Region:Global

Author(s):Rebecca

Product Code:KRAD0302

Pages:95

Published On:August 2025

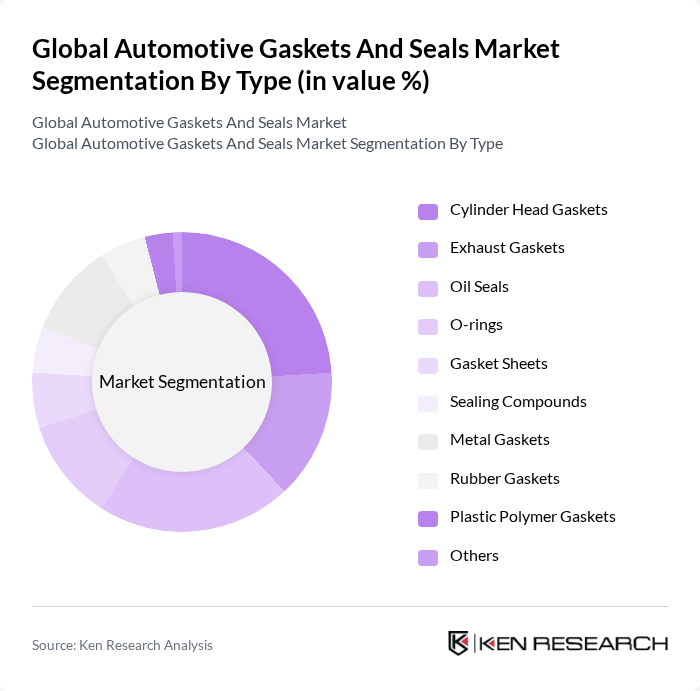

By Type:The market is segmented into various types of gaskets and seals, including Cylinder Head Gaskets, Exhaust Gaskets, Oil Seals, O-rings, Gasket Sheets, Sealing Compounds, Metal Gaskets, Rubber Gaskets, Plastic Polymer Gaskets, and Others. Among these, Cylinder Head Gaskets and Oil Seals are particularly significant due to their critical roles in engine performance and reliability. The demand for these components is driven by the increasing production of internal combustion engine vehicles and the need for effective sealing solutions in hybrid and electric vehicles .

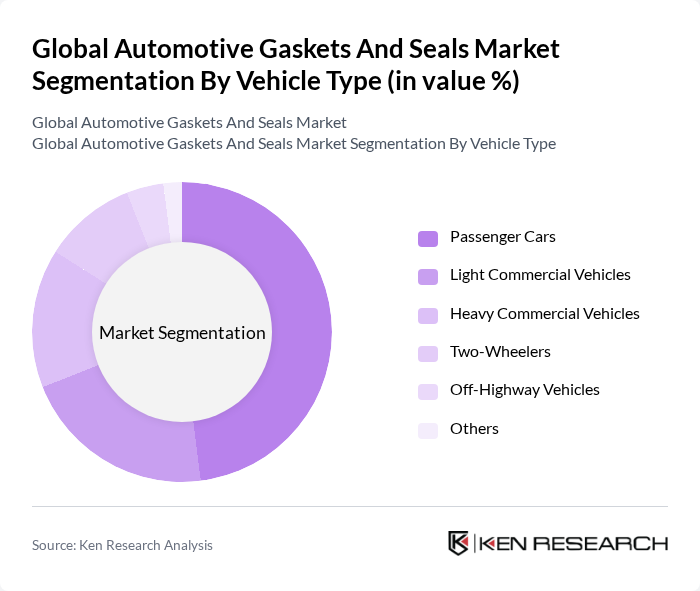

By Vehicle Type:The market is segmented by vehicle type into Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers, Off-Highway Vehicles, and Others. Passenger Cars dominate the market due to their high production volumes and the increasing consumer preference for personal vehicles. The growth in urbanization and disposable income in emerging economies is also contributing to the rising demand for passenger cars, thereby boosting the need for gaskets and seals .

The Global Automotive Gaskets and Seals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Federal-Mogul Corporation, ElringKlinger AG, Dana Incorporated, Trelleborg AB, Victor Reinz (a brand of Dana Incorporated), MAHLE GmbH, NOK Corporation, Parker Hannifin Corporation, Cooper Standard Automotive Inc., Henniges Automotive Holdings, Inc., Saint-Gobain S.A., Aisin Seiki Co., Ltd., Sika AG, JTEKT Corporation, Continental AG, SKF Group, Tenneco Inc., Freudenberg Sealing Technologies, Hutchinson SA, KACO GmbH + Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The automotive gaskets and seals market is poised for transformative growth, driven by the shift towards electric vehicles (EVs) and the increasing emphasis on sustainability. As EV production is expected to reach 20 million units in future, manufacturers will need to adapt their sealing technologies to meet the unique requirements of electric drivetrains. Additionally, the focus on recycling and eco-friendly materials will create new avenues for innovation, positioning the market for robust expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cylinder Head Gaskets Exhaust Gaskets Oil Seals O-rings Gasket Sheets Sealing Compounds Metal Gaskets Rubber Gaskets Plastic Polymer Gaskets Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Two-Wheelers Off-Highway Vehicles Others |

| By Application | Engine Components Transmission Systems HVAC Systems Fuel Systems Battery & Electric Powertrain (EV/Hybrid) Others |

| By Material | Metal Rubber Silicone Composite Materials Plastic Polymers Paper Others |

| By Sales Channel | OEMs Aftermarket Online Retail Distributors Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Gaskets | 120 | Product Engineers, Quality Assurance Managers |

| Commercial Vehicle Seals | 90 | Procurement Managers, Fleet Operations Directors |

| Electric Vehicle Components | 60 | R&D Engineers, Sustainability Officers |

| Aftermarket Gasket Suppliers | 50 | Sales Managers, Distribution Coordinators |

| OEM Gasket Manufacturers | 70 | Manufacturing Managers, Supply Chain Analysts |

The Global Automotive Gaskets and Seals Market is valued at approximately USD 27 billion, driven by increasing vehicle demand, advancements in automotive technology, and a focus on fuel efficiency and emissions reduction.