Region:Global

Author(s):Shubham

Product Code:KRAB0774

Pages:81

Published On:August 2025

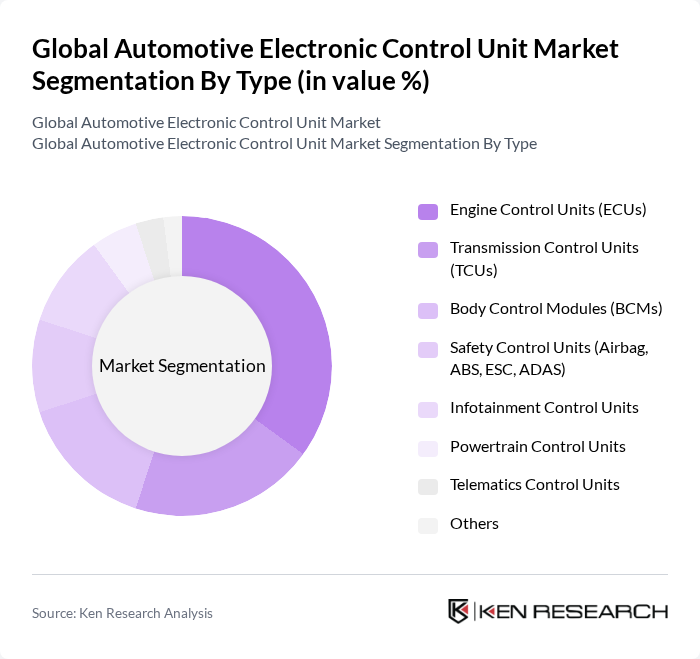

By Type:The market is segmented into various types of electronic control units, including Engine Control Units (ECUs), Transmission Control Units (TCUs), Body Control Modules (BCMs), Safety Control Units (Airbag, ABS, ESC, ADAS), Infotainment Control Units, Powertrain Control Units, Telematics Control Units, and Others. Among these, Engine Control Units (ECUs) hold the largest share due to their essential function in managing engine performance, fuel efficiency, and emissions. The increasing focus on regulatory compliance, fuel economy, and integration of hybrid and electric powertrains has led to higher demand for ECUs, making them a foundational component in modern vehicles.

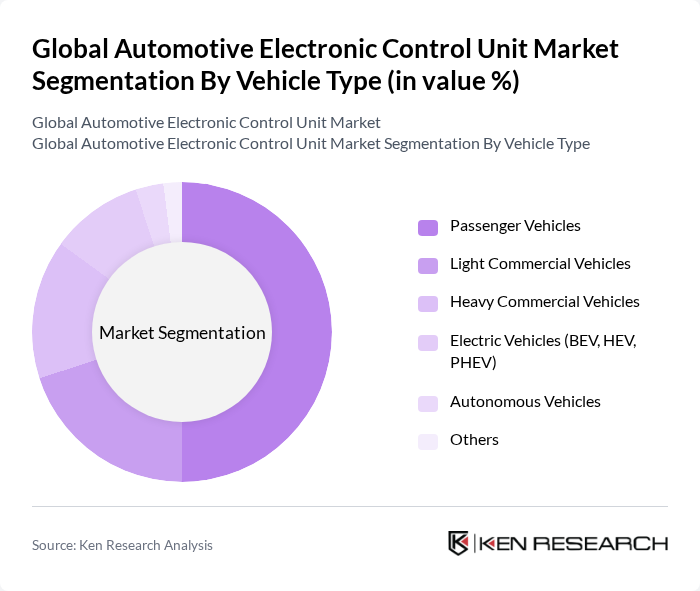

By Vehicle Type:The market is categorized by vehicle types, including Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, Electric Vehicles (BEV, HEV, PHEV), Autonomous Vehicles, and Others. Passenger Vehicles account for the largest share, driven by rising consumer preference for personal mobility, rapid urbanization, and the growing adoption of electric and hybrid vehicles. Increased disposable income and the proliferation of advanced safety and infotainment features further reinforce the dominance of passenger vehicles in the automotive electronic control unit market.

The Global Automotive Electronic Control Unit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, Denso Corporation, Hitachi Astemo, Ltd., Delphi Technologies, Infineon Technologies AG, NXP Semiconductors N.V., Texas Instruments Incorporated, STMicroelectronics N.V., Mitsubishi Electric Corporation, Analog Devices, Inc., Renesas Electronics Corporation, ZF Friedrichshafen AG, Valeo S.A., Aisin Corporation, Autoliv, Inc., NVIDIA Corporation, Qualcomm Technologies, Inc., Intel Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The automotive electronic control unit market is poised for transformative growth, driven by the increasing integration of smart technologies and the shift towards electrification. As manufacturers invest in advanced driver-assistance systems and autonomous vehicle technologies, the demand for sophisticated electronic control units will rise. Additionally, the focus on sustainability and regulatory compliance will further propel innovation, creating a dynamic landscape where collaboration between automotive and technology companies becomes essential for success.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Control Units (ECUs) Transmission Control Units (TCUs) Body Control Modules (BCMs) Safety Control Units (Airbag, ABS, ESC, ADAS) Infotainment Control Units Powertrain Control Units Telematics Control Units Others |

| By Vehicle Type | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles (BEV, HEV, PHEV) Autonomous Vehicles Others |

| By Component | Microcontrollers Sensors Actuators Software/Firmware Power Supply Modules Others |

| By Application | Engine Management Safety and Security (Airbag, ABS, ESC, ADAS) Comfort and Convenience Infotainment & Connectivity Telematics Others |

| By Sales Channel | OEMs Aftermarket Distributors Online Sales Others |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle ECU Manufacturers | 100 | Product Managers, R&D Engineers |

| Commercial Vehicle ECU Suppliers | 60 | Supply Chain Managers, Technical Directors |

| Automotive OEMs | 80 | Procurement Officers, Engineering Managers |

| Aftermarket ECU Providers | 50 | Sales Managers, Business Development Executives |

| Industry Analysts and Consultants | 40 | Market Analysts, Automotive Consultants |

The Global Automotive Electronic Control Unit Market is valued at approximately USD 83 billion, reflecting significant growth driven by advancements in automotive technology, increased demand for electric vehicles, and the integration of advanced driver assistance systems (ADAS).