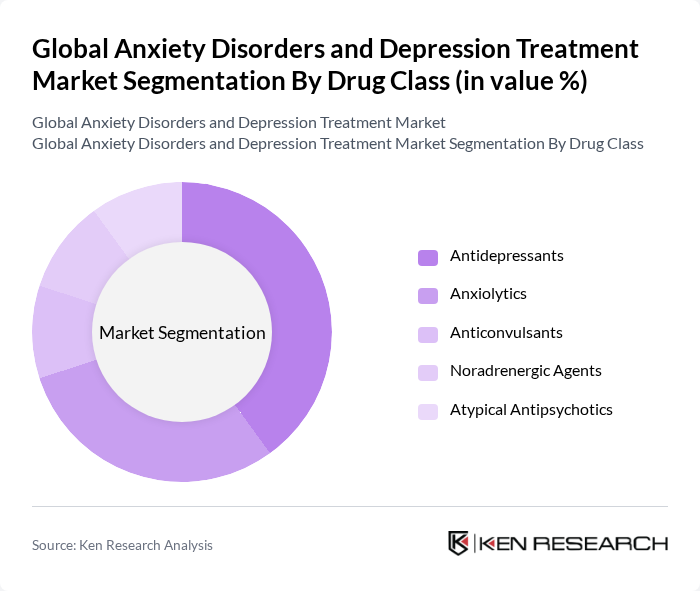

By Drug Class:The drug class segment includes various categories of medications used to treat anxiety and depression. The primary subsegments are Antidepressants, Anxiolytics, Anticonvulsants, Noradrenergic Agents, and Atypical Antipsychotics. Antidepressants are the most widely prescribed due to their effectiveness in treating major depressive disorders and anxiety. Anxiolytics are also popular for their rapid action in alleviating anxiety symptoms. The increasing acceptance of mental health treatment, the growing number of prescriptions, and the development of new pharmacological agents contribute to the dominance of these drug classes .

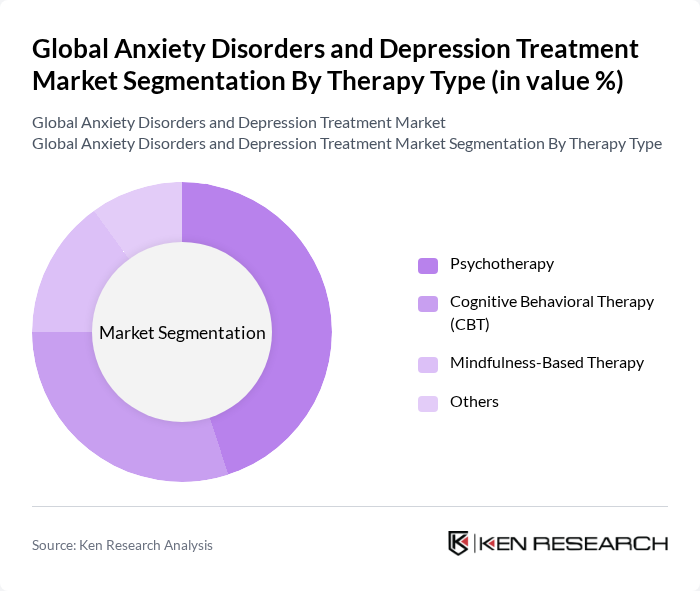

By Therapy Type:This segment encompasses various therapeutic approaches used in treating anxiety and depression, including Psychotherapy, Cognitive Behavioral Therapy (CBT), Mindfulness-Based Therapy, and others. Psychotherapy remains the most utilized form of treatment, as it provides patients with coping strategies and emotional support. CBT is particularly effective for anxiety disorders, leading to its growing popularity. The increasing recognition of the importance of mental health, the effectiveness of these therapies, and the adoption of digital and telehealth platforms are driving their market presence .

The Global Anxiety Disorders and Depression Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Eli Lilly and Company, AstraZeneca PLC, GlaxoSmithKline PLC, Novartis AG, Merck & Co., Inc., Bristol-Myers Squibb Company, AbbVie Inc., Takeda Pharmaceutical Company Limited, Sanofi S.A., Otsuka Pharmaceutical Co., Ltd., H. Lundbeck A/S, Amgen Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Boehringer Ingelheim International GmbH, Viatris Inc., Alkermes plc, Jazz Pharmaceuticals plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the anxiety disorders and depression treatment market in None appears promising, driven by increasing investments in mental health initiatives and technological advancements. The integration of teletherapy and digital solutions is expected to enhance accessibility, allowing more individuals to receive timely care. Additionally, the growing focus on preventive mental health care will likely lead to innovative treatment approaches, fostering a more supportive environment for those affected by mental health disorders in the region.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Antidepressants Anxiolytics Anticonvulsants Noradrenergic Agents Atypical Antipsychotics |

| By Therapy Type | Psychotherapy Cognitive Behavioral Therapy (CBT) Mindfulness-Based Therapy Others |

| By Indication | Depression Anxiety Disorders |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Others |

| By End-User | Hospitals Outpatient Clinics Homecare Settings Telehealth Platforms |

| By Age Group | Children Adolescents Adults Elderly |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Psychiatric Treatment Facilities | 100 | Psychiatrists, Clinical Directors |

| General Practitioners | 80 | Family Physicians, Primary Care Providers |

| Therapeutic Practices | 60 | Clinical Psychologists, Licensed Therapists |

| Patient Advocacy Groups | 50 | Patient Representatives, Mental Health Advocates |

| Insurance Providers | 40 | Healthcare Analysts, Policy Underwriters |

The Global Anxiety Disorders and Depression Treatment Market is valued at approximately USD 15 billion, driven by the rising prevalence of these disorders and increased awareness of mental health issues, along with the expansion of treatment options.