Region:Global

Author(s):Geetanshi

Product Code:KRAD0131

Pages:94

Published On:August 2025

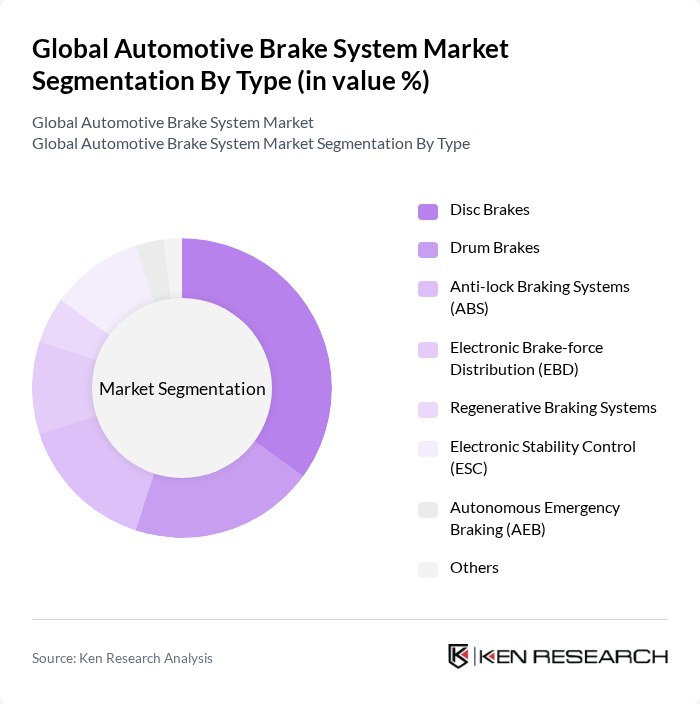

By Type:The market is segmented into Disc Brakes, Drum Brakes, Anti-lock Braking Systems (ABS), Electronic Brake-force Distribution (EBD), Regenerative Braking Systems, Electronic Stability Control (ESC), Autonomous Emergency Braking (AEB), and Others. Disc Brakes remain the most widely used due to their superior heat dissipation and consistent performance, especially in high-speed and high-load conditions. The growing focus on vehicle safety and regulatory compliance has accelerated the adoption of ABS and ESC systems, which significantly improve vehicle control and stability during emergency braking. Regenerative braking systems are gaining traction, particularly in electric and hybrid vehicles, as they enable energy recovery and contribute to overall vehicle efficiency .

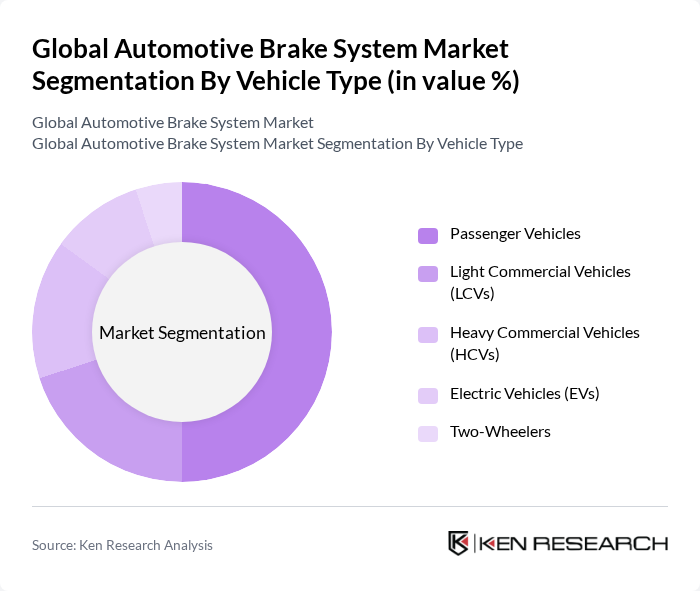

By Vehicle Type:The market is categorized into Passenger Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), and Two-Wheelers. Passenger Vehicles account for the largest share, driven by high production volumes and increasing consumer demand for safety features. The accelerating adoption of electric vehicles is also spurring demand for advanced braking technologies, particularly regenerative and electronically controlled systems, to optimize energy use and enhance safety .

The Global Automotive Brake System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Aisin Seiki Co., Ltd., Brembo S.p.A., Akebono Brake Industry Co., Ltd., Nissin Kogyo Co., Ltd., TRW Automotive Holdings Corp. (now part of ZF Friedrichshafen AG), Hitachi Astemo, Ltd., Mando Corporation, TMD Friction Holdings GmbH, Federal-Mogul Motorparts (now part of Tenneco Inc.), JTEKT Corporation, Valeo S.A., and SGL Carbon SE contribute to innovation, geographic expansion, and service delivery in this sector.

The automotive brake system market is poised for significant transformation driven by technological advancements and regulatory changes. The shift towards electric vehicles is expected to accelerate the development of innovative braking solutions, particularly regenerative braking systems. Additionally, the integration of IoT technologies will enhance system performance and safety. As manufacturers adapt to these trends, the market will likely see increased investment in research and development, fostering a competitive landscape that prioritizes safety and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Disc Brakes Drum Brakes Anti-lock Braking Systems (ABS) Electronic Brake-force Distribution (EBD) Regenerative Braking Systems Electronic Stability Control (ESC) Autonomous Emergency Braking (AEB) Others |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Electric Vehicles (EVs) Two-Wheelers |

| By Component | Brake Pads Brake Rotors/Discs Brake Calipers Brake Lines & Hoses Brake Fluids Master Cylinder Brake Booster |

| By Sales Channel | OEMs Aftermarket |

| By Distribution Mode | Direct Sales Online Sales Retail Sales |

| By Price Range | Economy Mid-Range Premium |

| By Application | Commercial Transportation Personal Use Emergency Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Brake Systems | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Brake Systems | 90 | Fleet Managers, Procurement Specialists |

| Aftermarket Brake Components | 60 | Retail Managers, Service Center Owners |

| Brake System Innovations | 50 | R&D Directors, Technology Officers |

| Regulatory Compliance in Brake Systems | 40 | Compliance Officers, Safety Inspectors |

The Global Automotive Brake System Market is valued at approximately USD 45 billion, with estimates ranging from USD 24 billion to USD 51.5 billion. This valuation reflects a five-year analysis and is influenced by various factors including vehicle safety demands and technological advancements.