Region:Global

Author(s):Rebecca

Product Code:KRAC0214

Pages:82

Published On:August 2025

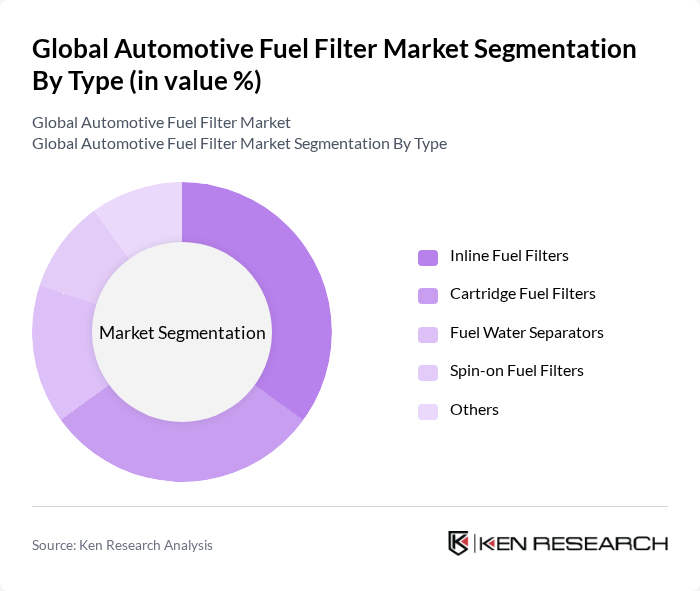

By Type:The market is segmented into Inline Fuel Filters, Cartridge Fuel Filters, Fuel Water Separators, Spin-on Fuel Filters, and Others. Inline Fuel Filters are increasingly preferred for their compact design and effective contaminant removal, especially in modern high-pressure fuel systems. Cartridge Fuel Filters remain popular due to their ease of replacement and consistent performance in maintaining fuel quality. Fuel Water Separators are gaining importance, particularly in diesel applications, due to the rise of ultra-low-sulphur diesel and the need to prevent water contamination. Spin-on Fuel Filters are widely used in commercial vehicles for their durability and quick servicing features.

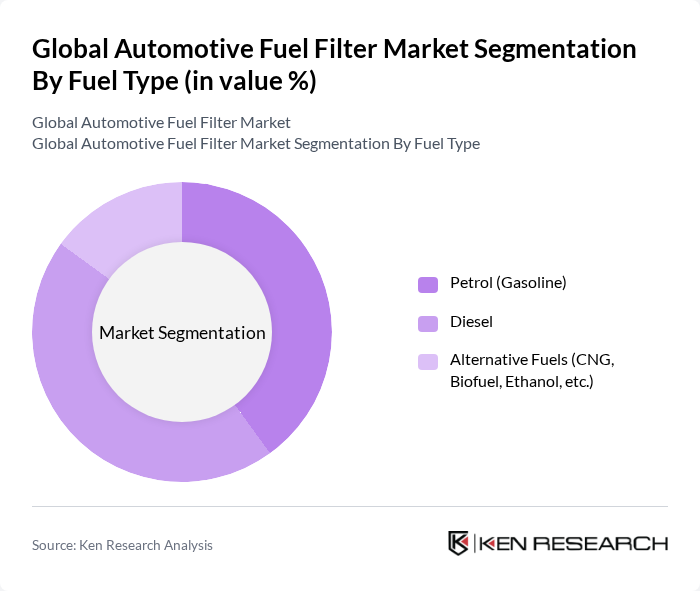

By Fuel Type:The market is categorized into Petrol (Gasoline), Diesel, and Alternative Fuels (CNG, Biofuel, Ethanol, etc.). Diesel fuel filters are prominent due to the expanding diesel vehicle segment and the critical need for water separation and particulate filtration. The demand for petrol fuel filters remains strong, especially in passenger cars. The growing adoption of alternative fuel vehicles, such as those using CNG, biofuels, and ethanol, is driving innovation in filter technology to address unique filtration requirements and support eco-friendly mobility.

The Global Automotive Fuel Filter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Donaldson Company, Inc., Mahle GmbH, MANN+HUMMEL GmbH, ACDelco (General Motors Company), Robert Bosch GmbH, DENSO Corporation, Fram Group (First Brands Group, LLC), Parker Hannifin Corporation, Sogefi S.p.A., Hengst SE, K&N Engineering, Inc., Delphi Technologies (BorgWarner Inc.), UFI Filters S.p.A., Tenneco Inc., Aisin Corporation, Roki Co., Ltd., and Uno Minda Limited contribute to innovation, geographic expansion, and service delivery in this space.

The automotive fuel filter market is poised for significant transformation driven by technological advancements and regulatory changes. As manufacturers increasingly adopt IoT technologies, fuel filtration systems will become smarter, enhancing performance and efficiency. Additionally, the shift towards electric vehicles will create new opportunities for innovative filtration solutions. Companies that invest in research and development to create eco-friendly and efficient products will likely lead the market, adapting to evolving consumer preferences and regulatory demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Inline Fuel Filters Cartridge Fuel Filters Fuel Water Separators Spin-on Fuel Filters Others |

| By Fuel Type | Petrol (Gasoline) Diesel Alternative Fuels (CNG, Biofuel, Ethanol, etc.) |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Medium and Heavy Commercial Vehicles Two-Wheelers Off-Highway Vehicles (Agricultural, Construction, Mining) |

| By Sales Channel | OEM Aftermarket Online Platforms Organized Retailers Independent Garages |

| By Filter Media | Cellulose Synthetic (Glass, Polyester) Multi-layer Composites Water Separator/Coalescer Elements Others |

| By Geography | North America (U.S., Canada, Rest of North America) Europe (Germany, U.K., France, Italy, Spain, Russia, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia & New Zealand, Rest of Asia-Pacific) South America (Brazil, Argentina, Rest of South America) Middle East & Africa (Saudi Arabia, UAE, Turkey, South Africa, Egypt, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Fuel Filter Market | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Fuel Filter Market | 90 | Fleet Managers, Maintenance Supervisors |

| Aftermarket Fuel Filter Sales | 60 | Retail Managers, Automotive Parts Distributors |

| Fuel Filter Technology Innovations | 50 | R&D Engineers, Technical Directors |

| Regulatory Impact on Fuel Filters | 40 | Compliance Officers, Policy Analysts |

The Global Automotive Fuel Filter Market is valued at approximately USD 3 billion, reflecting a steady growth driven by increasing vehicle ownership, stricter emission regulations, and advancements in fuel filtration technologies.