Region:Global

Author(s):Geetanshi

Product Code:KRAD0102

Pages:99

Published On:August 2025

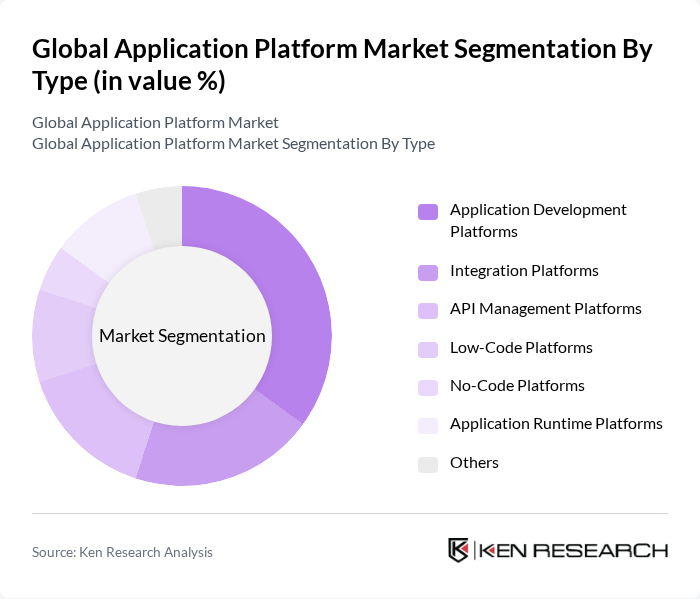

By Type:The market is segmented into various types, including Application Development Platforms, Integration Platforms, API Management Platforms, Low-Code Platforms, No-Code Platforms, Application Runtime Platforms, and Others. Among these, Application Development Platforms are leading due to their essential role in enabling businesses to create and deploy applications rapidly. The increasing need for custom applications, the shift towards agile development methodologies, and the integration of artificial intelligence and automation are driving the demand for these platforms.

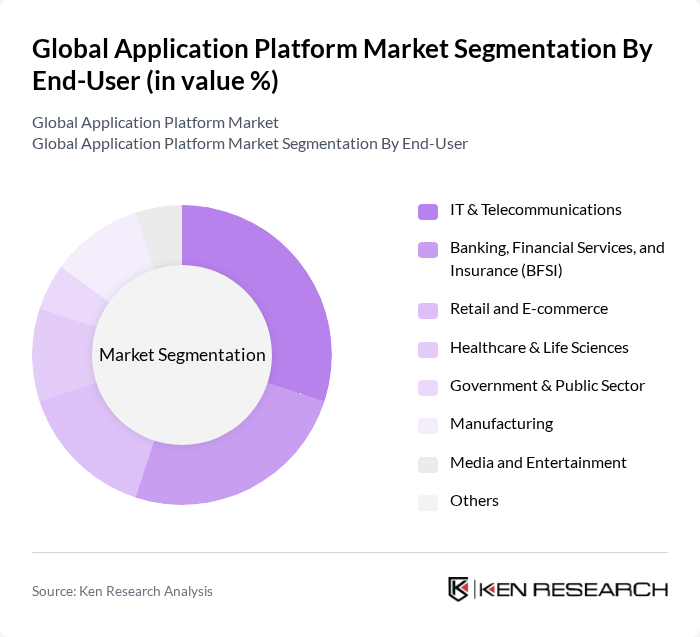

By End-User:The market is segmented by end-users, including IT & Telecommunications, Banking, Financial Services, and Insurance (BFSI), Retail and E-commerce, Healthcare & Life Sciences, Government & Public Sector, Manufacturing, Media and Entertainment, and Others. The IT & Telecommunications sector is the dominant segment, driven by the need for robust application solutions to manage complex IT environments, enhance service delivery, and support digital transformation initiatives.

The Global Application Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Oracle Corporation, Salesforce, Inc., IBM Corporation, SAP SE, Google LLC, Amazon Web Services, Inc., Mendix B.V., Appian Corporation, Pegasystems Inc., ServiceNow, Inc., Red Hat, Inc., OutSystems, Zoho Corporation, Betty Blocks, Siemens AG, Quick Base, Inc., Kony, Inc. (now Temenos), Fujitsu Limited, Software AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the application platform market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As organizations increasingly adopt hybrid application platforms, the integration of AI and machine learning will enhance operational efficiencies. Furthermore, the emphasis on sustainability will lead to the development of eco-friendly application solutions, aligning with global environmental goals. These trends indicate a dynamic market landscape that will continue to adapt to emerging technologies and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Application Development Platforms Integration Platforms API Management Platforms Low-Code Platforms No-Code Platforms Application Runtime Platforms Others |

| By End-User | IT & Telecommunications Banking, Financial Services, and Insurance (BFSI) Retail and E-commerce Healthcare & Life Sciences Government & Public Sector Manufacturing Media and Entertainment Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Industry Vertical | Manufacturing Education Transportation and Logistics Media and Entertainment Energy & Utilities Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East and Africa |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Application Platforms | 100 | CTOs, IT Managers |

| Mobile Application Development | 80 | Software Developers, Product Managers |

| Cloud-Based Application Solutions | 60 | Cloud Architects, System Administrators |

| Industry-Specific Application Platforms | 50 | Business Analysts, Industry Experts |

| Application Integration Services | 40 | Integration Specialists, Technical Leads |

The Global Application Platform Market is valued at approximately USD 9 billion, driven by the increasing demand for digital transformation, cloud computing, and efficient application development solutions across various industries.