Region:Global

Author(s):Shubham

Product Code:KRAA1768

Pages:81

Published On:August 2025

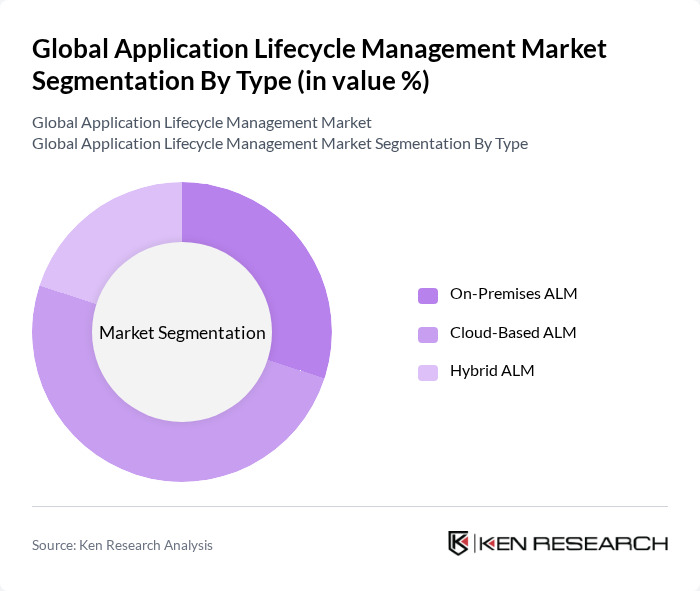

By Type:The segmentation of the market by type includes On-Premises ALM, Cloud-Based ALM, and Hybrid ALM. Each of these sub-segments caters to different organizational needs and preferences, with cloud-based solutions gaining significant traction due to their flexibility and cost-effectiveness.

The Cloud-Based ALM segment is currently leading the market due to its scalability, ease of access, and lower upfront costs compared to traditional on-premises solutions. Organizations are increasingly adopting cloud-based platforms to facilitate remote collaboration and streamline their development processes. The flexibility offered by cloud solutions allows businesses to scale their operations efficiently, making it the preferred choice for many enterprises .

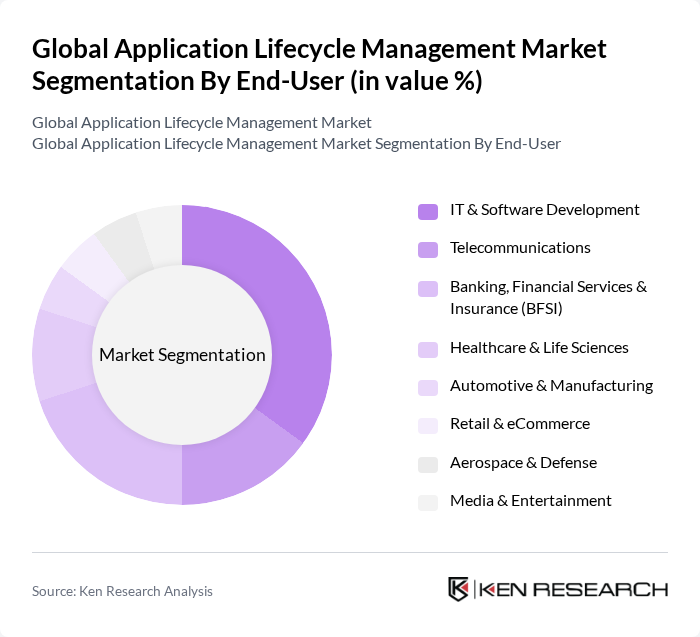

By End-User:The market is segmented by end-user into IT & Software Development, Telecommunications, Banking, Financial Services & Insurance (BFSI), Healthcare & Life Sciences, Automotive & Manufacturing, Retail & eCommerce, Aerospace & Defense, and Media & Entertainment. Each sector has unique requirements that influence their ALM strategies .

The IT & Software Development sector is the dominant end-user of ALM solutions, driven by the need for efficient project management and collaboration tools. As software development becomes increasingly complex, organizations in this sector are leveraging ALM tools to enhance productivity, ensure quality, and accelerate time-to-market. The growing trend of agile and DevOps methodologies further propels the demand for ALM solutions in this segment .

The Global Application Lifecycle Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Atlassian Corporation Plc, OpenText Corporation (Micro Focus), IBM Corporation, Microsoft Corporation, Broadcom Inc. (CA Technologies), Oracle Corporation, SAP SE, Digital.ai Software, Inc. (formerly CollabNet VersionOne), GitLab Inc., Jenkins (CloudBees, Inc.), Planview, Inc., Azure DevOps (formerly Team Foundation Server), ServiceNow, Inc., PTC Inc. (Codebeamer), Siemens Digital Industries Software (Polarion ALM) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ALM market appears promising, driven by technological advancements and evolving development methodologies. As organizations increasingly prioritize software quality and efficiency, the demand for integrated ALM solutions is expected to rise. Additionally, the growing emphasis on collaboration and automation in software development will likely lead to the emergence of innovative tools that enhance productivity and streamline workflows, positioning ALM as a critical component of digital transformation strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | On-Premises ALM Cloud-Based ALM Hybrid ALM |

| By End-User | IT & Software Development Telecommunications Banking, Financial Services & Insurance (BFSI) Healthcare & Life Sciences Automotive & Manufacturing Retail & eCommerce Aerospace & Defense Media & Entertainment |

| By Component | Solutions (ALM Platforms, Requirements & Test Management, Source Code & Version Control, CI/CD & Release Management) Services (Implementation & Integration, Training & Consulting, Support & Maintenance, Managed Services) |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Application | Project & Portfolio Management Requirements & Change Management Test Management, QA & Release Orchestration DevOps & Continuous Integration/Continuous Delivery (CI/CD) Application Security & Compliance (DevSecOps) |

| By Organization Size | Large Enterprises Small & Medium-sized Enterprises (SMEs) |

| By Platform | Web-based ALM Mobile-based ALM |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Application Lifecycle Management | 120 | IT Directors, Software Architects |

| SMB Application Development Practices | 100 | Project Managers, Development Team Leads |

| Cloud-based ALM Solutions | 80 | Cloud Engineers, System Administrators |

| Regulatory Compliance in ALM | 70 | Compliance Officers, Risk Management Specialists |

| Integration of ALM with DevOps | 90 | DevOps Engineers, Continuous Integration Managers |

The Global Application Lifecycle Management Market is valued at approximately USD 4.5 billion, reflecting a historical analysis and aligning with various analyst estimates that range from USD 4.2 to 4.9 billion, driven by the demand for efficient software development and collaboration.