Region:Global

Author(s):Shubham

Product Code:KRAA1817

Pages:92

Published On:August 2025

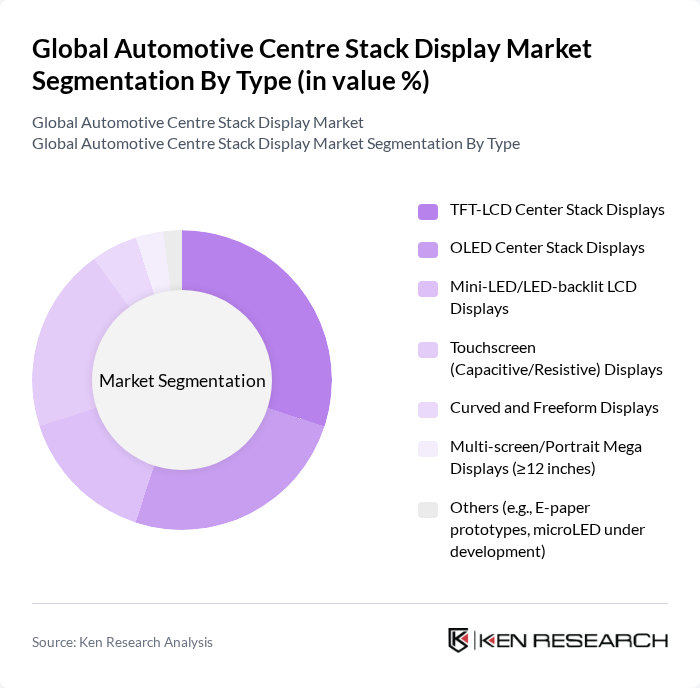

By Type:The market is segmented into various types of displays, including TFT-LCD, OLED, Mini-LED, touchscreen displays, curved displays, multi-screen displays, and others. Each type caters to different consumer preferences and technological advancements.

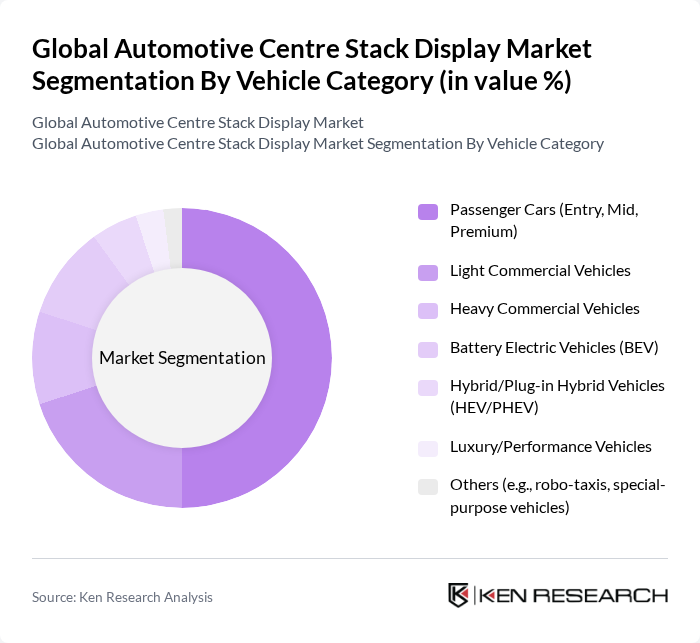

By Vehicle Category:The market is categorized into passenger cars, light commercial vehicles, heavy commercial vehicles, battery electric vehicles, hybrid vehicles, luxury vehicles, and others. This segmentation reflects the diverse applications of display technologies across different vehicle types. Center stack displays are now standard across passenger cars, with premium trims adopting larger and multi-screen layouts; electrified vehicles emphasize energy and charging UX on the center stack, further supporting larger and higher-resolution displays.

The Global Automotive Centre Stack Display Market is characterized by a dynamic mix of regional and international players. Leading participants such as DENSO Corporation, Continental AG, Panasonic Automotive Systems Co., Ltd., LG Display Co., Ltd., Visteon Corporation, Harman International (a Samsung Electronics company), Robert Bosch GmbH (Bosch Mobility), Nippon Seiki Co., Ltd., Clarion (Faurecia Clarion Electronics, Forvia), Valeo SE, Aptiv PLC, Forvia (Faurecia) SE, Magna International Inc., Samsung Display Co., Ltd., Sharp Corporation, BOE Technology Group Co., Ltd., AUO Corporation, Tianma Microelectronics Co., Ltd., Japan Display Inc. (JDI), Panasonic Industry Co., Ltd. (optical bonding and components) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive centre stack display market appears promising, driven by ongoing technological innovations and evolving consumer preferences. As electric and autonomous vehicles gain traction, the demand for sophisticated infotainment systems and integrated displays is expected to rise significantly. Additionally, manufacturers are likely to focus on enhancing user experience through improved interface designs and touchless technologies, aligning with the growing trend of digitalization in the automotive sector. This evolution will create new avenues for growth and innovation in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | TFT-LCD Center Stack Displays OLED Center Stack Displays Mini-LED/LED-backlit LCD Displays Touchscreen (Capacitive/Resistive) Displays Curved and Freeform Displays Multi-screen/Portrait Mega Displays (?12 inches) Others (e.g., E-paper prototypes, microLED under development) |

| By Vehicle Category | Passenger Cars (Entry, Mid, Premium) Light Commercial Vehicles Heavy Commercial Vehicles Battery Electric Vehicles (BEV) Hybrid/Plug-in Hybrid Vehicles (HEV/PHEV) Luxury/Performance Vehicles Others (e.g., robo-taxis, special-purpose vehicles) |

| By Component | Display Panel/Module (cell, cover glass, optical bonding) HMI and Control Electronics (touch controller, haptics) SoC/IVI Head Unit and Software Stack Connectivity and Wireless Modules (Bluetooth/Wi?Fi/5G) Thermal and Power Management Others (cables, harnesses, brackets) |

| By Application | Infotainment and Media Connected Navigation and Telematics HVAC and Vehicle Controls Driver Assistance Visualization (ADAS UI) Vehicle Health/Diagnostics and OTA Interfaces App Ecosystem and Voice Assistant Integration Others |

| By Sales Channel | OEM-fitted (Factory Installations) Aftermarket Retrofit Fleet/OEM Service Networks Others |

| By Screen Size | ?7 inches –11 inches –14 inches ?15 inches |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 120 | Product Managers, R&D Directors |

| Display Technology Suppliers | 100 | Sales Managers, Technical Engineers |

| Automotive Design Firms | 80 | Design Engineers, User Experience Specialists |

| Market Analysts | 60 | Industry Analysts, Market Researchers |

| Consumer Focus Groups | 75 | Automotive Enthusiasts, Tech-savvy Consumers |

The Global Automotive Centre Stack Display Market is valued at approximately USD 10 billion, driven by the increasing demand for advanced infotainment systems and smart technologies in vehicles, alongside the adoption of larger touch displays and integrated human-machine interfaces (HMI).