Region:Global

Author(s):Rebecca

Product Code:KRAA1453

Pages:92

Published On:August 2025

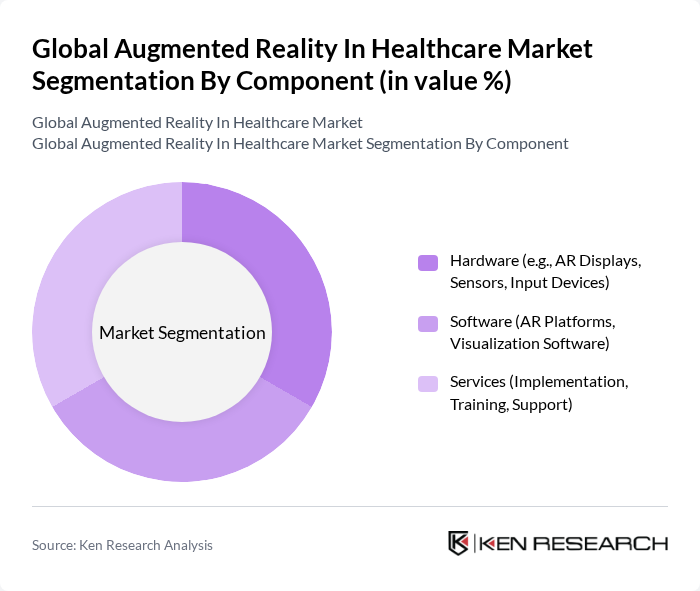

By Component:The market is segmented into Hardware, Software, and Services. Hardware includes AR displays, sensors, and input devices, while Software encompasses AR platforms and visualization software. Services cover implementation, training, and support. Among these, the Hardware segment is currently leading due to the increasing demand for AR devices that enhance surgical precision and training capabilities. In 2023, hardware accounted for the largest share, driven by the adoption of advanced AR headsets and imaging devices in clinical and educational settings .

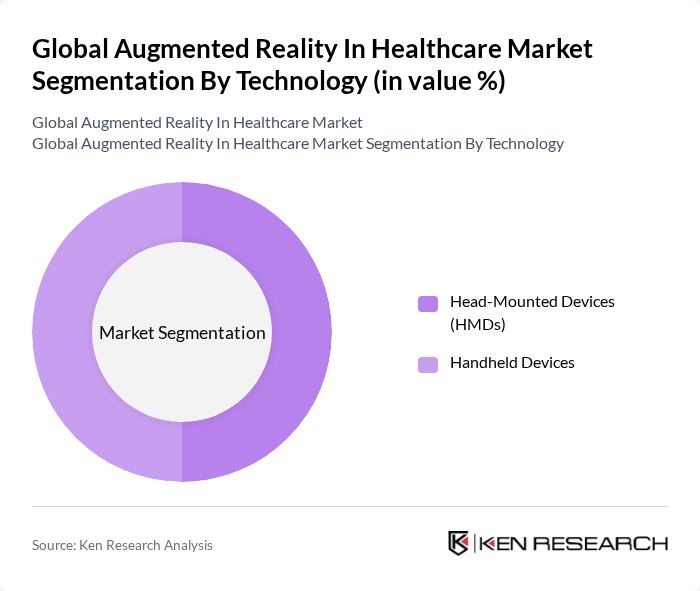

By Technology:The market is divided into Head-Mounted Devices (HMDs) and Handheld Devices. HMDs are gaining traction due to their immersive experience, which is particularly beneficial in surgical settings. Handheld devices are also popular for their portability and ease of use in various healthcare applications. The HMD segment is currently the dominant technology, driven by advancements in display technology and user interface design. AR technologies, especially HMDs, are increasingly used for surgical visualization, medical training, and patient education .

The Global Augmented Reality In Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Google LLC, Siemens Healthineers AG, Augmedix, Inc., Osso VR, Inc., ImmersiveTouch, Inc., Magic Leap, Inc., PTC Inc., HTC Corporation (VIVEPORT), Atheer, Inc., Medivis, Inc., FundamentalVR Ltd., XRHealth, Proprio, Inc., Brainlab AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of augmented reality in healthcare appears promising, driven by technological advancements and increasing acceptance among healthcare professionals. As AR applications become more sophisticated, their integration with artificial intelligence will enhance diagnostic capabilities and patient outcomes. Furthermore, the growing emphasis on patient-centered care will likely lead to increased investments in AR solutions, fostering innovation and improving healthcare delivery. The focus on personalized medicine will also create new avenues for AR applications, particularly in rehabilitation and mental health.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware (e.g., AR Displays, Sensors, Input Devices) Software (AR Platforms, Visualization Software) Services (Implementation, Training, Support) |

| By Technology | Head-Mounted Devices (HMDs) Handheld Devices |

| By Product | AR Displays AR Sensors AR Input Devices AR Semiconductor Components Other Products |

| By Application | Surgical Planning & Visualization Medical Training & Education Patient Monitoring & Rehabilitation Patient Care & Engagement Other Applications |

| By End-User | Hospitals & Clinics Research Laboratories Academic & Training Institutes Other End Users |

| By Distribution Channel | Direct Sales Online Sales Distributors |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Customer Segment | Individual Practitioners Healthcare Organizations Educational Institutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Surgical AR Applications | 100 | Surgeons, Surgical Technologists |

| AR in Medical Training | 70 | Medical Educators, Training Coordinators |

| Patient Engagement Tools | 60 | Healthcare Administrators, Patient Experience Managers |

| AR for Rehabilitation | 50 | Physical Therapists, Rehabilitation Specialists |

| AR in Diagnostics | 80 | Radiologists, Diagnostic Imaging Technicians |

The Global Augmented Reality in Healthcare Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by the adoption of AR technologies in medical training, surgical planning, and patient engagement.