Region:Global

Author(s):Rebecca

Product Code:KRAB0276

Pages:97

Published On:August 2025

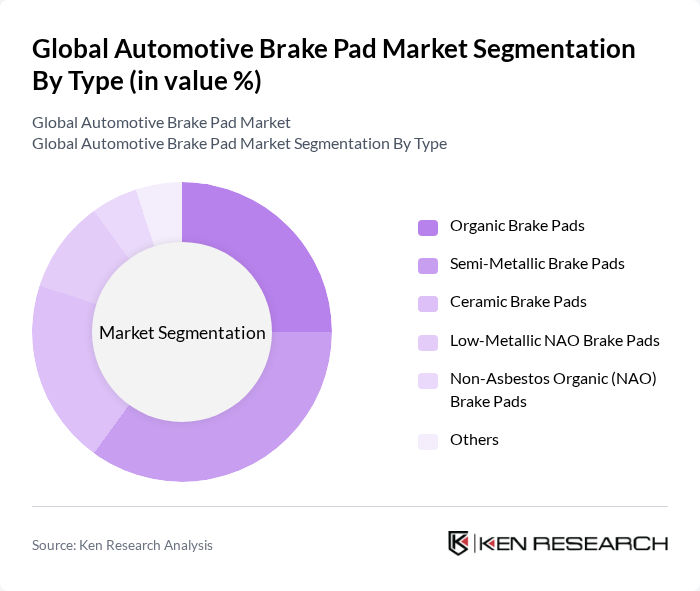

By Type:The brake pad market is segmented into Organic Brake Pads, Semi-Metallic Brake Pads, Ceramic Brake Pads, Low-Metallic NAO Brake Pads, Non-Asbestos Organic (NAO) Brake Pads, and Others. Among these, Semi-Metallic Brake Pads are currently leading the market due to their superior performance in heat dissipation and durability, making them a preferred choice for high-performance and commercial vehicles. Organic Brake Pads are also popular for their quieter operation, lower dust production, and gentler treatment of brake rotors, appealing to consumers focused on comfort and cleanliness .

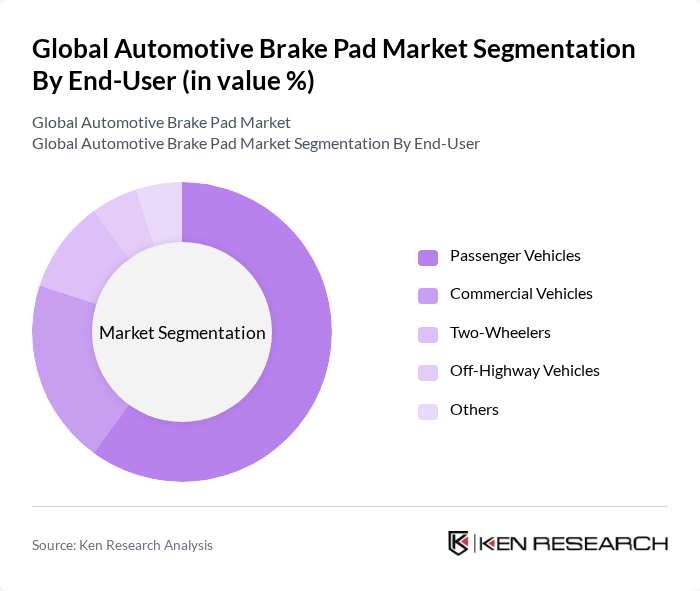

By End-User:The market is segmented by end-user into Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Off-Highway Vehicles, and Others. The Passenger Vehicles segment dominates the market, driven by the increasing number of personal vehicles and the growing emphasis on safety features. The rise in disposable income and changing consumer preferences towards personal mobility further bolster the demand for brake pads in this segment .

The Global Automotive Brake Pad Market is characterized by a dynamic mix of regional and international players. Leading participants such as Akebono Brake Industry Co., Ltd., Robert Bosch GmbH (Bosch Automotive Aftermarket), Brembo S.p.A., Federal-Mogul Motorparts (a Tenneco company), Nisshinbo Holdings Inc., ZF Friedrichshafen AG (TRW Automotive), Aisin Corporation, TMD Friction Holdings GmbH, EBC Brakes, Ferodo (a brand of TMD Friction), Mintex (a brand of TMD Friction), Raybestos (a brand of Brake Parts Inc.), Wagner Brake (a brand of Federal-Mogul/Tenneco), Centric Parts (a division of APC Automotive Technologies), Hella Pagid (a joint venture of HELLA GmbH & Co. KGaA and TMD Friction) contribute to innovation, geographic expansion, and service delivery in this space.

The automotive brake pad market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As electric vehicles (EVs) gain traction, the demand for specialized brake pads designed for EVs is expected to rise. Additionally, the focus on sustainability will push manufacturers to innovate eco-friendly products. Strategic partnerships between automotive companies and brake pad manufacturers will likely enhance product offerings, ensuring compliance with safety and environmental standards while meeting consumer expectations for performance and reliability.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Brake Pads Semi-Metallic Brake Pads Ceramic Brake Pads Low-Metallic NAO Brake Pads Non-Asbestos Organic (NAO) Brake Pads Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Off-Highway Vehicles Others |

| By Sales Channel | OEMs Aftermarket Online Retail Others |

| By Material | Asbestos-Free Materials Non-Asbestos Organic Materials Semi-Metallic Materials Ceramic Materials Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Two-Wheelers Electric Vehicles Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Brake Pad Manufacturers | 100 | Product Development Managers, Quality Assurance Engineers |

| Aftermarket Brake Pad Suppliers | 80 | Sales Directors, Supply Chain Managers |

| Automotive Repair Shops | 60 | Service Managers, Technicians |

| Automotive Industry Analysts | 40 | Market Analysts, Research Directors |

| Regulatory Bodies and Standards Organizations | 40 | Compliance Officers, Regulatory Affairs Managers |

The Global Automotive Brake Pad Market is valued at approximately USD 4 billion, driven by increasing vehicle production and advancements in brake pad technology, such as the use of ceramic and non-asbestos organic materials.