Region:Global

Author(s):Dev

Product Code:KRAD0463

Pages:98

Published On:August 2025

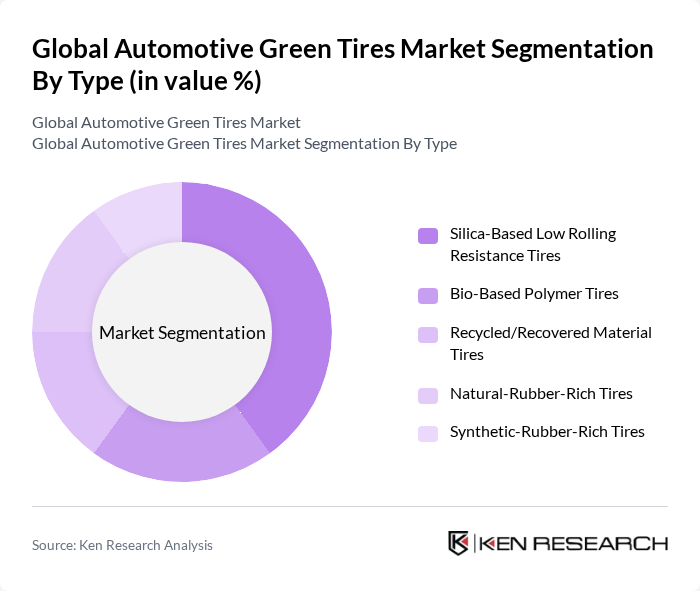

By Type:The market is segmented into various types of green tires, including Silica-Based Low Rolling Resistance Tires, Bio-Based Polymer Tires, Recycled/Recovered Material Tires, Natural-Rubber-Rich Tires, and Synthetic-Rubber-Rich Tires. Among these, Silica-Based Low Rolling Resistance Tires are leading due to their efficiency in reducing fuel consumption and enhancing vehicle performance; lower rolling resistance is a primary, well-documented driver for OEM fitment and replacement demand in regions with fuel economy and CO? targets.

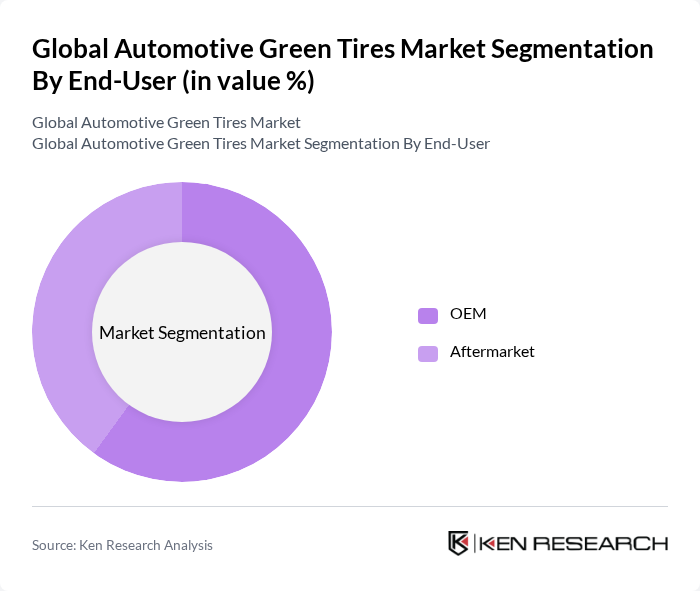

By End-User:The market is divided into two primary end-user segments: OEM (Original Equipment Manufacturer) and Aftermarket. The OEM segment is currently dominating the market due to the increasing production of electric and hybrid vehicles, which benefit from specialized low rolling resistance and EV-optimized tires to extend driving range; regulatory and labeling pressures also encourage OEM adoption at the point of new vehicle production.

The Global Automotive Green Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin, Bridgestone, Continental AG, The Goodyear Tire & Rubber Company, Pirelli & C. S.p.A., The Yokohama Rubber Co., Ltd., Hankook Tire & Technology Co., Ltd., Sumitomo Rubber Industries, Ltd. (Dunlop), Apollo Tyres Ltd., Nokian Tyres plc, Toyo Tire Corporation, Nexen Tire Corporation, Kumho Tire Co., Inc., Linglong Tire (Shandong Linglong Tire Co., Ltd.), CEAT Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive green tires market appears promising, driven by increasing consumer demand for sustainable products and ongoing technological advancements. As electric vehicle sales continue to rise, projected to reach35%of total vehicle sales in the future, the need for specialized tires will grow. Additionally, manufacturers are likely to invest in innovative materials and production methods, enhancing the performance and sustainability of green tires. This evolving landscape presents significant opportunities for growth and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Silica-Based Low Rolling Resistance Tires Bio-Based Polymer Tires Recycled/Recovered Material Tires Natural-Rubber-Rich Tires Synthetic-Rubber-Rich Tires |

| By End-User | OEM Aftermarket |

| By Application | Passenger Vehicles Commercial Vehicles Two-Wheelers and Other Vehicles |

| By Distribution Channel | Offline (Dealers & Retail Chains) Online (E-commerce Platforms) Direct to OEM |

| By Price Range | Budget Mid-Range Premium |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | Low Rolling Resistance Compounds (High-Dispersible Silica) Smart/Connected Tire Features Sustainable Manufacturing & Circularity (Retreading, Recycling) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Owners | 140 | Car Owners, Eco-conscious Consumers |

| Commercial Fleet Operators | 100 | Fleet Managers, Procurement Officers |

| Automotive Retailers | 80 | Sales Managers, Product Line Managers |

| Environmental Regulatory Bodies | 50 | Policy Makers, Environmental Analysts |

| Research and Development Departments | 70 | R&D Managers, Sustainability Officers |

The Global Automotive Green Tires Market is valued at approximately USD 11.5 billion, reflecting a growing trend towards sustainable automotive solutions. This valuation is based on a comprehensive five-year analysis of market dynamics and consumer preferences.