Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0024

Pages:82

Published On:August 2025

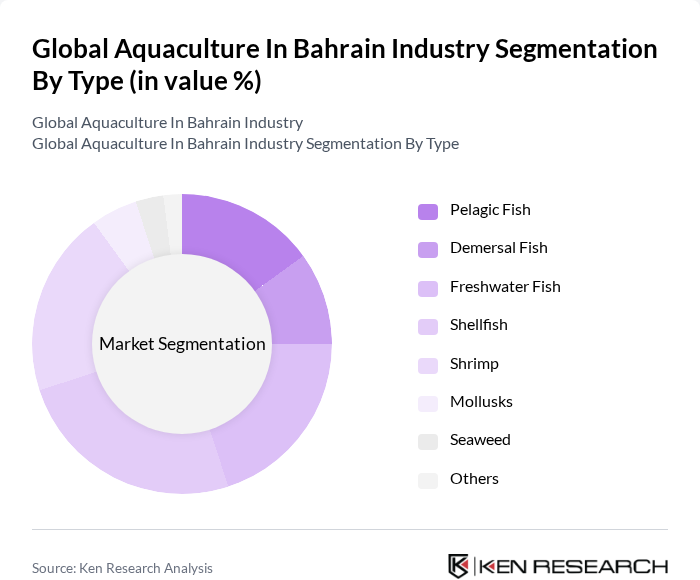

By Type:The aquaculture market in Bahrain is segmented into various types, including Pelagic Fish, Demersal Fish, Freshwater Fish, Shellfish, Shrimp, Mollusks, Seaweed, and Others. Among these, Shrimp and Shellfish are particularly prominent due to their high demand in both local and export markets. The increasing consumer preference for seafood, coupled with the rising trend of healthy eating, has led to a surge in the production of these types. The market is also witnessing innovations in farming techniques, such as recirculating aquaculture systems and integrated multi-trophic aquaculture, which enhance yield and sustainability .

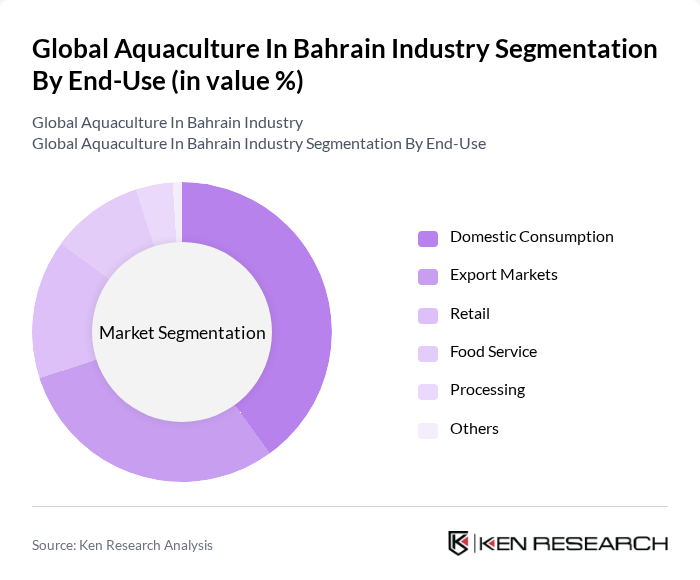

By End-Use:The end-use segmentation of the aquaculture market in Bahrain includes Domestic Consumption, Export Markets, Retail, Food Service, Processing, and Others. Domestic Consumption and Export Markets are the leading segments, driven by the increasing local demand for seafood and the growing international appetite for Bahraini aquaculture products. The retail sector is also expanding, with more consumers seeking fresh and sustainable seafood options, further boosting the market .

The Global Aquaculture In Bahrain Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Bahrain National Seafood Company B.S.C. (c), Century Fisheries Company W.L.L., Blue Reef Aquarium Trading Co. W.L.L., Banader Fish Processing and Distribution Co. W.L.L., Almarai Food Processing Company, Arab Aquaculture Bahrain, Bahrain Import and Export Co. W.L.L., Fish World W.L.L., Al Rawdah Fish Company W.L.L., Gulf Seafood, Alia Fish Processing Industries, Yaquby International, Global Suhaimi Fisheries, APM Fisheries, Bahrain Seafood Co., Mohammed Zainal Co. W.L.L., Fins Trading and Services W.L.L., Kuwait Fish Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aquaculture industry in Bahrain appears promising, driven by increasing domestic demand and government initiatives aimed at sustainability. In future, the sector is expected to see enhanced production capabilities due to technological advancements and improved farming practices. Additionally, the focus on environmental sustainability will likely lead to the adoption of more eco-friendly practices, positioning Bahrain as a leader in responsible aquaculture in the region, thus attracting investment and fostering growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Pelagic Fish Demersal Fish Freshwater Fish Shellfish Shrimp Mollusks Seaweed Others |

| By End-Use | Domestic Consumption Export Markets Retail Food Service Processing Others |

| By Production Method | Wild-Caught Farmed Cage Farming Pond Farming Others |

| By Species | Tilapia Sea Bream Shrimp Catfish Others |

| By Distribution Channel | Retail Food Service Online Sales Wholesale Others |

| By Certification Type | Organic Certification Sustainability Certification Quality Assurance Certification Others |

| By Market Segment | Commercial Aquaculture Subsistence Aquaculture Recreational Aquaculture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Marine Fish Farming | 60 | Aquaculture Farm Owners, Production Managers |

| Freshwater Aquaculture | 50 | Farm Operators, Supply Chain Managers |

| Aquaculture Feed Suppliers | 40 | Sales Managers, Product Development Specialists |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

| Research Institutions Focused on Aquaculture | 40 | Researchers, Academic Professors |

The Global Aquaculture Industry in Bahrain is valued at approximately USD 430 million, reflecting significant growth driven by rising seafood demand, technological advancements, and government initiatives to enhance local production capabilities.