Region:Global

Author(s):Shubham

Product Code:KRAC0686

Pages:83

Published On:August 2025

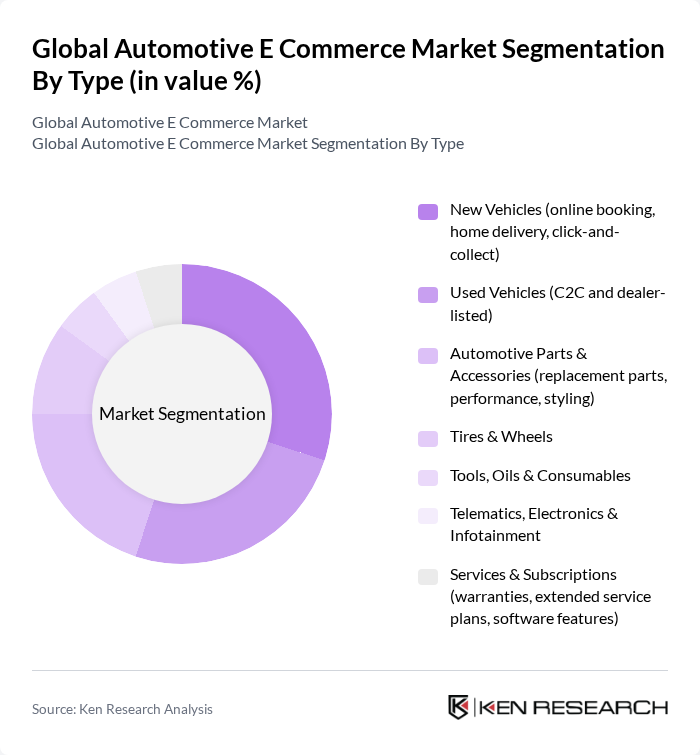

By Type:The segmentation by type includes various categories such as New Vehicles, Used Vehicles, Automotive Parts & Accessories, Tires & Wheels, Tools, Oils & Consumables, Telematics, Electronics & Infotainment, and Services & Subscriptions. Each of these subsegments plays a crucial role in the overall market dynamics.

The New Vehicles segment is currently dominating the market due to the increasing trend of online vehicle purchases, which offers consumers convenience and a wider selection. The rise of digital platforms has made it easier for consumers to compare prices and features, leading to a significant shift in buying behavior. Additionally, the growing acceptance of home delivery services has further propelled this segment's growth. The Used Vehicles segment also shows strong performance, driven by the demand for affordable options and the increasing trust in online transactions.

By End-User:The end-user segmentation includes Individual Consumers, Professional Installers/Workshops, Fleet Operators & Mobility Providers, and Automotive Dealerships & Independent Retailers. Each segment has unique needs and purchasing behaviors that influence the overall market.

The Individual Consumers segment is leading the market, primarily due to the growing trend of DIY (Do It Yourself) automotive maintenance and repair. Consumers are increasingly turning to online platforms for purchasing parts and accessories, driven by the desire for cost savings and convenience. Professional Installers and Workshops also represent a significant portion of the market, as they rely on e-commerce for sourcing parts and tools efficiently. Fleet Operators and Mobility Providers are emerging as key players, leveraging online platforms to manage their vehicle maintenance needs effectively.

The Global Automotive E Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.com, Inc., eBay Inc., Alibaba Group Holding Limited, JD.com, Inc., Walmart Inc., AutoZone, Inc., Advance Auto Parts, Inc., Genuine Parts Company (NAPA), LKQ Corporation, CarParts.com, Inc., RockAuto, LLC, CARiD (VerticalScope Inc.), O’Reilly Automotive, Inc., Auto1 Group SE, Carvana Co., Vroom, Inc., Cars.com Inc., AutoTrader Group (AutoTrader.co.uk – Auto Trader Group plc), CarGurus, Inc., TrueCar, Inc., Edmunds.com, Inc., Cox Automotive, Inc. (Kelley Blue Book, Autotrader.com, Manheim), Denso Corporation (aftermarket e-commerce initiatives), Robert Bosch GmbH (Bosch Automotive Aftermarket), Tuhu Car Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive e-commerce market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As platforms increasingly integrate AI and machine learning, personalized shopping experiences will enhance customer engagement. Additionally, the expansion into emerging markets, where internet penetration is rapidly increasing, presents significant opportunities. Companies that adapt to these trends and prioritize consumer trust will likely thrive, positioning themselves as leaders in the evolving automotive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | New Vehicles (online booking, home delivery, click-and-collect) Used Vehicles (C2C and dealer-listed) Automotive Parts & Accessories (replacement parts, performance, styling) Tires & Wheels Tools, Oils & Consumables Telematics, Electronics & Infotainment Services & Subscriptions (warranties, extended service plans, software features) |

| By End-User | Individual Consumers (DIY) Professional Installers/Workshops (DIFM) Fleet Operators & Mobility Providers Automotive Dealerships & Independent Retailers |

| By Sales Channel | OEM-Operated Stores (direct-to-consumer) Specialist Aftermarket Retailers (pure-play e-tailers) Third-Party Marketplaces Omnichannel (online-to-offline, BOPIS) |

| By Payment Method | Credit/Debit Cards Digital Wallets & BNPL Bank Transfers Cash on Delivery (select markets) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Demographics | Age Group Income Level Geographic Location |

| By Vehicle Type | Passenger Cars SUVs & Crossovers Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles (EVs) & Hybrids Performance & Luxury Vehicles |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Vehicle Sales | 120 | eCommerce Managers, Sales Directors |

| Automotive Parts and Accessories | 100 | Product Managers, Supply Chain Analysts |

| Consumer Insights on Automotive Purchases | 140 | Automotive Consumers, Market Researchers |

| Logistics and Delivery Services in Automotive E-commerce | 80 | Logistics Managers, Operations Directors |

| Technological Innovations in Automotive E-commerce | 70 | IT Managers, Digital Transformation Leads |

The Global Automotive E Commerce Market is valued at approximately USD 100 billion, reflecting significant growth driven by consumer preferences for convenience and increased smartphone and internet penetration over the past five years.