Region:Global

Author(s):Shubham

Product Code:KRAA1696

Pages:92

Published On:August 2025

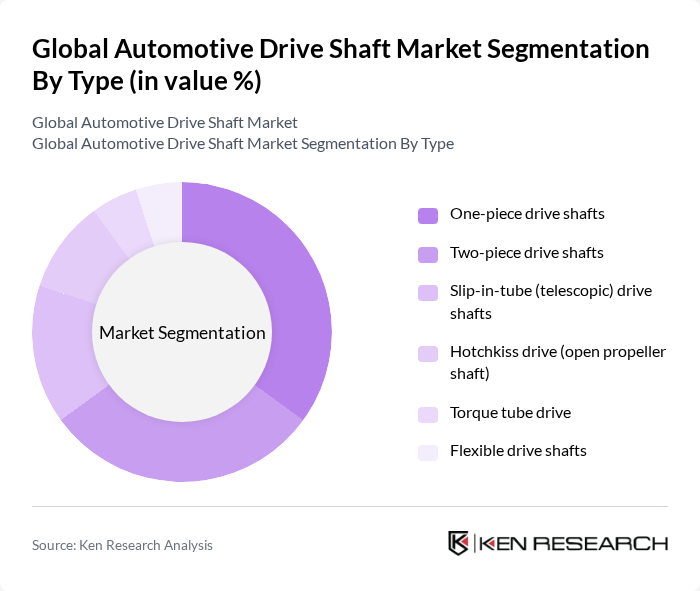

By Type:The market is segmented into various types of drive shafts, including one-piece, two-piece, slip-in-tube (telescopic), Hotchkiss drive (open propeller shaft), torque tube, and flexible drive shafts. One-piece drive shafts are gaining traction for packaging simplicity and mass reduction in shorter wheelbase and performance applications, while two-piece shafts remain prevalent in longer wheelbase vehicles and trucks for NVH control and critical speed management. Demand for slip-in-tube designs is increasing where compact packaging and axial movement compliance are required, particularly in modern multi-link suspensions and certain AWD architectures.

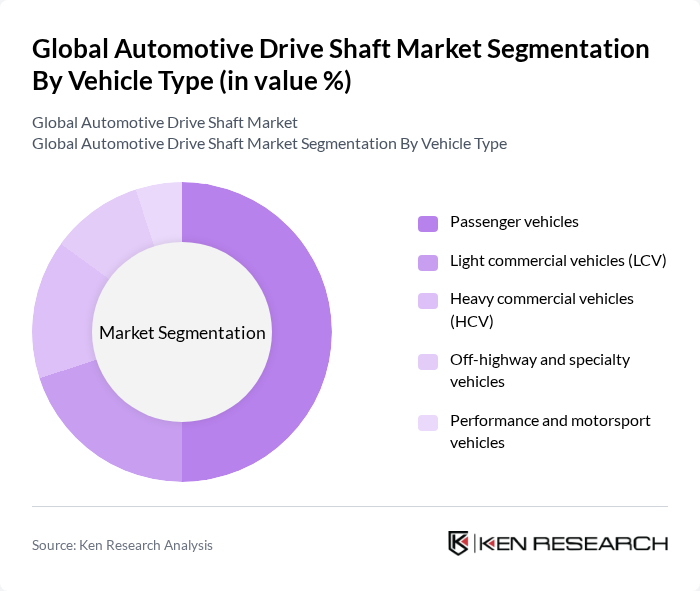

By Vehicle Type:The segmentation by vehicle type includes passenger vehicles, light commercial vehicles (LCV), heavy commercial vehicles (HCV), off-highway and specialty vehicles, and performance and motorsport vehicles. Passenger vehicles dominate owing to large-scale production and global parc growth. Electrification in passenger and commercial fleets is influencing specifications toward lighter, higher-torsional-stiffness shafts and integrated e-axle half-shafts. LCV demand is supported by e-commerce and last-mile delivery growth, sustaining volumes for both conventional and electrified drivelines.

The Global Automotive Drive Shaft Market is characterized by a dynamic mix of regional and international players. Leading participants such as GKN Automotive, Dana Incorporated, American Axle & Manufacturing (AAM), NTN Corporation, JTEKT Corporation (including Koyo), ZF Friedrichshafen AG, Nexteer Automotive, Hyundai WIA Corporation, Meritor, Inc. (now part of Cummins Inc.), IFA Group (Industrievereinigung Fahrzeugbau), Aisin Corporation, Schaeffler AG, Neapco Holdings, Wanxiang Qianchao Co., Ltd., GWB (Shafts) by Dana and Elbe Group contribute to innovation, geographic expansion, and service delivery in this space.

The automotive drive shaft market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As manufacturers increasingly adopt modular designs and integrate smart technologies, the market will likely see enhanced product offerings. Additionally, the growing emphasis on sustainability will push companies to innovate in material sourcing and recycling practices. These trends will create a dynamic landscape, fostering collaboration between traditional automotive players and emerging electric vehicle manufacturers, ultimately reshaping the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | One-piece drive shafts Two-piece drive shafts Slip-in-tube (telescopic) drive shafts Hotchkiss drive (open propeller shaft) Torque tube drive Flexible drive shafts |

| By Vehicle Type | Passenger vehicles Light commercial vehicles (LCV) Heavy commercial vehicles (HCV) Off-highway and specialty vehicles Performance and motorsport vehicles |

| By Sales Channel | OEM Aftermarket |

| By Material | Steel Aluminum Carbon fiber/composite Hybrid structures (e.g., aluminum-steel, composite-steel) |

| By Drivetrain | Front-wheel drive Rear-wheel drive All-wheel/4-wheel drive E-axle and hybrid driveline applications |

| By Distribution Channel | Direct sales to OEMs Authorized distributors/wholesalers Online and e-commerce aftermarket Retail and workshops |

| By Design | Hollow shaft Solid shaft Composite layup designs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Drive Shafts | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Drive Shafts | 90 | Fleet Managers, Procurement Specialists |

| Aftermarket Drive Shaft Sales | 70 | Retail Managers, Parts Distributors |

| Drive Shaft Manufacturing Processes | 60 | Manufacturing Engineers, Quality Control Managers |

| Technological Innovations in Drive Shafts | 50 | R&D Managers, Automotive Technology Experts |

The Global Automotive Drive Shaft Market is valued at approximately USD 36.5 billion, driven by increasing demand for passenger and commercial vehicles, advancements in automotive technology, and the adoption of lightweight materials to enhance fuel efficiency.