Region:Global

Author(s):Dev

Product Code:KRAD0479

Pages:94

Published On:August 2025

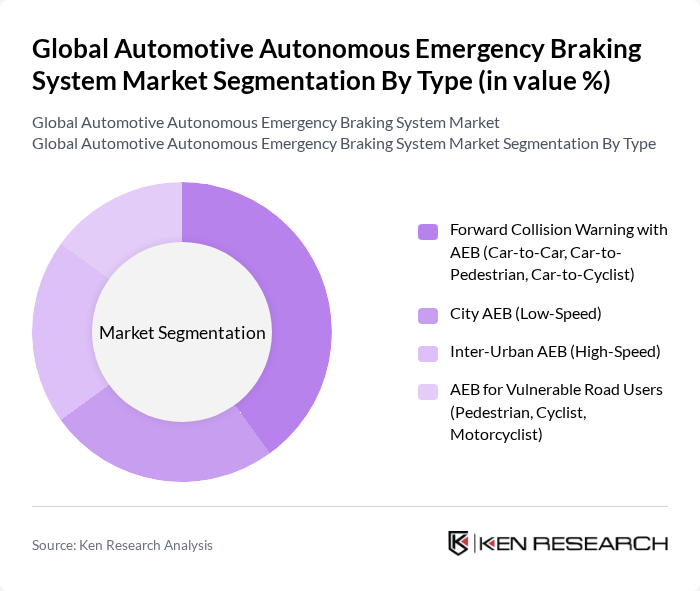

By Type:The market is segmented into various types of Autonomous Emergency Braking systems, including Forward Collision Warning with AEB, City AEB, Inter-Urban AEB, and AEB for Vulnerable Road Users. Among these, Forward Collision Warning with AEB is the most dominant segment due to its widespread implementation in passenger vehicles, driven by consumer demand for enhanced safety features and regulatory requirements.

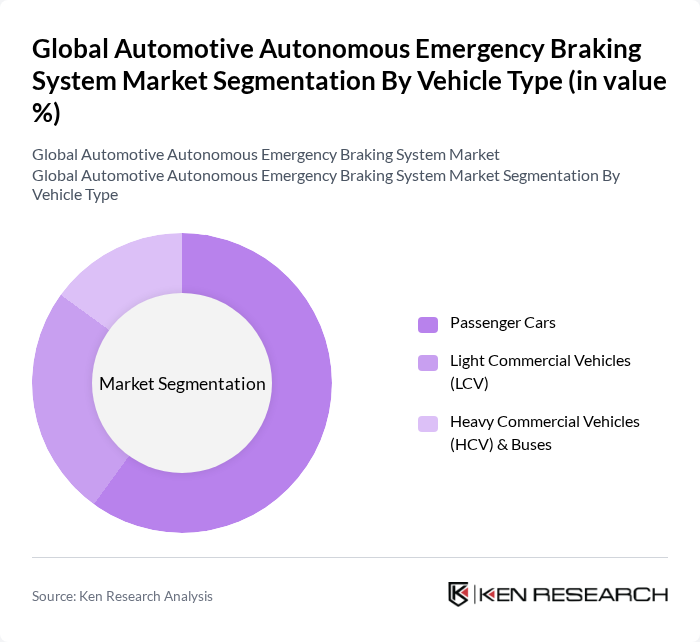

By Vehicle Type:The market is categorized into Passenger Cars, Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV) & Buses. The Passenger Cars segment holds the largest share, driven by the increasing consumer preference for safety features in personal vehicles and the growing trend of integrating advanced driver-assistance systems (ADAS) in new car models.

The Global Automotive Autonomous Emergency Braking System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, DENSO Corporation, Aptiv PLC, Aisin Corporation, Hitachi Astemo, Ltd., Mobileye Global Inc., Autoliv, Inc., Valeo SE, Hyundai Mobis Co., Ltd., Panasonic Holdings Corporation, NXP Semiconductors N.V., Texas Instruments Incorporated, Infineon Technologies AG, ON Semiconductor Corporation (onsemi), STMicroelectronics N.V., Renesas Electronics Corporation, HELLA GmbH & Co. KGaA (FORVIA HELLA), Magna International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive AEB market appears promising, driven by technological advancements and increasing regulatory pressures. As manufacturers invest heavily in R&D, the integration of AI and machine learning into AEB systems is expected to enhance their effectiveness. Additionally, the push for electric vehicles will likely accelerate the adoption of AEB technologies, as these vehicles often come equipped with advanced safety features. The market is poised for significant growth as consumer awareness and demand for safety technologies continue to rise.

| Segment | Sub-Segments |

|---|---|

| By Type | Forward Collision Warning with AEB (Car-to-Car, Car-to-Pedestrian, Car-to-Cyclist) City AEB (Low-Speed) Inter-Urban AEB (High-Speed) AEB for Vulnerable Road Users (Pedestrian, Cyclist, Motorcyclist) |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) & Buses |

| By Component | Sensors (Camera, Radar, LiDAR, Ultrasonic) Electronic Control Unit (ECU) & Algorithms Brake Actuation Module (Hydraulic/Electromechanical) Human–Machine Interface (HMI) & Warning Systems |

| By Technology | Camera-Based AEB Radar-Based AEB LiDAR-Based AEB Sensor Fusion AEB |

| By Sales Channel | OEM (Factory-Fitted) Aftermarket (Retrofit Kits) |

| By Autonomy Level (SAE) | L1/L2 Driver Assistance (AEB as ADAS) L2+/L3 Partial Automation (Enhanced AEB with Predictive Features) L4/L5 (Robotaxi, Shuttle – Safety Redundancy AEB) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs Implementing AEB Systems | 120 | Product Development Managers, Safety Engineers |

| Aftermarket Suppliers of AEB Components | 80 | Supply Chain Managers, Procurement Specialists |

| Fleet Operators Utilizing AEB Technology | 70 | Fleet Managers, Safety Compliance Officers |

| Regulatory Bodies Overseeing AEB Standards | 50 | Policy Makers, Safety Analysts |

| Automotive Safety Research Institutions | 60 | Research Directors, Automotive Safety Experts |

The Global Automotive Autonomous Emergency Braking System Market is valued at approximately USD 33 billion, reflecting a significant growth driven by increasing safety regulations and advancements in sensor technologies aimed at enhancing vehicle safety features.