Region:Global

Author(s):Geetanshi

Product Code:KRAC0074

Pages:81

Published On:August 2025

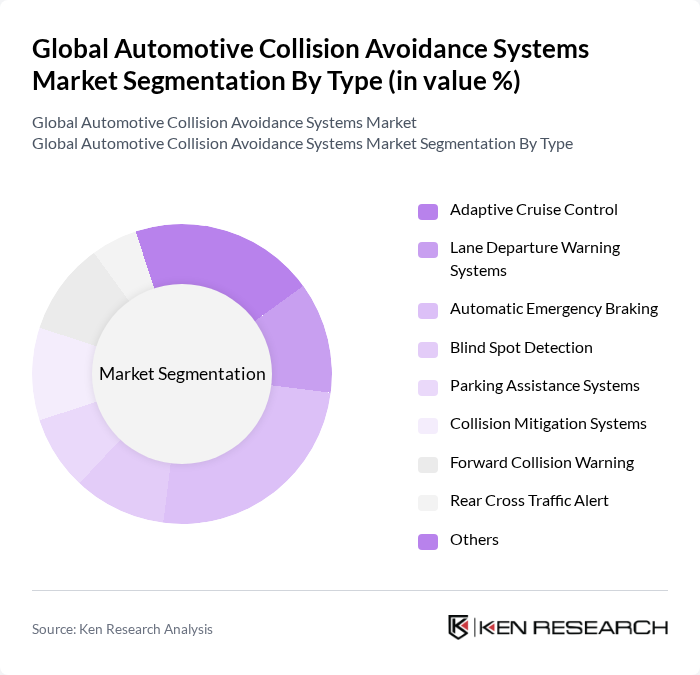

By Type:The market is segmented into various types of collision avoidance systems, including Adaptive Cruise Control, Lane Departure Warning Systems, Automatic Emergency Braking, Blind Spot Detection, Parking Assistance Systems, Collision Mitigation Systems, Forward Collision Warning, Rear Cross Traffic Alert, and Others. Among these, Automatic Emergency Braking is currently the leading sub-segment due to its critical role in preventing accidents and enhancing vehicle safety. The increasing focus on reducing road accidents and improving driver assistance technologies has led to a surge in demand for this system .

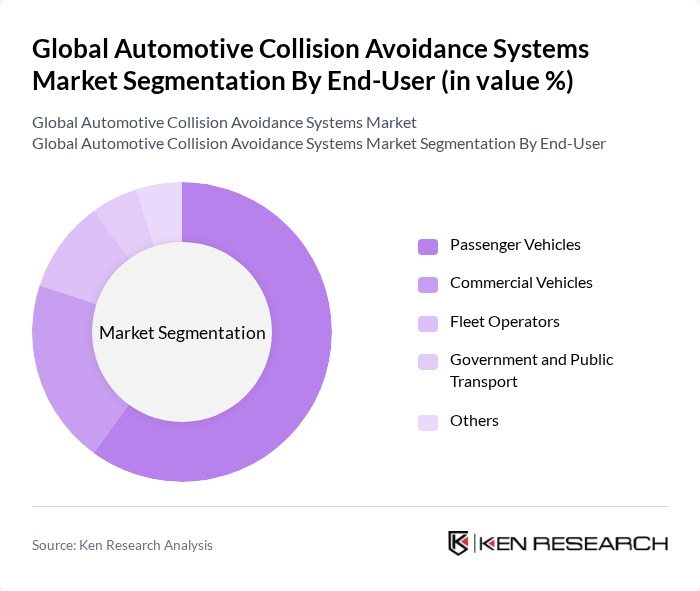

By End-User:The end-user segmentation includes Passenger Vehicles, Commercial Vehicles, Fleet Operators, Government and Public Transport, and Others. The Passenger Vehicles segment dominates the market, driven by consumer preferences for safety features and the increasing integration of advanced driver-assistance systems (ADAS) in personal vehicles. The growing awareness of road safety and the rising number of road accidents have further propelled the demand for collision avoidance systems in this segment. Additionally, commercial vehicles are increasingly adopting collision avoidance technologies to enhance operational safety and reduce accident-related costs in logistics, mining, and construction industries .

The Global Automotive Collision Avoidance Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch GmbH, Continental AG, Denso Corporation, Aptiv PLC, Mobileye Global Inc., ZF Friedrichshafen AG, Valeo S.A., Autoliv Inc., Aisin Corporation, Hyundai Mobis Co., Ltd., Panasonic Corporation, Texas Instruments Incorporated, NXP Semiconductors N.V., Infineon Technologies AG, Qualcomm Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of automotive collision avoidance systems is poised for transformative growth, driven by technological advancements and regulatory pressures. As machine learning and artificial intelligence continue to evolve, their integration into safety systems will enhance real-time decision-making capabilities. Furthermore, the rise of electric vehicles will create new opportunities for innovative safety features, as manufacturers seek to differentiate their offerings in a competitive market. The focus on user-centric design will also shape the development of these systems, ensuring they meet consumer expectations for safety and convenience.

| Segment | Sub-Segments |

|---|---|

| By Type | Adaptive Cruise Control Lane Departure Warning Systems Automatic Emergency Braking Blind Spot Detection Parking Assistance Systems Collision Mitigation Systems Forward Collision Warning Rear Cross Traffic Alert Others |

| By End-User | Passenger Vehicles Commercial Vehicles Fleet Operators Government and Public Transport Others |

| By Component | Sensors (Radar, LiDAR, Ultrasonic) Cameras Control Units/ECUs Software & Algorithms Others |

| By Sales Channel | OEMs Aftermarket Online Sales Others |

| By Distribution Mode | Direct Sales Distributors Retail Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Application | Urban Driving Highway Driving Off-Road Driving Others |

| By Technology | Radar LiDAR Camera Ultrasonic Others |

| By Function | Adaptive Automated Monitoring Warning |

| By Geography | North America Europe Asia-Pacific Rest of World |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Safety Systems | 120 | Automotive Engineers, Product Managers |

| Commercial Fleet Safety Technologies | 80 | Fleet Managers, Safety Compliance Officers |

| Consumer Perception of Safety Features | 100 | Car Owners, Automotive Enthusiasts |

| Regulatory Impact on Safety Systems | 60 | Policy Makers, Industry Analysts |

| Technological Innovations in Collision Avoidance | 70 | R&D Managers, Technology Developers |

The Global Automotive Collision Avoidance Systems Market is valued at approximately USD 64 billion, driven by increasing consumer demand for safety features, advancements in sensor technologies, and the rising adoption of autonomous driving systems.