Region:Global

Author(s):Dev

Product Code:KRAD0527

Pages:80

Published On:August 2025

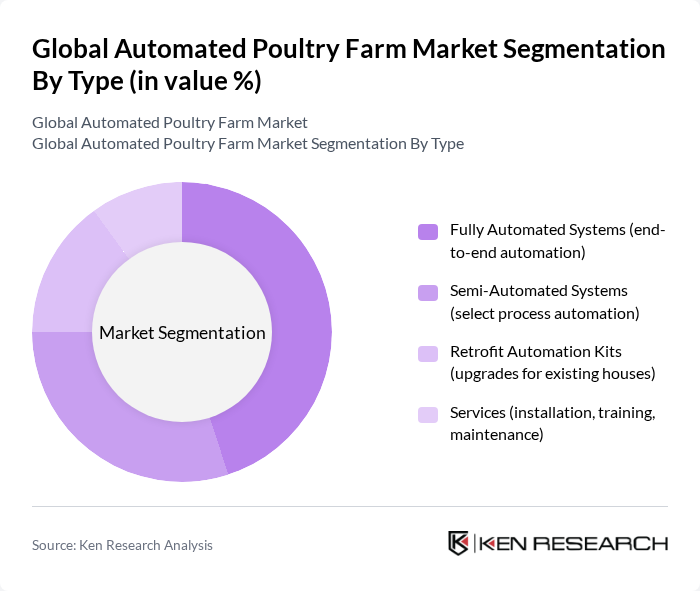

By Type:The market is segmented into Fully Automated Systems, Semi-Automated Systems, Retrofit Automation Kits, and Services. Fully Automated Systems are gaining traction due to their ability to streamline operations and reduce labor costs, supported by integrated AI/IoT controls and robotics for climate, feeding, and egg handling. Semi-Automated Systems cater to farms seeking a balance between automation and manual processes for specific tasks like feeding or ventilation control. Retrofit Automation Kits are popular among existing farms seeking upgrades to legacy houses without full rebuilds, covering sensors, controllers, and motorized mechanisms, while Services encompass installation, training, preventive maintenance, and software updates to ensure uptime and performance of automated systems.

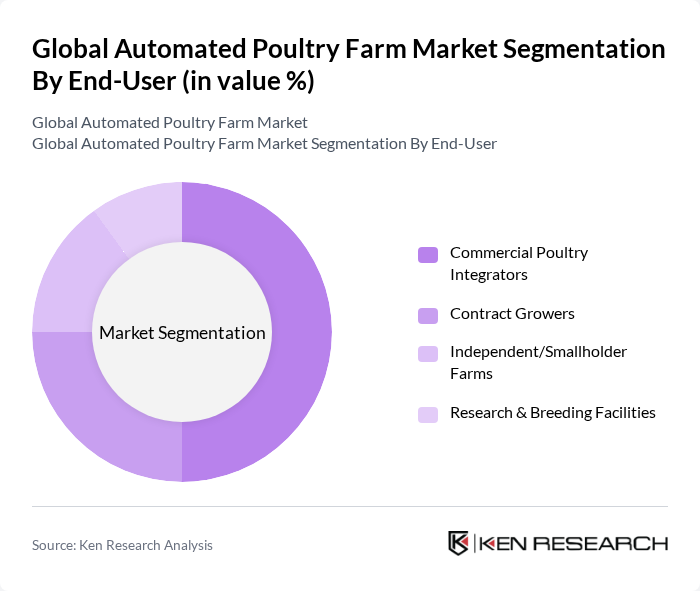

By End-User:The end-user segmentation includes Commercial Poultry Integrators, Contract Growers, Independent/Smallholder Farms, and Research & Breeding Facilities. Commercial Poultry Integrators dominate the market due to their large-scale operations and significant investments in automation technologies. Contract Growers are increasingly adopting automated solutions to meet the demands of integrators. Independent farms are gradually transitioning to automation, while research facilities focus on developing innovative solutions for the industry.

The Global Automated Poultry Farm Market is characterized by a dynamic mix of regional and international players. Leading participants such as Big Dutchman, Vencomatic Group, Chore-Time (CTB Inc., a Berkshire Hathaway company), Jansen Poultry Equipment, Facco, Petersime, Jamesway Incubator Company, Roxell (CTB Inc.), Lubing Maschinenfabrik, SKA Poultry Equipment, Farmer Automatic (Big Dutchman Group), Predicta GUARD (Poultry Sense / MSD Animal Health Intelligence), Munters (climate control), Cumberland (CTB Inc.), Yangzhou LiVi Machinery contribute to innovation, geographic expansion, and service delivery in this space.

The future of automated poultry farming is poised for significant transformation, driven by technological innovations and evolving consumer preferences. As farms increasingly adopt smart farming practices, the integration of IoT and data analytics will enhance operational efficiency and decision-making. Furthermore, the focus on sustainability will lead to the development of eco-friendly automated solutions, ensuring that poultry production meets both market demands and environmental standards. This evolution will likely reshape the industry landscape, fostering growth and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Automated Systems (end-to-end automation) Semi-Automated Systems (select process automation) Retrofit Automation Kits (upgrades for existing houses) Services (installation, training, maintenance) |

| By End-User | Commercial Poultry Integrators Contract Growers Independent/Smallholder Farms Research & Breeding Facilities |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Automated Feeding & Watering Systems Climate & Ventilation Control Egg Collection, Nesting & Grading Waste/Manure Handling & Litter Management Robotics (e.g., floor robots, mortality removal) IoT Sensors & Farm Management Software (AI/ML analytics) |

| By Application | Broilers (meat production) Layers (table eggs) Breeders (parent & grandparent stock) Hatcheries (incubation & hatching automation) |

| By Investment Source | Private Investments Government Funding Multilateral/Development Finance Co-ops & Producer Associations |

| By Policy Support | Grants and Subsidies Tax Incentives Research and Development Support Animal Welfare & Biosecurity Compliance Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automated Poultry Farm Owners | 120 | Poultry Farm Operators, Business Owners |

| Poultry Equipment Manufacturers | 90 | Product Managers, Sales Directors |

| Agricultural Technology Consultants | 70 | Consultants, Industry Analysts |

| Veterinary Experts in Poultry | 60 | Veterinarians, Animal Health Specialists |

| Regulatory Bodies and Associations | 50 | Policy Makers, Regulatory Officers |

The Global Automated Poultry Farm Market is valued at approximately USD 11 billion, reflecting significant growth driven by increasing poultry product demand, advancements in automation technology, and the integration of IoT and AI in farm management practices.