Region:Global

Author(s):Shubham

Product Code:KRAA1749

Pages:97

Published On:August 2025

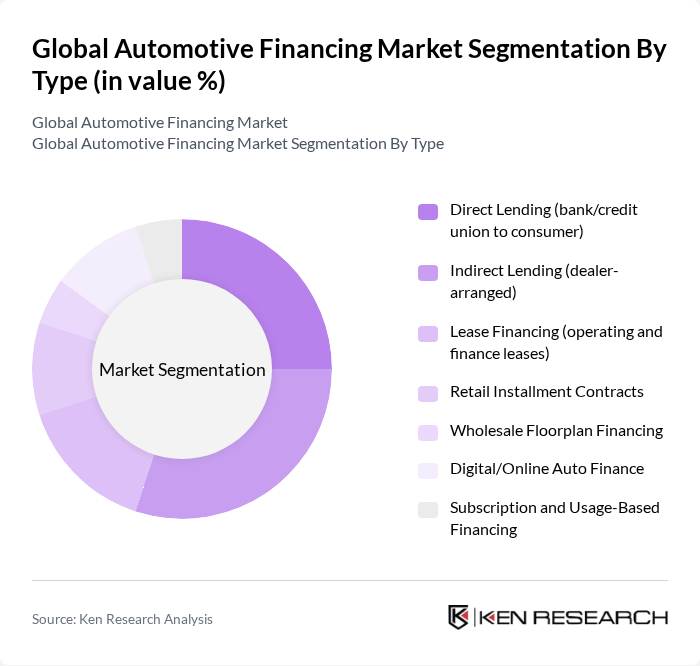

By Type:The automotive financing market can be segmented into various types, including Direct Lending, Indirect Lending, Lease Financing, Retail Installment Contracts, Wholesale Floorplan Financing, Digital/Online Auto Finance, and Subscription and Usage-Based Financing. Each of these segments caters to different consumer needs and preferences, with digital financing gaining traction due to the rise of online and mobile origination platforms offered by banks and captives .

By End-User:This segment includes Individual Consumers, Small & Medium Enterprises (SMEs), Large Fleets and Corporates, and Government & Public Sector Fleets. The individual consumer segment is particularly significant, driven by persistent consumer demand, higher vehicle transaction prices boosting financing uptake, and expanded captive/bank product offerings with digital onboarding .

The Global Automotive Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Financial Services (Toyota Motor Credit Corporation), Ford Credit (Ford Motor Credit Company), Volkswagen Financial Services AG, BMW Financial Services, Mercedes?Benz Mobility AG (Mercedes?Benz Financial Services), General Motors Financial Company, Inc. (GM Financial), Nissan Motor Acceptance Company (NMAC), American Honda Finance Corporation (Honda Financial Services), Hyundai Capital America (Hyundai Motor Finance), Kia Finance (Kia Motors Finance), Stellantis Financial Services (U.S.), Ally Financial Inc., Santander Consumer USA, Capital One Auto Finance, Bank of America Auto Loans, JPMorgan Chase & Co. (Chase Auto), Wells Fargo Auto, Credit Acceptance Corporation, TD Auto Finance LLC, and Volvo Financial Services (VFS US LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The automotive financing market is poised for significant transformation in the coming years, driven by technological advancements and evolving consumer preferences. The shift towards online financing solutions is expected to streamline the application process, enhancing customer experience. Additionally, the increasing focus on electric vehicle financing will create new opportunities for lenders to cater to environmentally conscious consumers. As the market adapts to these trends, innovative financing models will likely emerge, reshaping the competitive landscape and driving growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Direct Lending (bank/credit union to consumer) Indirect Lending (dealer-arranged) Lease Financing (operating and finance leases) Retail Installment Contracts Wholesale Floorplan Financing Digital/Online Auto Finance Subscription and Usage-Based Financing |

| By End-User | Individual Consumers Small & Medium Enterprises (SMEs) Large Fleets and Corporates Government & Public Sector Fleets |

| By Financing Provider | Banks Captive Finance (OEM-affiliated) Independent Finance Companies Credit Unions & Cooperative Lenders Fintech & Online Lenders |

| By Vehicle Type | New Passenger Vehicles Used Passenger Vehicles Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs)/Trucks & Buses Electric Vehicles (Battery EVs, PHEVs) Luxury & Premium Vehicles |

| By Loan/Lease Tenure | Short-term (?36 months) Medium-term (37–60 months) Long-term (>60 months) |

| By Channel | OEM/Dealer Channel Direct-to-Consumer (online and branch) Aggregators & Marketplaces |

| By Customer Credit Tier | Prime Borrowers Near-prime Borrowers Subprime Borrowers Deep Subprime Borrowers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Dealership Financing Options | 150 | Finance Managers, Sales Directors |

| Consumer Preferences in Automotive Financing | 140 | Car Buyers, Financial Advisors |

| Leasing vs. Buying Trends | 100 | Leasing Managers, Automotive Analysts |

| Impact of Interest Rates on Financing | 80 | Economists, Financial Planners |

| Regulatory Impacts on Automotive Financing | 70 | Compliance Officers, Legal Advisors |

The Global Automotive Financing Market is valued between USD 280 billion and USD 295 billion, based on a five-year historical analysis. Estimates from various industry trackers consistently place the market in the high USD 200 billion range.