Region:Global

Author(s):Geetanshi

Product Code:KRAD0033

Pages:92

Published On:August 2025

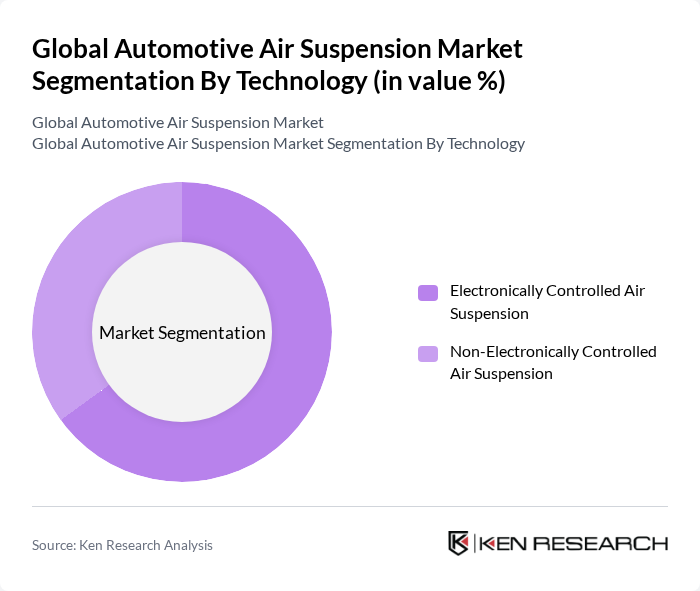

By Technology:The market is segmented into Electronically Controlled Air Suspension and Non-Electronically Controlled Air Suspension. The Electronically Controlled Air Suspension segment is gaining traction due to its ability to adapt to varying road conditions, providing superior comfort and handling. In contrast, Non-Electronically Controlled Air Suspension remains popular for its simplicity and cost-effectiveness, particularly in budget vehicles.

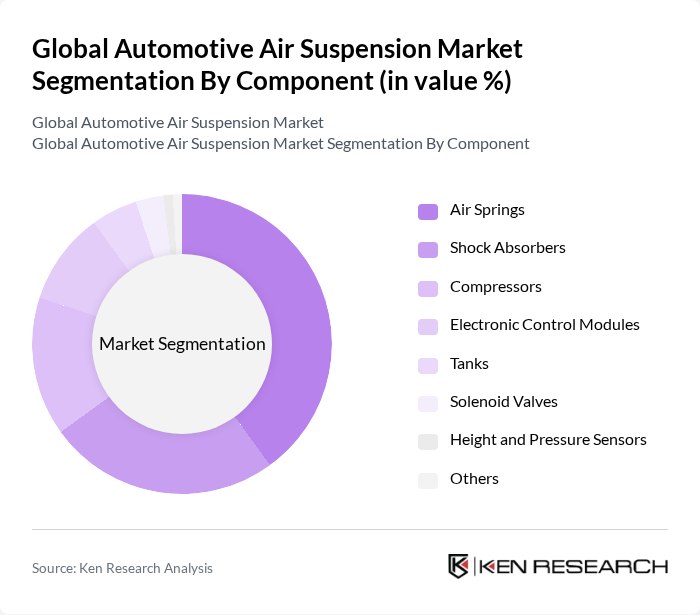

By Component:The market is further segmented into Air Springs, Shock Absorbers, Compressors, Electronic Control Modules, Tanks, Solenoid Valves, Height and Pressure Sensors, and Others. Air Springs are the leading component due to their critical role in providing the necessary support and comfort in air suspension systems. Shock Absorbers and Compressors also play significant roles, ensuring optimal performance and responsiveness of the suspension system.

The Global Automotive Air Suspension Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, WABCO Holdings Inc., ZF Friedrichshafen AG, BWI Group, Hitachi Astemo, Ltd., thyssenkrupp AG, Air Lift Company, Arnott, LLC, Firestone Industrial Products Company, LLC, Dunlop Systems and Components Ltd., Suncore Industries LLC, RideTech, Inc., AccuAir Suspension, Vibracoustic SE, Hendrickson International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive air suspension market appears promising, driven by technological advancements and shifting consumer preferences. As manufacturers increasingly prioritize comfort and performance, the integration of smart technologies and lightweight materials will likely enhance air suspension systems' appeal. Additionally, the growing emphasis on sustainability and eco-friendly solutions will further propel the adoption of air suspension in electric vehicles, aligning with global trends towards greener transportation options. The market is poised for significant growth as these trends continue to evolve.

| Segment | Sub-Segments |

|---|---|

| By Technology | Electronically Controlled Air Suspension Non-Electronically Controlled Air Suspension |

| By Component | Air Springs Shock Absorbers Compressors Electronic Control Modules Tanks Solenoid Valves Height and Pressure Sensors Others |

| By Application | Passenger Cars Light Commercial Vehicles Trucks Buses Others |

| By Sales Channel | OEMs Aftermarket |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Managers, R&D Engineers |

| Commercial Vehicle Manufacturers | 80 | Fleet Managers, Technical Directors |

| Aftermarket Suppliers | 60 | Sales Managers, Product Line Managers |

| Automotive Service Centers | 50 | Service Managers, Technicians |

| Industry Experts and Analysts | 40 | Market Analysts, Automotive Consultants |

The Global Automotive Air Suspension Market is valued at approximately USD 6.7 billion, driven by increasing demand for enhanced ride comfort and vehicle stability, particularly in luxury and commercial vehicles.