Region:Global

Author(s):Dev

Product Code:KRAA1591

Pages:87

Published On:August 2025

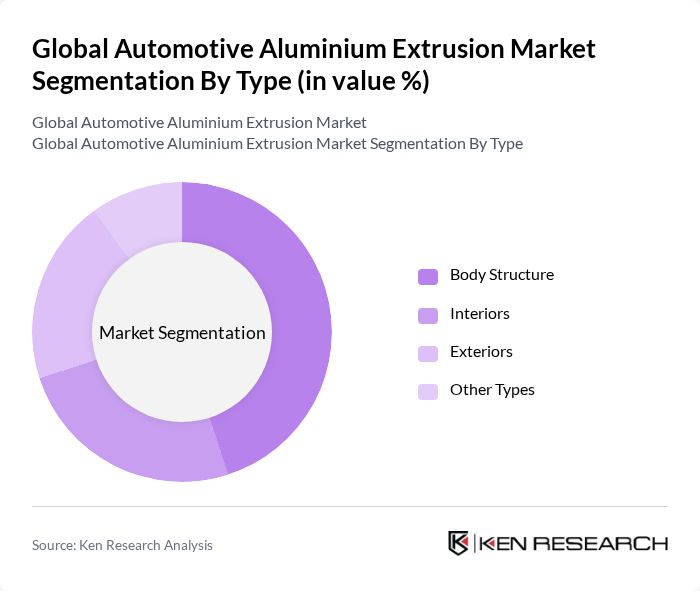

By Type:The market is segmented into various types, including Body Structure, Interiors, Exteriors, and Other Types. Among these, the Body Structure segment is the most dominant due to the increasing focus on vehicle safety and structural integrity. The demand for lightweight body structures that enhance fuel efficiency and performance is driving this segment's growth. The Interiors and Exteriors segments are also significant, catering to consumer preferences for aesthetics and comfort.

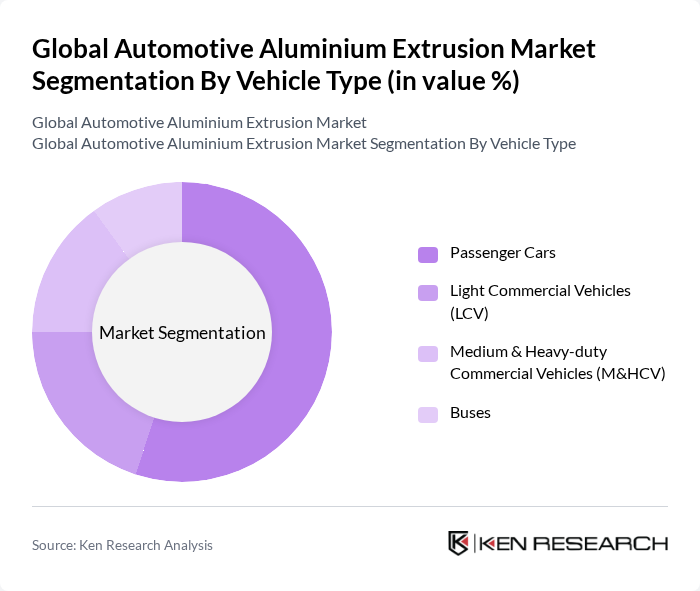

By Vehicle Type:The market is categorized into Passenger Cars, Light Commercial Vehicles (LCV), Medium & Heavy-duty Commercial Vehicles (M&HCV), and Buses. The Passenger Cars segment holds the largest share, driven by the rising consumer demand for fuel-efficient and lightweight vehicles. The LCV segment is also growing due to the increasing use of aluminium in commercial applications, while the M&HCV and Buses segments are expanding as manufacturers seek to improve payload capacity and reduce emissions.

The Global Automotive Aluminium Extrusion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Norsk Hydro ASA (Hydro Extrusions), Constellium SE, Novelis Inc., UACJ Corporation, Alcoa Corporation, Hindalco Industries Limited, Kaiser Aluminum Corporation, Gulf Extrusions LLC, China Zhongwang Holdings Limited, Jindal Aluminium Limited, Arconic Corporation, Nemak, S.A.B. de C.V., Cevher Jant A.?., KUMZ (Kamensk-Uralsky Metallurgical Works), SAPA Extrusions (legacy brand under Hydro) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive aluminium extrusion market appears promising, driven by the ongoing transition towards electric and hybrid vehicles. As manufacturers increasingly adopt lightweight materials to enhance efficiency, the demand for aluminium extrusions is expected to rise. Additionally, advancements in recycling technologies will likely improve the sustainability of aluminium production, aligning with global trends towards circular economy practices. This shift will create new opportunities for innovation and growth within the sector, fostering a more sustainable automotive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Body Structure Interiors Exteriors Other Types |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Medium & Heavy-duty Commercial Vehicles (M&HCV) Buses |

| By Application | Chassis & Suspension (subframes, cross-members, control arms) Body-in-White & Crash Management (bumpers, side impact beams) Battery Enclosures & Thermal Systems (EV trays, heat exchangers) Doors, Closures & Trim (roof rails, window frames, seat structures) |

| By Product Form | Extruded Profiles Fabricated/Machined Parts Assemblies & Modules Others |

| By Alloy/Temper | xxx Series (e.g., 6061, 6063) xxx Series High-Recycled/Low-Carbon Aluminium Others |

| By Sales Channel | Direct to OEM Tier-1/Tier-2 Suppliers Distributors Others |

| By Geography | North America Europe Asia-Pacific Rest of the World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 120 | Product Development Managers, Procurement Directors |

| Aluminum Extrusion Suppliers | 90 | Sales Managers, Operations Directors |

| Automotive Component Manufacturers | 70 | Engineering Managers, Quality Assurance Heads |

| Industry Analysts | 50 | Market Research Analysts, Industry Consultants |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Global Automotive Aluminium Extrusion Market is valued at approximately USD 80 billion, driven by the increasing adoption of lightweight aluminium structures in vehicles to enhance fuel efficiency and meet stringent emissions targets.