Region:Global

Author(s):Geetanshi

Product Code:KRAA1177

Pages:85

Published On:August 2025

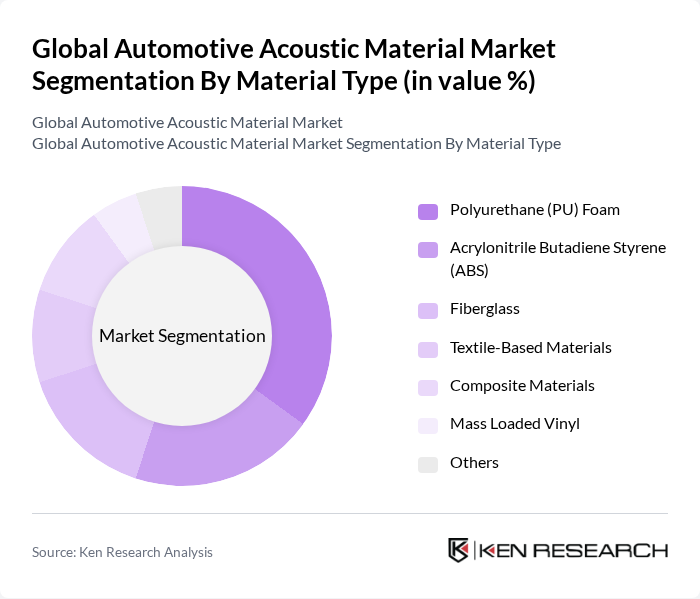

By Material Type:The market is segmented into various material types, including Polyurethane (PU) Foam, Acrylonitrile Butadiene Styrene (ABS), Fiberglass, Textile-Based Materials, Composite Materials, Mass Loaded Vinyl, and Others. Among these, Polyurethane (PU) Foam remains the leading subsegment due to its excellent sound absorption properties and lightweight nature, making it a preferred choice for automotive manufacturers. The increasing focus on lightweight and sustainable materials to enhance fuel efficiency and meet regulatory requirements further drives the demand for PU Foam .

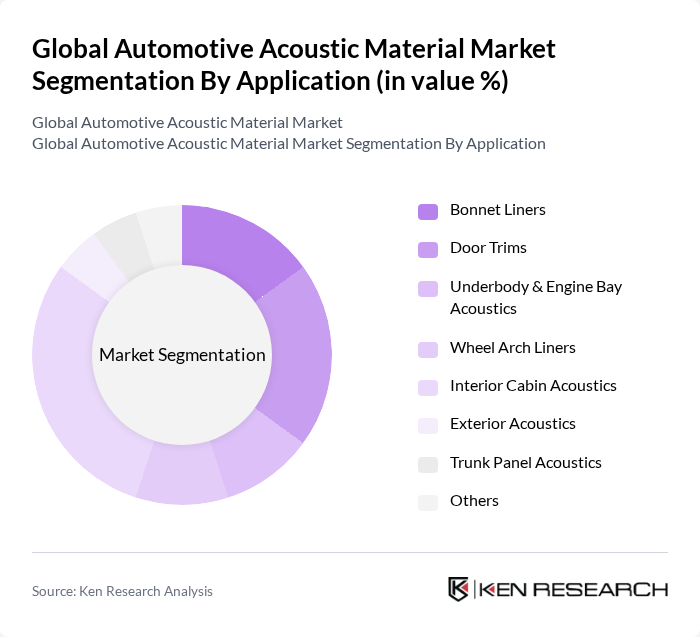

By Application:The applications of automotive acoustic materials include Bonnet Liners, Door Trims, Underbody & Engine Bay Acoustics, Wheel Arch Liners, Interior Cabin Acoustics, Exterior Acoustics, Trunk Panel Acoustics, and Others. The Interior Cabin Acoustics segment is the most significant due to the growing consumer demand for quieter and more comfortable driving experiences. As vehicle interiors become more sophisticated, the need for effective sound insulation materials has surged, making this segment a focal point for manufacturers .

The Global Automotive Acoustic Material Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, 3M Company, DuPont de Nemours, Inc., Covestro AG, Huntsman Corporation, Soundcoat Company, Autoneum Holding AG, Knauf Insulation, Saint-Gobain S.A., Acoustiblok, Inc., Armacell International S.A., Lydall, Inc., Trelleborg AB, Sika AG, Dow Chemical Company, Toray Industries, Inc., Nihon Tokushu Toryo Co., Ltd., Adler Pelzer Group, Grupo Antolin, UGN, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive acoustic material market appears promising, driven by the increasing integration of electric vehicles and advancements in material science. As electric vehicle production is projected to exceed 25 million units in future, the demand for effective noise reduction solutions will rise. Additionally, manufacturers are likely to invest in sustainable materials, aligning with global sustainability goals. This shift will not only enhance vehicle performance but also cater to environmentally conscious consumers, fostering innovation in the acoustic materials sector.

| Segment | Sub-Segments |

|---|---|

| By Material Type | Polyurethane (PU) Foam Acrylonitrile Butadiene Styrene (ABS) Fiberglass Textile-Based Materials Composite Materials Mass Loaded Vinyl Others |

| By Application | Bonnet Liners Door Trims Underbody & Engine Bay Acoustics Wheel Arch Liners Interior Cabin Acoustics Exterior Acoustics Trunk Panel Acoustics Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Electric Vehicles Luxury Vehicles Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, France, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria, Rest of ME&A) Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Material Source | Natural Materials Synthetic Materials Recycled Materials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Acoustic Solutions | 120 | Product Development Engineers, Acoustic Specialists |

| Commercial Vehicle Noise Control | 90 | Fleet Managers, Vehicle Design Engineers |

| Electric Vehicle Acoustic Materials | 60 | R&D Managers, Sustainability Officers |

| Automotive Supplier Insights | 50 | Sales Directors, Supply Chain Managers |

| Regulatory Impact on Acoustic Standards | 40 | Compliance Officers, Policy Analysts |

The Global Automotive Acoustic Material Market is valued at approximately USD 5.2 billion, driven by the increasing demand for noise reduction in vehicles and the shift towards electric and hybrid vehicles requiring advanced acoustic solutions.