Region:Global

Author(s):Geetanshi

Product Code:KRAB0012

Pages:88

Published On:August 2025

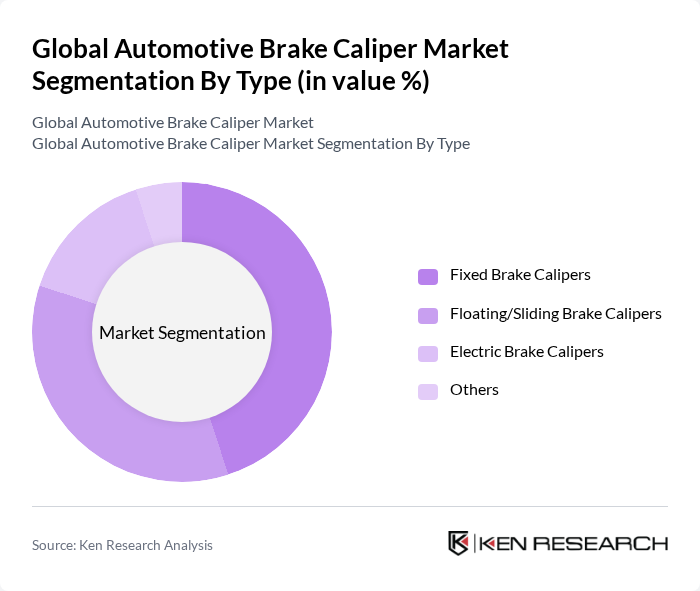

By Type:The market is segmented into Fixed Brake Calipers, Floating/Sliding Brake Calipers, Electric Brake Calipers, and Others. Fixed Brake Calipers are preferred for their superior performance and reliability in high-performance and premium vehicles. Floating/Sliding Brake Calipers are widely used in mass-market vehicles due to their cost-effectiveness and ease of installation. Electric Brake Calipers are gaining traction with the rise of electric vehicles, offering enhanced control, efficiency, and compatibility with electronic braking systems .

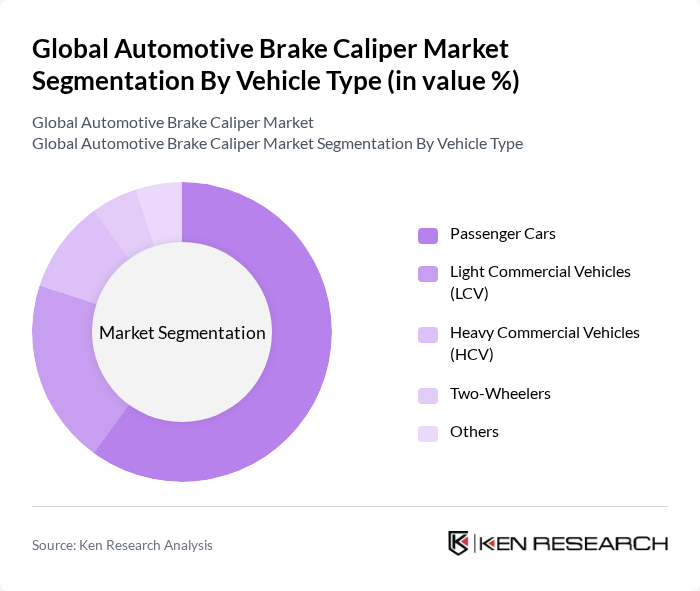

By Vehicle Type:The segmentation includes Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers, and Others. Passenger Cars account for the largest share due to high production volumes and increasing focus on safety features. The LCV segment is significant, supported by the expansion of e-commerce and logistics sectors that require reliable braking systems for delivery vehicles. HCVs maintain steady demand, particularly in construction and transportation industries .

The Global Automotive Brake Caliper Market is characterized by a dynamic mix of regional and international players. Leading participants such as Brembo S.p.A., Akebono Brake Industry Co., Ltd., Continental AG, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Bosch Mobility Solutions, TRW Automotive (ZF Aftermarket), Nissin Kogyo Co., Ltd., Hitachi Astemo, Ltd., Dura Automotive Systems, LLC, TMD Friction Holdings GmbH, Mando Corporation, Federal-Mogul Motorparts (now part of DRiV, Tenneco Inc.), WABCO Holdings Inc. (now part of ZF Group), and ACDelco (General Motors) contribute to innovation, geographic expansion, and service delivery in this space .

The automotive brake caliper market is poised for significant transformation, driven by the shift towards electric and hybrid vehicles, which are expected to constitute over 35% of global vehicle sales in future. Additionally, the integration of advanced driver assistance systems (ADAS) will further enhance the demand for high-performance brake calipers. As manufacturers adapt to these trends, the focus on sustainability and lightweight materials will also shape product development, ensuring that the market remains dynamic and responsive to consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Brake Calipers Floating/Sliding Brake Calipers Electric Brake Calipers Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Two-Wheelers Others |

| By Material | Aluminum Cast Iron Composite Materials Others |

| By Sales Channel | OEM Aftermarket |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Automotive Manufacturing Vehicle Maintenance Performance Upgrades Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Brake Caliper Procurement | 100 | Procurement Managers, Product Development Engineers |

| Aftermarket Brake Caliper Sales | 80 | Sales Managers, Distribution Channel Partners |

| Brake Caliper Manufacturing Insights | 70 | Manufacturing Engineers, Quality Control Managers |

| Electric Vehicle Brake Systems | 50 | R&D Engineers, Automotive Technology Specialists |

| Brake Caliper Market Trends | 90 | Market Analysts, Industry Consultants |

The Global Automotive Brake Caliper Market is valued at approximately USD 16.3 billion, driven by increasing vehicle safety demands, advancements in braking technologies, and the rise in global automobile production, particularly with the growth of electric vehicles.