Region:Global

Author(s):Rebecca

Product Code:KRAB0255

Pages:81

Published On:August 2025

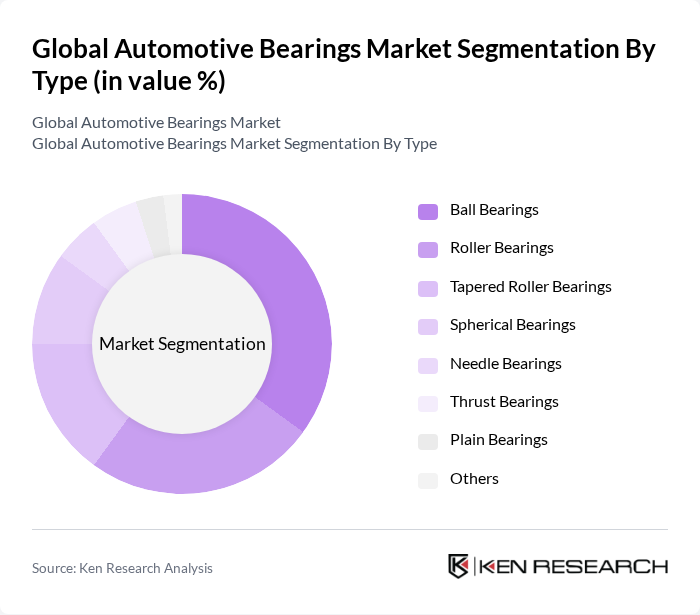

By Type:The automotive bearings market is segmented into ball bearings, roller bearings, tapered roller bearings, spherical bearings, needle bearings, thrust bearings, plain bearings, and others. Ball bearings remain the most widely used type due to their versatility and ability to handle both radial and axial loads efficiently. Roller bearings are essential for heavy-duty applications requiring higher load capacities. The demand for specialized bearings, such as tapered and spherical bearings, is increasing as manufacturers seek to improve vehicle performance, reduce friction, and enhance efficiency in electric and hybrid vehicles .

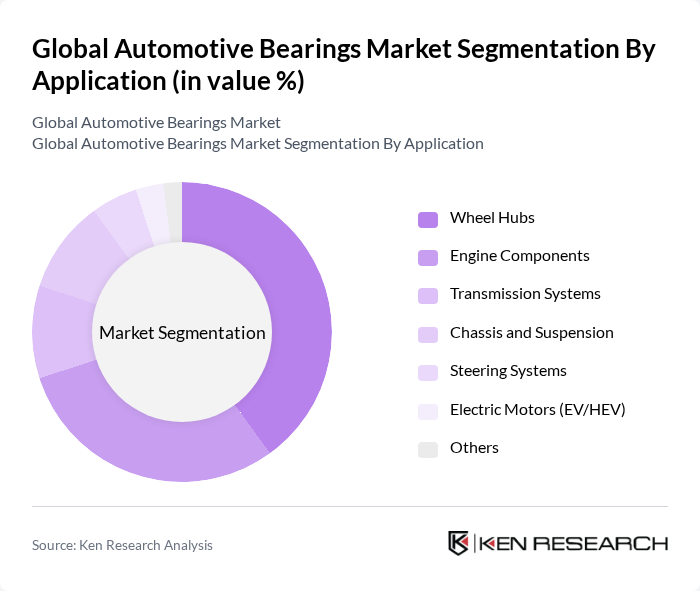

By Application:Automotive bearings are used in wheel hubs, engine components, transmission systems, chassis and suspension, steering systems, electric motors (EV/HEV), and other vehicle systems. Wheel hubs represent the largest application segment, supported by the high production of passenger vehicles and the need for reliable performance under diverse driving conditions. Engine components also account for a significant share, as manufacturers focus on improving engine efficiency and reducing friction. The transition to electric and hybrid vehicles is driving demand for bearings in electric motors and powertrain systems .

The Global Automotive Bearings Market is characterized by a dynamic mix of regional and international players. Leading participants such as SKF Group, Schaeffler AG, The Timken Company, NSK Ltd., NTN Corporation, JTEKT Corporation, Regal Rexnord Corporation, ZF Friedrichshafen AG, C&U Group, Harbin Bearing Manufacturing Co., Ltd., MinebeaMitsumi Inc., Koyo Seiko Co., Ltd. (JTEKT), SNL Bearings Ltd., Aisin Corporation, Trelleborg AB contribute to innovation, geographic expansion, and service delivery in this space.

The automotive bearings market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly adopt lightweight materials and smart technologies, the demand for innovative bearing solutions will rise. Additionally, the integration of IoT for real-time monitoring will enhance operational efficiency. The focus on sustainability will further propel the development of eco-friendly bearings, aligning with global environmental goals and consumer expectations for greener automotive solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Ball Bearings Roller Bearings Tapered Roller Bearings Spherical Bearings Needle Bearings Thrust Bearings Plain Bearings Others |

| By Application | Wheel Hubs Engine Components Transmission Systems Chassis and Suspension Steering Systems Electric Motors (EV/HEV) Others |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers Off-Highway Vehicles Heavy Machinery Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Distributors Online Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Material | Steel Ceramic Plastic Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Bearings | 100 | Product Managers, R&D Engineers |

| Commercial Vehicle Bearings | 60 | Procurement Managers, Supply Chain Analysts |

| Aftermarket Bearing Sales | 50 | Sales Directors, Marketing Managers |

| Electric Vehicle Bearings | 40 | Technical Specialists, Innovation Managers |

| Global Bearing Manufacturers | 45 | Operations Managers, Quality Control Engineers |

The Global Automotive Bearings Market is valued at approximately USD 45 billion, driven by increasing vehicle production, rising demand for electric vehicles, and advancements in automotive technology focused on fuel efficiency and performance.