Global Automotive Adhesives and Sealants Market Overview

- The Global Automotive Adhesives and Sealants Market is valued at USD 10.8 billion, based on a five-year historical analysis. Growth is primarily driven by the rising demand for lightweight vehicles, the adoption of advanced bonding solutions in electric and autonomous vehicles, and the increasing use of eco-friendly materials to meet sustainability targets. Enhanced safety, durability requirements, and the transition away from traditional mechanical fasteners are also key contributors to market expansion .

- Key players in this market are concentrated in regions such as North America, Europe, and Asia-Pacific. Countries like Germany and the United States maintain dominance due to their robust automotive manufacturing sectors, continuous technological innovation, and significant investments in research and development, which drive the performance and application scope of adhesives and sealants .

- In 2023, the European Union reinforced regulations on VOC emissions from automotive adhesives and sealants, requiring compliance with the REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) Regulation (EC) No 1907/2006, issued by the European Parliament and Council. This regulation mandates registration and evaluation of chemical substances, sets thresholds for hazardous components, and drives the adoption of safer, sustainable materials in automotive manufacturing .

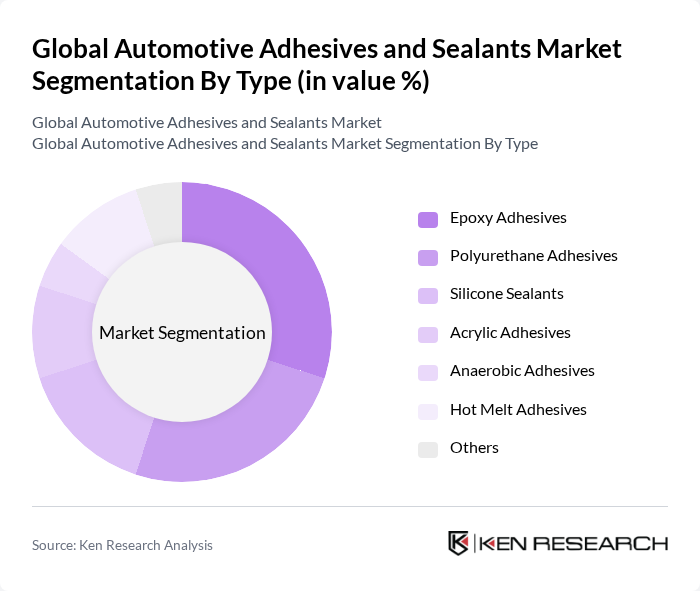

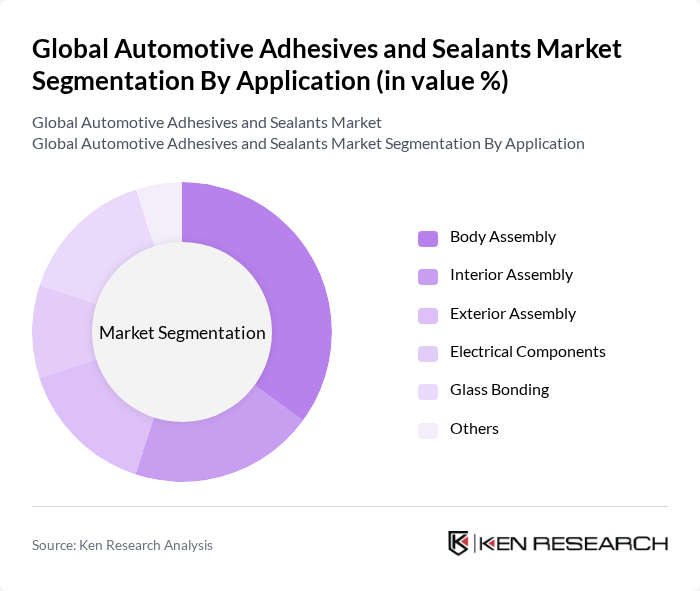

Global Automotive Adhesives and Sealants Market Segmentation

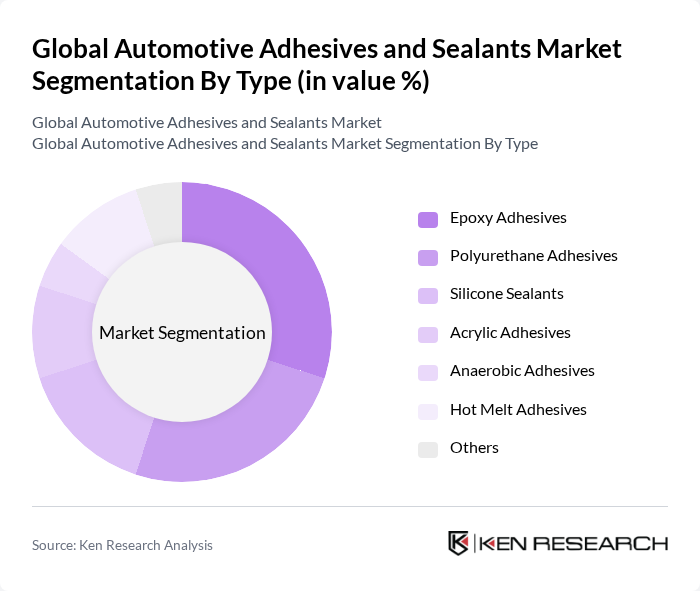

By Type:The market is segmented into various types of adhesives and sealants, including epoxy adhesives, polyurethane adhesives, silicone sealants, acrylic adhesives, anaerobic adhesives, hot melt adhesives, and others. Epoxy adhesives are gaining traction due to their high bonding strength, chemical resistance, and durability, making them suitable for structural and safety-critical automotive applications. Polyurethane adhesives are widely used for their flexibility, impact resistance, and compatibility with a range of substrates, especially in body and interior assembly .

By Application:The applications of automotive adhesives and sealants include body assembly, interior assembly, exterior assembly, electrical components, glass bonding, and others. The body assembly segment leads the market, driven by the automotive industry's focus on structural integrity, crashworthiness, and weight reduction. The surge in electric vehicle production has further increased demand for specialized adhesives in battery packs and electronic component assembly, supporting safety and thermal management requirements .

Global Automotive Adhesives and Sealants Market Competitive Landscape

The Global Automotive Adhesives and Sealants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, BASF SE, Dow Inc., Arkema S.A., Huntsman Corporation, LORD Corporation (a subsidiary of Parker Hannifin), Illinois Tool Works Inc. (ITW), Momentive Performance Materials Inc., RPM International Inc., Wacker Chemie AG, Covestro AG, Bostik (a subsidiary of Arkema), Jowat SE, PPG Industries, Inc., Ashland Global Holdings Inc., Permabond LLC, Soudal N.V. contribute to innovation, geographic expansion, and service delivery in this space.

Global Automotive Adhesives and Sealants Market Industry Analysis

Growth Drivers

- Increasing Demand for Lightweight Vehicles:The automotive industry is witnessing a significant shift towards lightweight vehicles, driven by consumer preferences and regulatory pressures. In future, the average weight of new vehicles is projected to decrease by approximately 100 kg, leading to a demand for adhesives that facilitate weight reduction. This trend is supported by the anticipated increase in global automotive production, which is expected to reach approximately 90 million units, further driving the need for advanced adhesive solutions.

- Rising Automotive Production and Sales:Global automotive production is projected to grow to approximately 90 million units in future, reflecting a robust recovery post-pandemic. This surge in production is accompanied by a corresponding increase in adhesive and sealant usage, estimated at approximately 1.5 million tons. The growth in sales, particularly in emerging markets, is expected to contribute significantly to the demand for high-performance adhesives, which are essential for vehicle assembly and durability.

- Technological Advancements in Adhesive Formulations:Innovations in adhesive technology are enhancing performance characteristics, such as bonding strength and curing times. In future, the introduction of new formulations is expected to increase the market share of high-performance adhesives by approximately 20%. These advancements are crucial for meeting the demands of modern automotive designs, which require materials that can withstand extreme conditions while ensuring safety and longevity.

Market Challenges

- Fluctuating Raw Material Prices:The automotive adhesives market faces challenges due to the volatility of raw material prices, particularly petrochemicals. In future, the price of key raw materials is expected to fluctuate by up to approximately 15%, impacting production costs and profit margins for manufacturers. This unpredictability can hinder investment in new technologies and limit the ability to offer competitive pricing, affecting overall market growth.

- Stringent Environmental Regulations:Increasingly stringent environmental regulations are posing challenges for manufacturers in the automotive adhesives sector. In future, compliance with regulations such as REACH and RoHS is expected to require significant investment, estimated at approximately $500 million across the industry. These regulations necessitate the development of eco-friendly products, which can be costly and time-consuming, potentially slowing down innovation and market entry for new products.

Global Automotive Adhesives and Sealants Market Future Outlook

The future of the automotive adhesives and sealants market appears promising, driven by the ongoing transition towards electric vehicles and the integration of advanced technologies. As manufacturers increasingly focus on sustainability, the demand for bio-based adhesives is expected to rise significantly. Additionally, the growing adoption of advanced driver-assistance systems (ADAS) will create new opportunities for innovative adhesive solutions, enhancing vehicle safety and performance while aligning with environmental goals.

Market Opportunities

- Expansion in Electric Vehicle Manufacturing:The shift towards electric vehicles presents a substantial opportunity for adhesive manufacturers. With electric vehicle production projected to reach approximately 20 million units in future, the demand for specialized adhesives that support lightweight construction and battery assembly is expected to grow significantly, potentially increasing market revenues by approximately $300 million.

- Development of Bio-Based Adhesives:The increasing focus on sustainability is driving the development of bio-based adhesives. In future, the market for bio-based adhesives is anticipated to grow by approximately 25%, as manufacturers seek to comply with environmental regulations and consumer preferences for eco-friendly products. This trend not only supports regulatory compliance but also enhances brand reputation and market competitiveness.