Region:Global

Author(s):Dev

Product Code:KRAC0568

Pages:94

Published On:August 2025

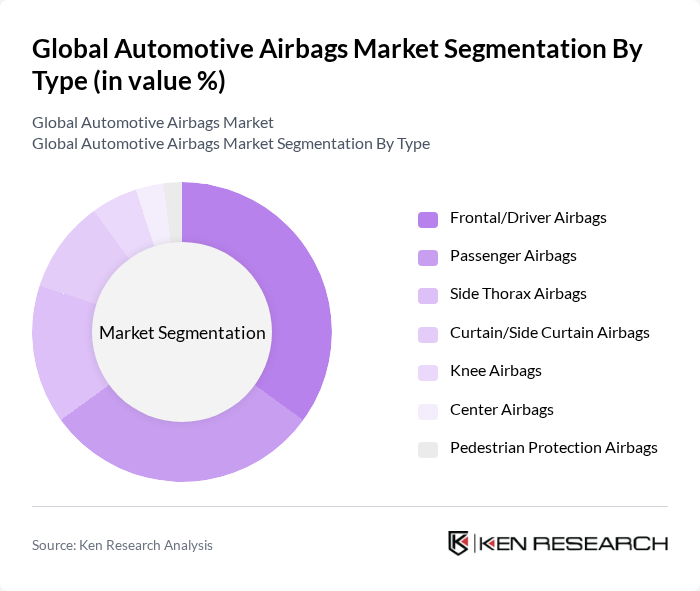

By Type:The market is segmented into various types of airbags, including Frontal/Driver Airbags, Passenger Airbags, Side Thorax Airbags, Curtain/Side Curtain Airbags, Knee Airbags, Center Airbags, and Pedestrian Protection Airbags. Among these, Frontal/Driver Airbags and Passenger Airbags are the most widely used due to their essential role in protecting occupants during frontal collisions. The increasing focus on safety regulations and consumer demand for enhanced safety features are driving the growth of these segments; OEMs are also expanding adoption of side/curtain and knee airbags, and deploying center airbags to mitigate far?side impacts.

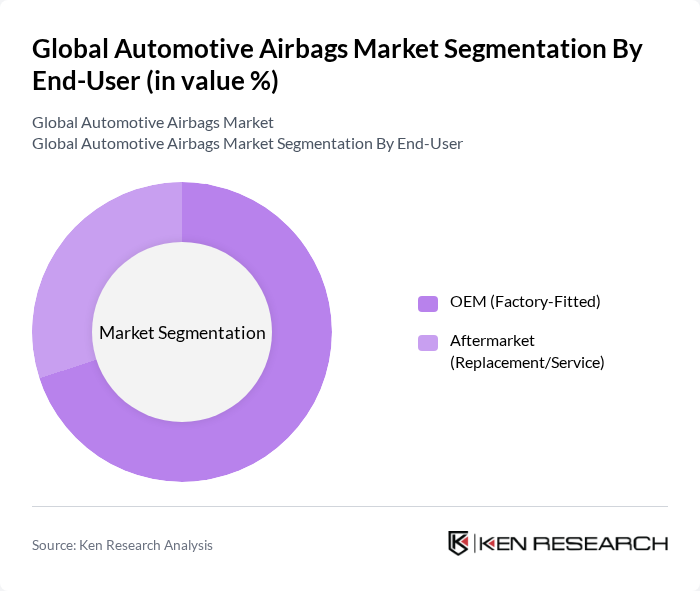

By End-User:The market is divided into OEM (Factory-Fitted) and Aftermarket (Replacement/Service) segments. The OEM segment dominates as manufacturers integrate multiple airbags per vehicle to comply with regulations and new safety ratings, while the aftermarket segment serves replacements tied to collision repairs and long?running vehicle fleets.

The Global Automotive Airbags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Autoliv Inc., Joyson Safety Systems (including legacy Takata assets), ZF Friedrichshafen AG (ZF Passive Safety Systems), Toyoda Gosei Co., Ltd., Hyundai Mobis Co., Ltd., Continental AG, DENSO Corporation, Robert Bosch GmbH (sensors/ECUs for airbags), Nihon Plast Co., Ltd., Sumitomo Riko Company Limited, Daicel Corporation (inflators via Daicel Safety Systems), KSS/Key Safety Systems (now part of Joyson Safety Systems), Ashimori Industry Co., Ltd., East Joy Long Motor Airbag Co., Ltd. (China), Ningbo Jifeng Auto Parts Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive airbags market is poised for transformation, driven by technological innovations and evolving consumer preferences. As manufacturers increasingly adopt AI and smart technologies, the deployment of airbags will become more efficient and tailored to individual crash scenarios. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly materials in airbag production, aligning with global environmental goals and enhancing market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Frontal/Driver Airbags Passenger Airbags Side Thorax Airbags Curtain/Side Curtain Airbags Knee Airbags Center Airbags Pedestrian Protection Airbags |

| By End-User | OEM (Factory-Fitted) Aftermarket (Replacement/Service) |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Buses & Coaches |

| By Distribution Channel | OEMs Independent Aftermarket Authorized Service Networks |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Material | Nylon 6,6 Nylon 6 Polyester (PET) Others (e.g., Coated Fabrics) |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Airbag Systems | 150 | Product Managers, Safety Engineers |

| Commercial Vehicle Safety Features | 100 | Fleet Managers, Compliance Officers |

| Airbag Manufacturing Processes | 80 | Manufacturing Engineers, Quality Assurance Managers |

| Regulatory Compliance in Automotive Safety | 70 | Regulatory Affairs Specialists, Safety Inspectors |

| Consumer Awareness and Preferences | 90 | Market Researchers, Consumer Insights Analysts |

The Global Automotive Airbags Market is valued at approximately USD 17 billion, based on a five-year historical analysis. This valuation aligns with various industry trackers that estimate the market in the mid-to-high teens in USD billions.