Region:Global

Author(s):Dev

Product Code:KRAD0391

Pages:81

Published On:August 2025

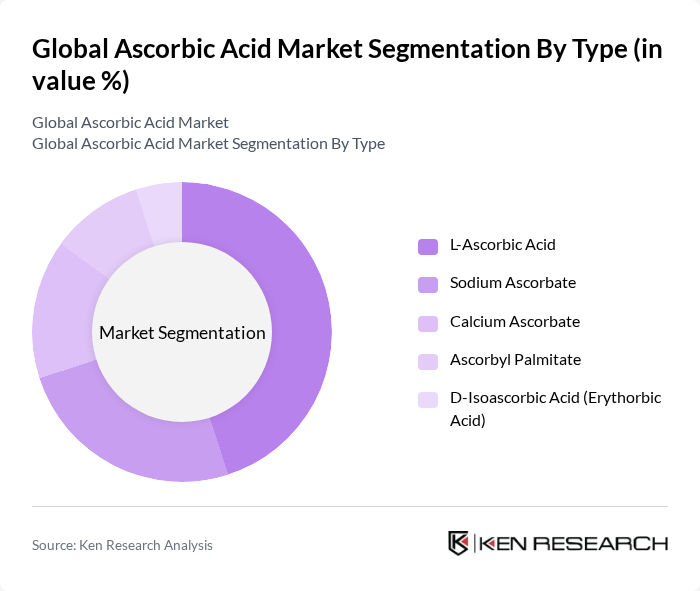

By Type:The ascorbic acid market is segmented into various types, including L-Ascorbic Acid, Sodium Ascorbate, Calcium Ascorbate, Ascorbyl Palmitate, and D-Isoascorbic Acid (Erythorbic Acid). Among these,L-Ascorbic Acidis the most widely used form due to its biological activity as vitamin C and effectiveness as an antioxidant; it is prevalent in food preservation and fortification and widely used in topical cosmetics for skin-brightening and anti?oxidative benefits .Sodium AscorbateandCalcium Ascorbateare buffered salts favored in pharmaceutical and supplement formulations for improved gastric tolerance and stability across dosage forms .

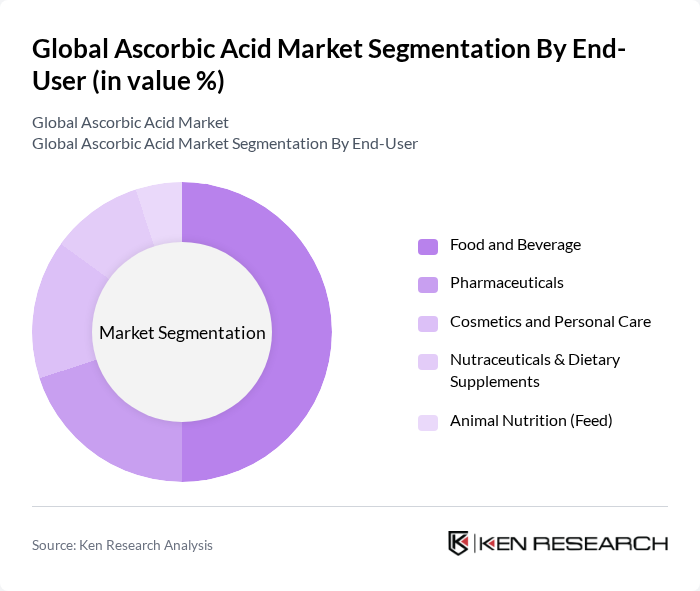

By End-User:The end-user segmentation of the ascorbic acid market includes Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Nutraceuticals & Dietary Supplements, and Animal Nutrition (Feed). TheFood and Beveragesector holds the largest share, with usage as an antioxidant and preservative to control oxidation and preserve color, as well as for fortification in beverages and processed foods . ThePharmaceuticalsandNutraceuticals & Dietary Supplementssegments are significant due to widespread use for vitamin C deficiency management and preventive health, whileCosmetics and Personal Careleverages L?ascorbic acid and derivatives in topical formulations for stability and skin benefits .

The Global Ascorbic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as dsm-firmenich, BASF SE, CSPC Pharmaceutical Group Limited (Hebei), Northeast Pharmaceutical Group Co., Ltd., Zhejiang NHU Co., Ltd., Zhejiang Medicine Co., Ltd. (Xinchang Pharmaceutical Factory), Shandong Luwei Pharmaceutical Co., Ltd., North China Pharmaceutical Group Corporation (NCPC), Anhui Tiger Biotech Co., Ltd., Shandong Tianli Pharmaceutical Co., Ltd., The Wright Group, Kemin Industries, Inc., Glanbia Nutritionals, Lonza Group Ltd., Merck KGaA contribute to innovation, geographic expansion, and service delivery in this space .

The future of the ascorbic acid market appears promising, driven by increasing consumer demand for health-oriented products and innovations in product formulations. The trend towards natural and organic ingredients is expected to shape product development, with manufacturers focusing on sustainable sourcing practices. Additionally, the growth of e-commerce platforms is likely to enhance product accessibility, allowing consumers to easily purchase ascorbic acid supplements and fortified foods, further expanding market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | L-Ascorbic Acid Sodium Ascorbate Calcium Ascorbate Ascorbyl Palmitate D-Isoascorbic Acid (Erythorbic Acid) |

| By End-User | Food and Beverage Pharmaceuticals Cosmetics and Personal Care Nutraceuticals & Dietary Supplements Animal Nutrition (Feed) |

| By Application | Antioxidant Preservative Nutritional Fortification/Supplement Reducing & Flour Treatment Agent (Bakery/Meat Processing) Skin Care Active (Brightening/Anti-aging) |

| By Distribution Channel | Direct (B2B) Sales Distributors/Wholesalers Online (E-commerce/Marketplace) Retail & Specialty Stores |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging (25 kg bags/drums) Retail Packaging (consumer formats) Liquid/Solution Formats |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Companies | 100 | Regulatory Affairs Managers, R&D Directors |

| Cosmetic Product Developers | 80 | Formulation Chemists, Brand Managers |

| Distributors and Suppliers | 70 | Sales Managers, Supply Chain Coordinators |

| Research Institutions | 60 | Research Scientists, Market Analysts |

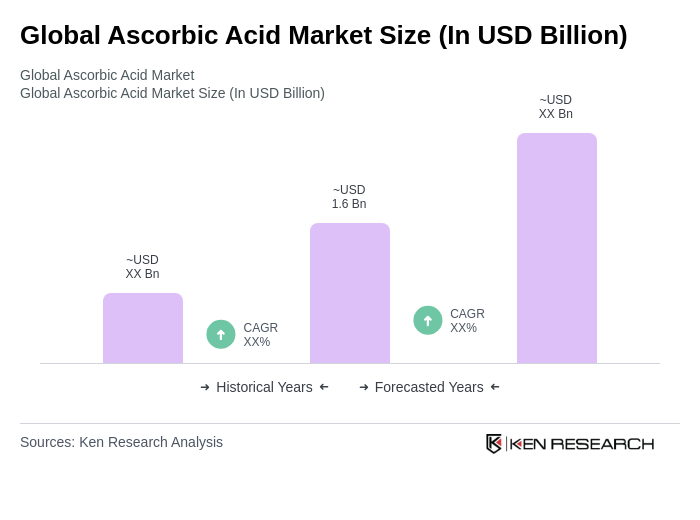

The Global Ascorbic Acid Market is valued at approximately USD 1.6 billion, based on a five-year historical analysis. Recent assessments indicate values near the low-to-mid USD one billion range, driven by growth in fortified foods, supplements, and personal care applications.