Region:Global

Author(s):Rebecca

Product Code:KRAA1392

Pages:95

Published On:August 2025

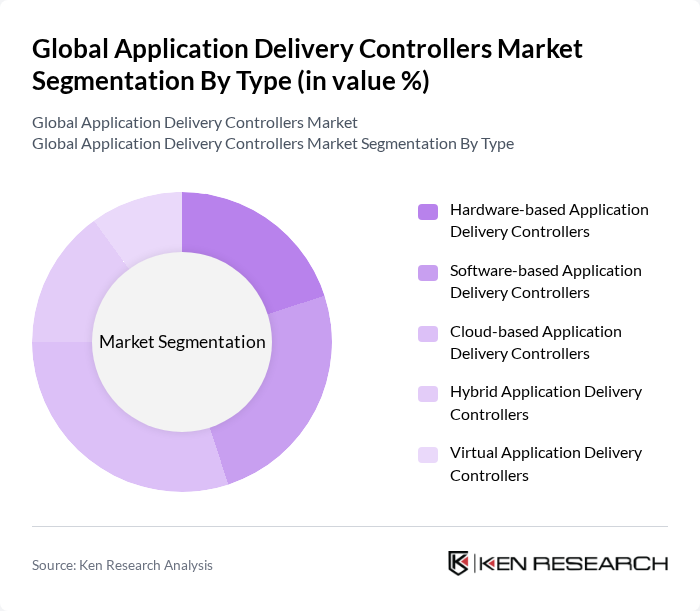

By Type:The market is segmented into five types: Hardware-based Application Delivery Controllers, Software-based Application Delivery Controllers, Cloud-based Application Delivery Controllers, Hybrid Application Delivery Controllers, and Virtual Application Delivery Controllers. Among these, the Cloud-based Application Delivery Controllers segment is experiencing the fastest growth due to its scalability, cost-effectiveness, and ease of deployment. Organizations are increasingly shifting towards cloud solutions to enhance flexibility, support remote work, and reduce infrastructure costs, making this segment a leader in the market .

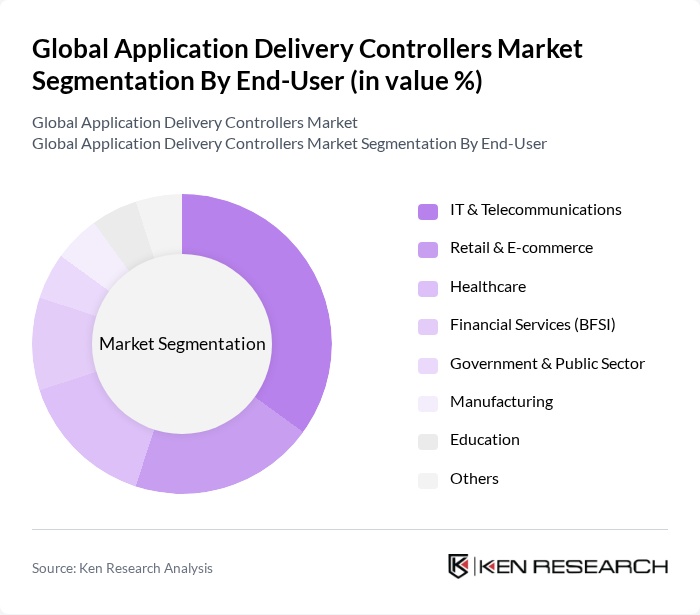

By End-User:The end-user segmentation includes IT & Telecommunications, Retail & E-commerce, Healthcare, Financial Services (BFSI), Government & Public Sector, Manufacturing, Education, and Others. The IT & Telecommunications sector is the dominant end-user, driven by the increasing need for robust application performance and security solutions. As digital transformation accelerates and 5G networks expand, organizations in this sector are investing heavily in application delivery controllers to ensure seamless service delivery and enhanced user experiences .

The Global Application Delivery Controllers Market is characterized by a dynamic mix of regional and international players. Leading participants such as F5, Inc., Citrix Systems, Inc., A10 Networks, Inc., Radware Ltd., Barracuda Networks, Inc., NGINX, Inc. (now part of F5, Inc.), Cisco Systems, Inc., Amazon Web Services, Inc. (AWS), Microsoft Corporation, VMware, Inc., Akamai Technologies, Inc., IBM Corporation, Oracle Corporation, Cloudflare, Inc., Fortinet, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the application delivery controllers market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly adopt software-defined networking and multi-cloud strategies, ADCs will play a pivotal role in ensuring seamless application performance. Furthermore, the rise of edge computing will necessitate innovative solutions to manage distributed applications effectively, creating new avenues for growth and development in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware-based Application Delivery Controllers Software-based Application Delivery Controllers Cloud-based Application Delivery Controllers Hybrid Application Delivery Controllers Virtual Application Delivery Controllers |

| By End-User | IT & Telecommunications Retail & E-commerce Healthcare Financial Services (BFSI) Government & Public Sector Manufacturing Education Others |

| By Deployment Mode | On-Premises Cloud Hybrid |

| By Application | Web Applications Mobile Applications API Management Cloud-native Applications Others |

| By Distribution Channel | Direct Sales Online Sales Distributors/Resellers |

| By Industry Vertical | BFSI IT & Telecom Healthcare Retail Manufacturing Education Government Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Application Delivery Solutions | 120 | IT Managers, Network Engineers |

| Cloud-Based Application Delivery Controllers | 90 | Cloud Architects, DevOps Engineers |

| Security-Integrated Application Delivery | 60 | Security Analysts, Compliance Officers |

| SMB Application Delivery Needs | 50 | Small Business Owners, IT Consultants |

| Telecommunications Sector Solutions | 70 | Telecom Network Managers, Systems Analysts |

The Global Application Delivery Controllers Market is valued at approximately USD 4.3 billion, driven by the increasing demand for application performance optimization, enhanced security measures, and the rising adoption of cloud-based solutions across various industries.