Region:Global

Author(s):Shubham

Product Code:KRAC0788

Pages:89

Published On:August 2025

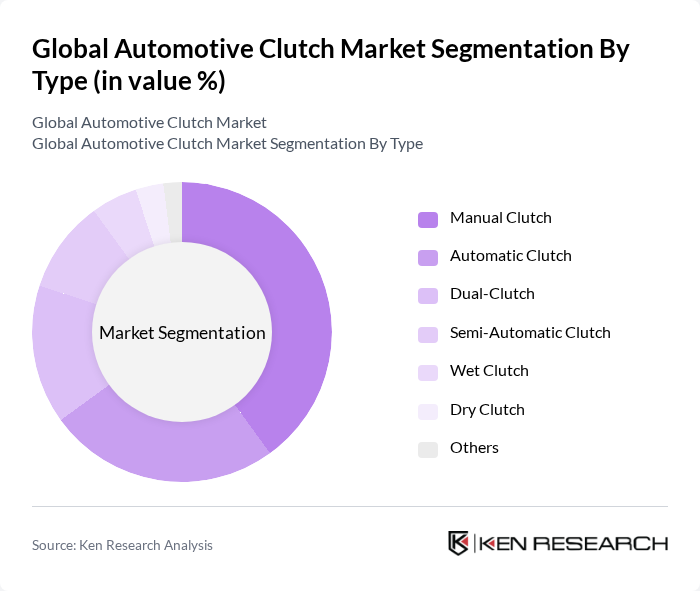

By Type:The automotive clutch market is segmented into Manual Clutch, Automatic Clutch, Dual-Clutch, Semi-Automatic Clutch, Wet Clutch, Dry Clutch, and Others. The Manual Clutch segment continues to hold a leading share, especially in emerging markets where affordability and fuel efficiency are key considerations. Automatic and Dual-Clutch systems are gaining momentum, driven by consumer preference for convenience and the need for faster, smoother gear shifts in high-performance and premium vehicles. Technological advancements in clutch actuation and friction materials are further supporting the growth of automatic and dual-clutch segments .

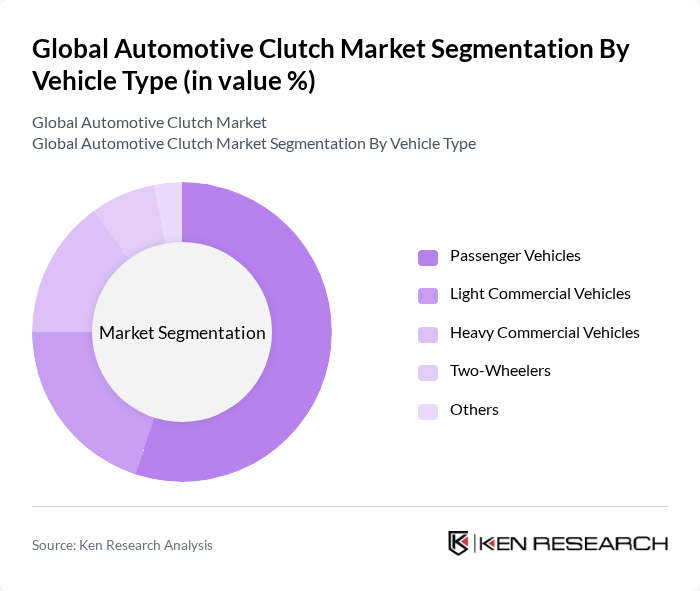

By Vehicle Type:This segment includes Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers, and Others. Passenger Vehicles account for the largest market share, supported by sustained demand for personal mobility and the proliferation of compact and mid-sized cars in emerging economies. Light Commercial Vehicles are significant contributors, particularly in urban logistics and last-mile delivery applications. The Heavy Commercial Vehicles segment is expanding due to increased global logistics activity and infrastructure development, while Two-Wheelers remain important in Asia-Pacific markets .

The Global Automotive Clutch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Valeo S.A., ZF Friedrichshafen AG, BorgWarner Inc., Aisin Seiki Co., Ltd., Schaeffler AG (LuK), Eaton Corporation plc, Clutch Auto Ltd., Exedy Corporation, NSK Ltd., F.C.C. Co., Ltd., Trelleborg AB, FTE automotive GmbH, Sogefi S.p.A., ACDelco, Dura Automotive Systems, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The automotive clutch market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As the shift towards electric vehicles accelerates, manufacturers are likely to invest in innovative clutch designs that enhance performance and efficiency. Additionally, the integration of smart technologies will redefine clutch systems, making them more responsive and efficient. The focus on sustainability will also drive the development of eco-friendly materials, ensuring that the market adapts to changing regulatory landscapes and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Clutch Automatic Clutch Dual-Clutch Semi-Automatic Clutch Wet Clutch Dry Clutch Others |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Two-Wheelers Others |

| By Application | OEM (Original Equipment Manufacturer) Aftermarket |

| By Transmission Type | Manual Transmission Automatic Transmission Automated Manual Transmission (AMT) Others |

| By Material | Organic Materials Metallic Materials Ceramic Materials Composite Materials |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Clutch Disc/Plate Size | Below 9 Inches Inches to 10 Inches Inches to 11 Inches Inches and Above |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Clutch Manufacturers | 100 | Production Managers, Quality Control Engineers |

| Commercial Vehicle Clutch Suppliers | 80 | Supply Chain Managers, Product Development Engineers |

| Aftermarket Clutch Retailers | 70 | Sales Managers, Inventory Analysts |

| Automotive Service Centers | 90 | Service Managers, Technicians |

| Electric Vehicle Component Manufacturers | 40 | R&D Engineers, Product Managers |

The Global Automotive Clutch Market is valued at approximately USD 13.7 billion, reflecting a five-year historical analysis. This valuation is influenced by factors such as rising vehicle production and advancements in clutch technology.