Region:Global

Author(s):Rebecca

Product Code:KRAC0292

Pages:99

Published On:August 2025

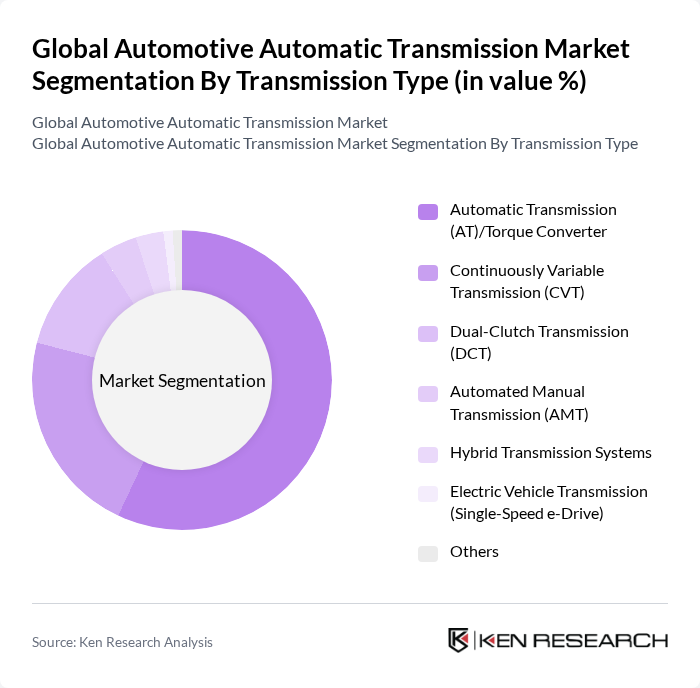

By Transmission Type:The transmission type segment includes a range of technologies tailored to diverse consumer preferences and vehicle requirements. The dominant subsegment is the Automatic Transmission (AT)/Torque Converter, favored for its smooth shifting, reliability, and ease of use. Continuously Variable Transmission (CVT) is gaining traction due to its superior fuel efficiency and seamless acceleration, especially in hybrid vehicles. Dual-Clutch Transmission (DCT) systems are increasingly popular for their rapid gear shifts and enhanced performance. Automated Manual Transmission (AMT) and hybrid transmission systems are also present, serving niche applications and supporting electrification trends. Electric vehicles commonly utilize single-speed e-drive transmissions, reflecting the unique torque characteristics of electric powertrains .

Source:

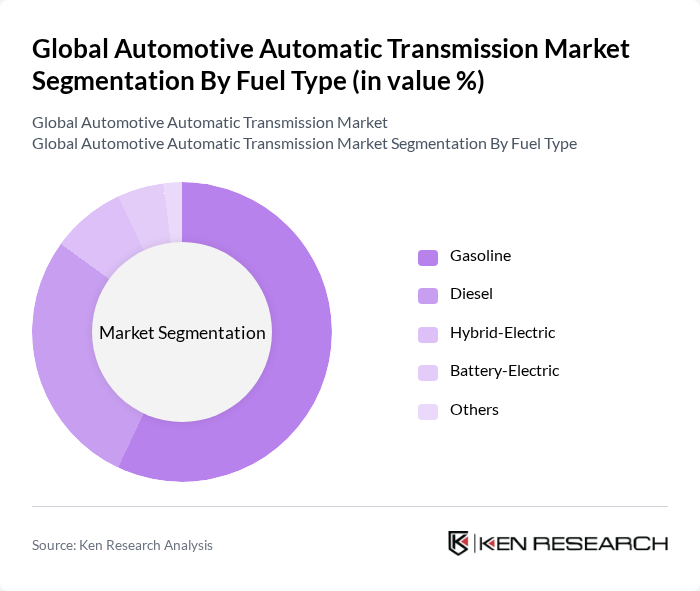

By Fuel Type:The fuel type segment reflects the ongoing transition in the automotive industry. Gasoline remains the most widely used fuel type, supported by its affordability and established infrastructure. However, there is a marked shift towards hybrid-electric and battery-electric vehicles, driven by environmental concerns, government incentives, and stricter emission regulations. Diesel's share is declining due to regulatory pressures and changing consumer preferences, while alternative fuels and electrification are reshaping the market landscape .

Source:

The Global Automotive Automatic Transmission Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aisin Corporation, ZF Friedrichshafen AG, BorgWarner Inc., Jatco Ltd., Hyundai Transys Inc., General Motors Company, Toyota Motor Corporation, Ford Motor Company, Mercedes-Benz Group AG, Nissan Motor Co., Ltd., Honda Motor Co., Ltd., Volkswagen AG, Magna International Inc., Eaton Corporation plc, and Allison Transmission Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the automotive automatic transmission market appears promising, driven by ongoing technological advancements and shifting consumer preferences. As electric and hybrid vehicles gain traction, manufacturers are likely to invest in developing more efficient transmission systems tailored for these powertrains. Additionally, the integration of smart technologies into transmission systems will enhance vehicle performance and user experience. The market is expected to adapt to these trends, ensuring that automatic transmissions remain a vital component of modern vehicles.

| Segment | Sub-Segments |

|---|---|

| By Transmission Type | Automatic Transmission (AT)/Torque Converter Continuously Variable Transmission (CVT) Dual-Clutch Transmission (DCT) Automated Manual Transmission (AMT) Hybrid Transmission Systems Electric Vehicle Transmission (Single-Speed e-Drive) Others |

| By Fuel Type | Gasoline Diesel Hybrid-Electric Battery-Electric Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Medium and Heavy Commercial Vehicles Others |

| By Component | Torque Converters Planetary Gear Sets Hydraulic and Mechatronic Controls Transmission Fluid Sensors Others |

| By Geography | North America Europe Asia-Pacific South America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Automatic Transmissions | 120 | Product Managers, R&D Engineers |

| Commercial Vehicle Transmission Systems | 90 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Transmission Technologies | 60 | EV Engineers, Battery Technology Experts |

| Aftermarket Transmission Services | 50 | Service Center Managers, Automotive Technicians |

| Transmission Component Suppliers | 70 | Supply Chain Managers, Quality Assurance Officers |

The Global Automotive Automatic Transmission Market is valued at approximately USD 168 billion, reflecting a significant growth trend driven by advancements in transmission technology and increasing demand for fuel-efficient vehicles.