Region:Global

Author(s):Rebecca

Product Code:KRAB0287

Pages:82

Published On:August 2025

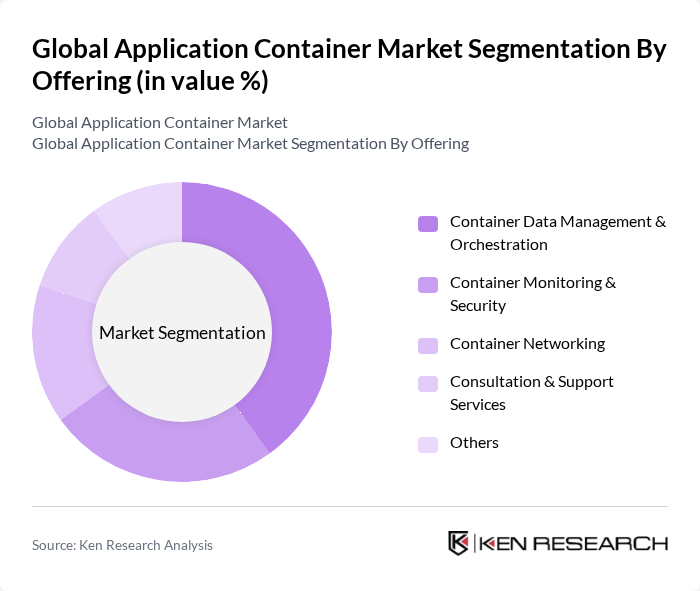

By Offering:The market is segmented into various offerings, including Container Data Management & Orchestration, Container Monitoring & Security, Container Networking, Consultation & Support Services, and Others. Among these, Container Data Management & Orchestration is the leading sub-segment, driven by the increasing complexity of managing containerized applications and the need for efficient orchestration tools. Organizations are increasingly adopting these solutions to streamline their operations and enhance productivity. Kubernetes has become the default orchestration platform, running on over 70% of container environments globally, while security and observability tools are rapidly gaining traction .

By Deployment Model:The market is categorized into Public Cloud, Private Cloud / On-Premises, and Hybrid Cloud. The Public Cloud segment is the most dominant, as organizations increasingly prefer cloud-based solutions for their scalability and cost-effectiveness. The flexibility offered by public cloud services allows businesses to deploy applications rapidly, which is essential in today’s fast-paced digital environment. Cloud deployment holds the largest share, representing over 63% of containerized workloads, while on-premise is shrinking due to the rising dominance of hybrid cloud strategies .

The Global Application Container Market is characterized by a dynamic mix of regional and international players. Leading participants such as Docker, Inc., Red Hat, Inc. (IBM Corporation), VMware, Inc., Google LLC (Google Kubernetes Engine), Amazon Web Services, Inc. (Amazon ECS, EKS), Microsoft Corporation (Azure Kubernetes Service), IBM Corporation, Oracle Corporation, SUSE LLC (Rancher Labs), Mirantis, Inc., Sysdig, Inc., HashiCorp, Inc., JFrog Ltd., Portainer.io, D2iQ, Inc. (formerly Mesosphere) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the application container market is poised for significant transformation, driven by technological advancements and evolving business needs. As organizations increasingly adopt hybrid cloud solutions, the demand for seamless integration and orchestration tools will rise. Additionally, the growing emphasis on container security will lead to the development of innovative security frameworks. Companies will also leverage AI and machine learning to enhance container management, optimizing resource allocation and improving operational efficiency in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Offering | Container Data Management & Orchestration Container Monitoring & Security Container Networking Consultation & Support Services Others |

| By Deployment Model | Public Cloud Private Cloud / On-Premises Hybrid Cloud |

| By Enterprise Size | Small and Medium-sized Enterprises (SMEs) Large Enterprises |

| By End-Use Industry | IT & Telecommunication BFSI (Banking, Financial Services & Insurance) Retail & E-commerce Healthcare & Lifesciences Media & Entertainment Manufacturing Education Others |

| By Application | Application Development Testing and Deployment Monitoring and Management Collaboration & Modernization Production Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Application Development | 120 | Software Architects, Development Team Leads |

| Cloud Service Adoption | 90 | IT Managers, Cloud Strategy Consultants |

| Container Orchestration Solutions | 70 | DevOps Engineers, System Administrators |

| Microservices Implementation | 60 | Product Managers, Technical Leads |

| Security in Containerized Environments | 50 | Security Analysts, Compliance Officers |

The Global Application Container Market is valued at approximately USD 5.8 billion, driven by the increasing adoption of cloud-native applications and the demand for efficient resource utilization among enterprises.