Global Audio Equipment Market Overview

- The Global Audio Equipment Market is valued at USD 38 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-quality audio experiences across entertainment, automotive, and personal use sectors. Key market drivers include the rise of streaming services, proliferation of smart devices, and rapid adoption of wireless and AI-integrated audio solutions. The trend toward portable and smart audio devices, along with innovations in sound quality and connectivity, continues to fuel market expansion .

- Key players in this market include the United States, Japan, Germany, and China. The dominance of these countries is attributed to advanced technological infrastructure, robust consumer electronics industries, and significant investments in research and development. The presence of major audio equipment manufacturers and ongoing innovation in these regions further strengthens their market leadership .

- In 2023, the European Union implemented Directive 2012/19/EU on Waste Electrical and Electronic Equipment (WEEE), updated by Regulation (EU) 2023/1542, which mandates manufacturers of audio equipment to comply with strict recycling and disposal guidelines. This regulation requires companies to design products for easier recycling and to take responsibility for the entire lifecycle of their products, promoting sustainability and reducing electronic waste .

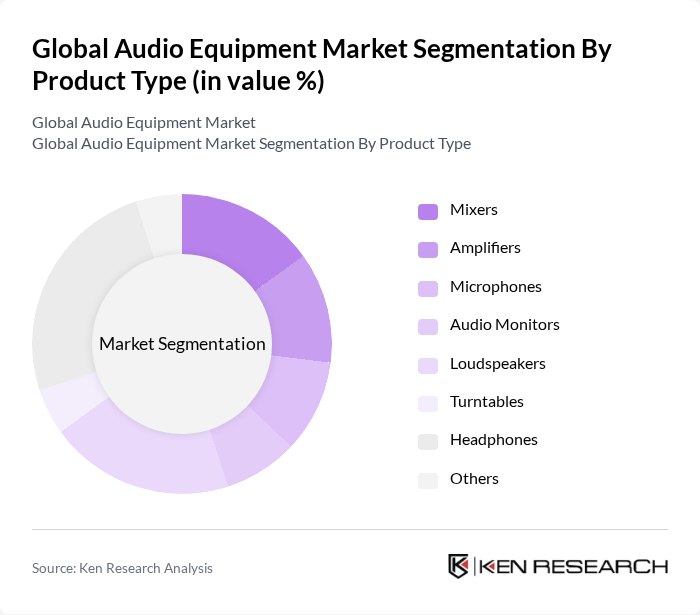

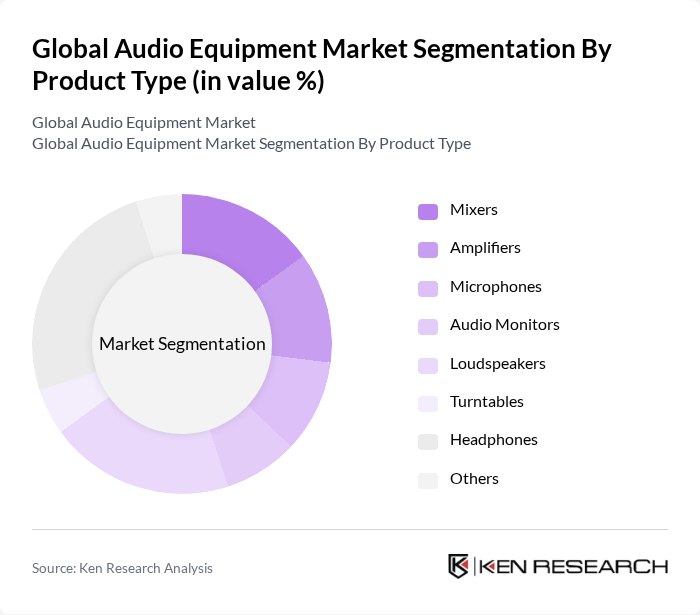

Global Audio Equipment Market Segmentation

By Product Type:The audio equipment market is segmented into mixers, amplifiers, microphones, audio monitors, loudspeakers, turntables, headphones, and others. Headphones have emerged as a dominant sub-segment, driven by the surge in personal audio consumption, remote work, and online learning. The demand for portable, high-quality audio solutions has led to significant innovation in headphone technology, including features such as wireless connectivity, noise cancellation, and integration with smart devices .

By End User:The audio equipment market is segmented by end users, including commercial, automotive, home entertainment, and other end users. The commercial segment leads the market, propelled by increasing demand for professional audio solutions in events, concerts, and broadcasting. Businesses are investing in advanced audio systems to enhance customer experiences and communication, while home entertainment and automotive segments are also experiencing robust growth due to rising consumer interest in immersive sound environments and in-car audio upgrades .

Global Audio Equipment Market Competitive Landscape

The Global Audio Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Bose Corporation, Sennheiser Electronic GmbH & Co. KG, Harman International Industries, Inc., Yamaha Corporation, Audio-Technica Corporation, Bang & Olufsen A/S, JBL (a subsidiary of Harman), Pioneer Corporation, AKG Acoustics (a subsidiary of Harman), Klipsch Group, Inc., Bowers & Wilkins, Denon (a brand of Sound United LLC), Marshall Amplification PLC, Skullcandy, Inc., Shure Incorporated, Alpine Electronics, Inc., LG Electronics Inc., Samsung Electronics Co., Ltd., Panasonic Corporation contribute to innovation, geographic expansion, and service delivery in this space.

Global Audio Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for High-Quality Audio Experiences:The global audio equipment market is witnessing a surge in demand for high-fidelity audio products, driven by consumer preferences for superior sound quality. In future, the global audio equipment market is projected to reach $30 billion, with high-end headphones and speakers accounting for a significant share. This trend is supported by the increasing disposable income of consumers, which is expected to rise by 4.5% in future, allowing for greater spending on premium audio products.

- Growth in the Entertainment and Media Industry:The entertainment and media sector is projected to grow to $2.6 trillion in future, fueling demand for audio equipment. This growth is largely attributed to the expansion of streaming services, which are expected to reach 1.5 billion subscribers globally. As consumers seek enhanced audio experiences for movies, music, and gaming, manufacturers are responding with innovative audio solutions, further driving market growth in the audio equipment sector.

- Rising Adoption of Smart Home Devices:The integration of audio equipment with smart home technology is becoming increasingly prevalent. In future, the smart home market is expected to exceed $150 billion, with audio devices playing a crucial role. The demand for voice-activated speakers and smart sound systems is rising, as 60% of households are projected to adopt smart home devices. This trend is driving manufacturers to innovate and create products that seamlessly integrate with smart home ecosystems.

Market Challenges

- Intense Competition Among Manufacturers:The audio equipment market is characterized by fierce competition, with over 500 manufacturers vying for market share. This saturation leads to price wars, which can erode profit margins. In future, the average profit margin for audio equipment manufacturers is expected to decline to 8%, down from 10%. Companies must differentiate their products through innovation and branding to maintain profitability in this competitive landscape.

- Supply Chain Disruptions:The audio equipment industry faces significant supply chain challenges, exacerbated by geopolitical tensions and the lingering effects of the COVID-19 pandemic. In future, 70% of manufacturers report experiencing delays in component sourcing, impacting production timelines. These disruptions can lead to increased costs and reduced availability of products, hindering the ability of companies to meet consumer demand effectively.

Global Audio Equipment Market Future Outlook

The future of the audio equipment market appears promising, driven by technological advancements and evolving consumer preferences. As the demand for immersive audio experiences grows, manufacturers are likely to invest in research and development to create innovative products. Additionally, the rise of subscription-based audio services will further enhance the market landscape, encouraging companies to explore new revenue streams and partnerships. The integration of artificial intelligence in audio devices will also play a pivotal role in shaping the future of this industry.

Market Opportunities

- Growth in Wireless Audio Solutions:The wireless audio segment is expected to expand significantly, with sales projected to reach $12 billion in future. This growth is driven by consumer preferences for convenience and mobility, as wireless headphones and speakers become increasingly popular. Manufacturers can capitalize on this trend by developing advanced wireless technologies that enhance user experience and sound quality.

- Expansion into Emerging Markets:Emerging markets present substantial growth opportunities for audio equipment manufacturers. In future, the Asia-Pacific region is expected to account for 35% of global audio equipment sales, driven by rising disposable incomes and urbanization. Companies can leverage this growth by tailoring products to meet the specific needs and preferences of consumers in these regions, enhancing market penetration.