Region:Global

Author(s):Rebecca

Product Code:KRAC0264

Pages:80

Published On:August 2025

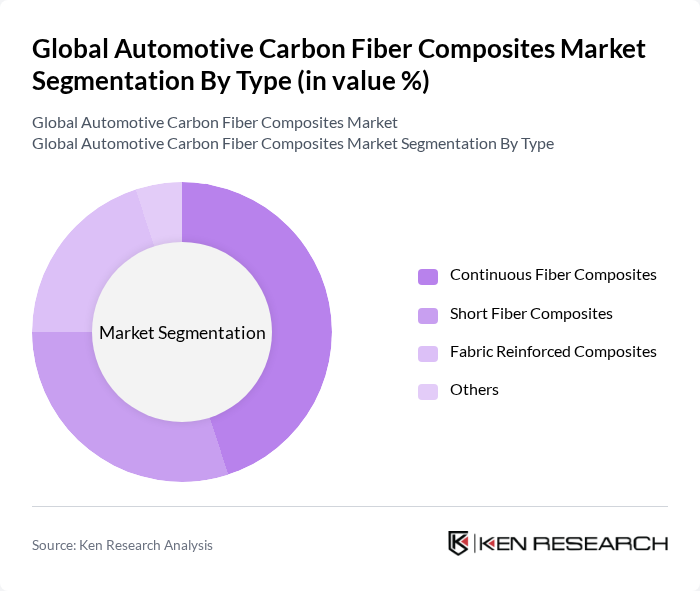

By Type:The market is segmented into Continuous Fiber Composites, Short Fiber Composites, Fabric Reinforced Composites, and Others. Continuous Fiber Composites are gaining traction due to their superior strength-to-weight ratio, making them ideal for high-performance and structural applications. Short Fiber Composites are also popular for their cost-effectiveness, ease of processing, and suitability for complex shapes and high-volume automotive parts. Fabric Reinforced Composites are increasingly used in various automotive applications due to their versatility, impact resistance, and ability to deliver both structural and aesthetic benefits .

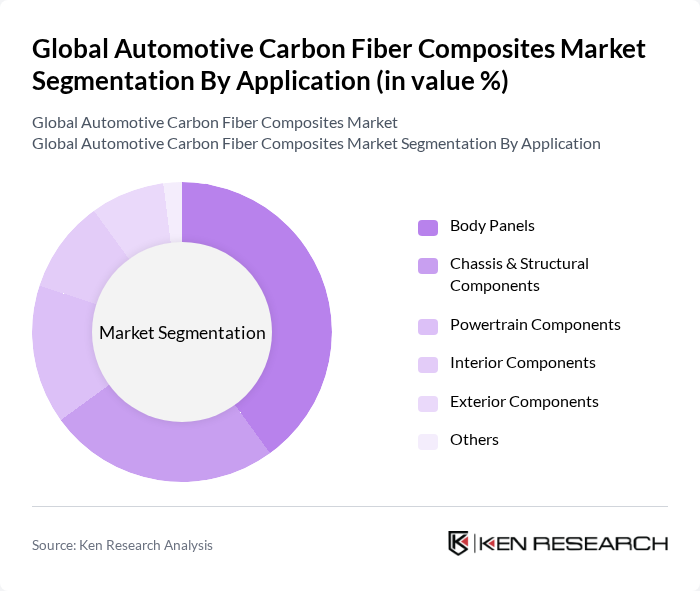

By Application:The applications of carbon fiber composites in the automotive sector include Body Panels, Chassis & Structural Components, Powertrain Components, Interior Components, Exterior Components, and Others. Body Panels are the leading application due to the increasing focus on weight reduction, fuel efficiency, and the need for improved crash safety. Chassis & Structural Components also hold significant market share as they enhance vehicle performance, safety, and structural rigidity. Powertrain Components benefit from carbon fiber’s ability to withstand high temperatures and reduce rotational mass, while Interior and Exterior Components leverage the material’s design flexibility and premium finish .

The Global Automotive Carbon Fiber Composites Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toray Industries, Inc., Hexcel Corporation, SGL Carbon SE, Mitsubishi Chemical Corporation, Teijin Limited, Solvay S.A., BASF SE, Owens Corning, Zoltek Companies, Inc., Formosa Plastics Corporation, Axiom Materials, Inc., Composite Resources, Inc., Advanced Composites Group, Jushi Group Co., Ltd., Gurit Holding AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive carbon fiber composites market appears promising, driven by ongoing technological advancements and increasing regulatory pressures for sustainability. As manufacturers seek to enhance vehicle performance while adhering to stringent fuel efficiency standards, the demand for lightweight materials is expected to rise. Additionally, the integration of smart technologies and the growth of electric vehicles will further propel the adoption of carbon fiber composites, creating a dynamic landscape for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Continuous Fiber Composites Short Fiber Composites Fabric Reinforced Composites Others |

| By Application | Body Panels Chassis & Structural Components Powertrain Components Interior Components Exterior Components Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles High-Performance & Luxury Vehicles Others |

| By Manufacturing Process | Hand Lay-Up Resin Transfer Molding (RTM) Prepreg Lay-Up Compression Molding Injection Molding Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs Utilizing Carbon Fiber | 100 | Product Development Managers, Material Engineers |

| Suppliers of Carbon Fiber Composites | 80 | Sales Directors, Supply Chain Managers |

| Automotive Industry Analysts | 50 | Market Analysts, Research Directors |

| Regulatory Bodies on Automotive Materials | 40 | Policy Makers, Compliance Officers |

| End-Users in Automotive Manufacturing | 70 | Production Managers, Quality Assurance Specialists |

The Global Automotive Carbon Fiber Composites Market is valued at approximately USD 2.5 billion, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions in the automotive sector.