Region:Global

Author(s):Shubham

Product Code:KRAD0777

Pages:91

Published On:August 2025

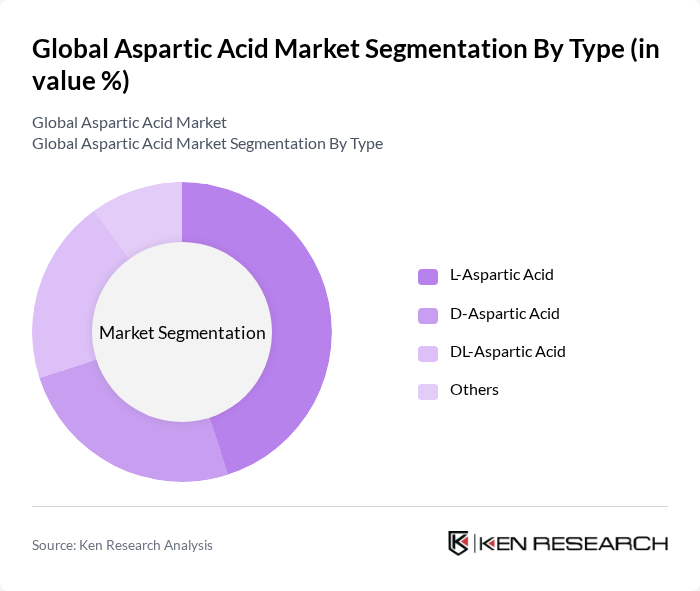

By Type:

The aspartic acid market is primarily dominated byL-Aspartic Acid, which is widely used in the food and beverage industry due to its flavor-enhancing properties and its role as a precursor in the production of aspartame. The increasing consumer preference for natural and low-calorie sweeteners has led to a surge in demand for L-Aspartic Acid, particularly in functional foods and dietary supplements.D-Aspartic Acidfollows closely, finding applications in dietary supplements aimed at enhancing athletic performance and muscle growth, especially in sports nutrition and male fertility products. The growing trend of fitness and health consciousness among consumers is driving the demand for these products, making L-Aspartic Acid the leading subsegment in the market .

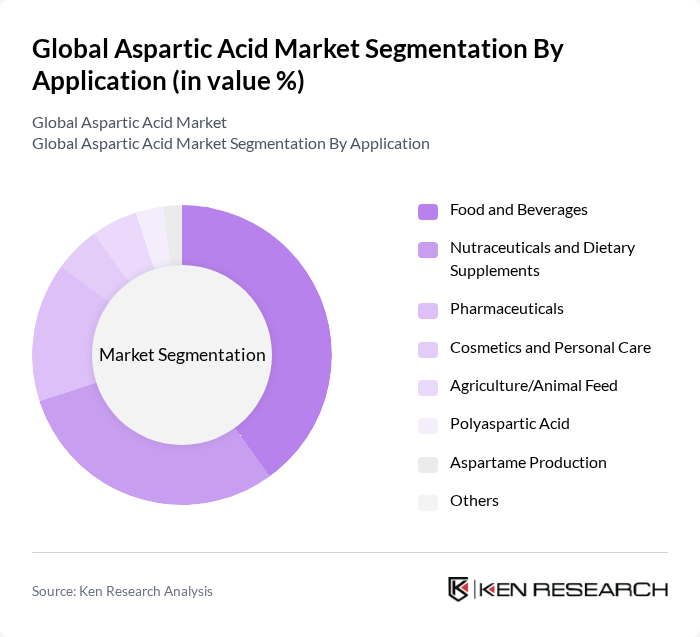

By Application:

The application segment of the aspartic acid market is led by thefood and beveragessector, which accounts for a significant portion of the market share. The increasing demand for low-calorie sweeteners, flavor enhancers, and functional ingredients in food products is driving this trend.Nutraceuticals and dietary supplementsare also gaining traction, particularly among health-conscious consumers seeking performance-enhancing and wellness products. Thepharmaceutical industryfollows, utilizing aspartic acid in various formulations for its role in amino acid synthesis and metabolic support. The diverse applications of aspartic acid across these sectors highlight its importance and contribute to its market leadership .

The Global Aspartic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ajinomoto Co., Inc., Evonik Industries AG, BASF SE, Kyowa Hakko Bio Co., Ltd., Fufeng Group Co., Ltd., Daesang Corporation, Showa Denko K.K., Jiangsu Boli Bioproducts Co., Ltd., Ningxia Eppen Biotech Co., Ltd., Zhejiang Jianfeng Chemical Co., Ltd., Hubei Huitian New Material Co., Ltd., Chengdu Huarui Chemical Co., Ltd., Shandong Qilu Pharmaceutical Co., Ltd., Shanghai Dazhong Pharmaceutical Co., Ltd., Tianjin Zhongxin Chemical Co., Ltd., Shijiazhuang Donghua Jinlong Chemical Co., Ltd., Jiangsu Kolod Food Ingredients Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the aspartic acid market appears promising, driven by the increasing focus on sustainability and innovation in production technologies. As consumers demand more eco-friendly products, manufacturers are likely to invest in green chemistry practices. Additionally, the rise of plant-based diets is expected to boost the demand for aspartic acid in food applications. Collaborations between companies and research institutions will further enhance product development, ensuring that the market adapts to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | L-Aspartic Acid D-Aspartic Acid DL-Aspartic Acid Others |

| By Application | Food and Beverages Nutraceuticals and Dietary Supplements Pharmaceuticals Cosmetics and Personal Care Agriculture/Animal Feed Polyaspartic Acid Aspartame Production Others |

| By End-User Industry | Food and Beverage Industry Pharmaceutical Industry Animal Feed Industry Cosmetics and Personal Care Industry Agricultural Sector Industrial Applications |

| By Production Method | Bio-fermentation Chemical Synthesis |

| By Purity Grade | Food Grade Pharmaceutical Grade Industrial Grade |

| By Region | North America Europe Asia-Pacific South America Middle East & Africa |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Product Form | Powder Liquid Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Applications | 60 | R&D Managers, Quality Assurance Specialists |

| Food & Beverage Sector | 50 | Product Development Managers, Regulatory Affairs Officers |

| Agricultural Chemicals | 40 | Agronomists, Supply Chain Managers |

| Cosmetic Industry | 40 | Formulation Chemists, Brand Managers |

| Industrial Applications | 50 | Operations Managers, Procurement Specialists |

The Global Aspartic Acid Market is valued at approximately USD 120 million, driven by increasing demand across various sectors such as food and beverages, pharmaceuticals, and nutraceuticals, reflecting a growing trend towards health-conscious products and sustainable practices.