Region:Global

Author(s):Geetanshi

Product Code:KRAB0141

Pages:91

Published On:August 2025

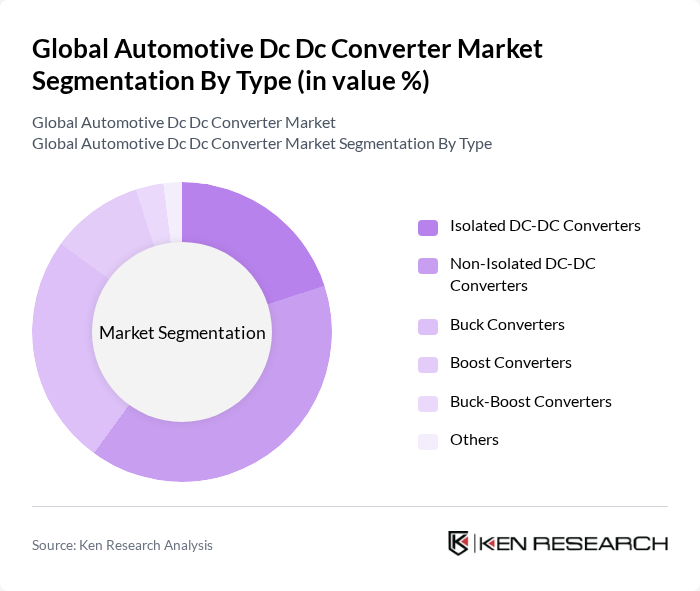

By Type:

The market is segmented into various types of DC-DC converters, including Isolated DC-DC Converters, Non-Isolated DC-DC Converters, Buck Converters, Boost Converters, Buck-Boost Converters, and Others. Among these, Non-Isolated DC-DC Converters are leading the market due to their cost-effectiveness and simplicity in design, making them a preferred choice for many automotive applications. Buck Converters also hold a significant share as they are widely used for voltage regulation in electric vehicles, enhancing overall efficiency. Isolated converters are favored for applications requiring electrical separation between circuits, particularly in safety-critical automotive subsystems.

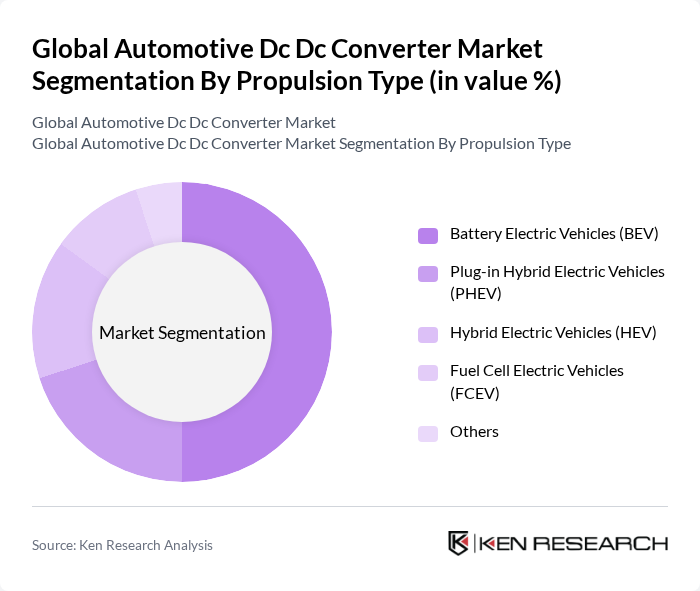

By Propulsion Type:

The market is categorized based on propulsion types, including Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Hybrid Electric Vehicles (HEV), Fuel Cell Electric Vehicles (FCEV), and Others. Battery Electric Vehicles (BEV) dominate the market due to the increasing consumer shift towards fully electric vehicles, driven by environmental concerns and government incentives. The growing infrastructure for EV charging stations also supports the expansion of BEVs, further solidifying their market leadership. Fuel Cell Electric Vehicles are gaining traction, particularly in regions with hydrogen infrastructure development, while hybrid and plug-in hybrid vehicles remain important segments for transitional markets.

The Global Automotive DC-DC Converter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Texas Instruments Inc., Infineon Technologies AG, ON Semiconductor Corporation, STMicroelectronics N.V., Vicor Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, Analog Devices, Inc., Delta Electronics, Inc., Murata Manufacturing Co., Ltd., Broadcom Inc., Maxim Integrated Products, Inc., Power Integrations, Inc., ROHM Semiconductor, TDK Corporation, Continental AG, BorgWarner Inc., Denso Corporation, Valeo, Toyota Industries Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive DC-DC converter market appears promising, driven by technological advancements and increasing regulatory support for electric mobility. As manufacturers focus on integrating smart technologies and enhancing energy efficiency, the demand for innovative power management solutions will rise. Additionally, the expansion of charging infrastructure and the growing adoption of hybrid vehicles will further stimulate market growth, positioning the industry for significant developments in the coming years in None.

| Segment | Sub-Segments |

|---|---|

| By Type | Isolated DC-DC Converters Non-Isolated DC-DC Converters Buck Converters Boost Converters Buck-Boost Converters Others |

| By Propulsion Type | Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) Hybrid Electric Vehicles (HEV) Fuel Cell Electric Vehicles (FCEV) Others |

| By Application | Power Management Systems Battery Management Systems Electric Drive Systems Charging Systems Infotainment & Lighting Systems Safety & ADAS Systems Others |

| By Power Output | Less than 1 kW kW to 10 kW More than 10 kW |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Electric Buses Two-Wheelers Others |

| By Region | Asia Pacific North America Europe Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 60 | Product Development Engineers, R&D Managers |

| Hybrid Vehicle Suppliers | 50 | Supply Chain Managers, Procurement Specialists |

| Automotive Component Distributors | 40 | Sales Managers, Distribution Coordinators |

| Charging Infrastructure Providers | 40 | Business Development Managers, Technical Directors |

| Automotive Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

The Global Automotive DC-DC Converter Market is valued at approximately USD 4.3 billion, driven by the increasing adoption of electric and hybrid vehicles, advancements in battery technologies, and a growing demand for energy-efficient automotive solutions.