Region:Global

Author(s):Dev

Product Code:KRAB0663

Pages:86

Published On:August 2025

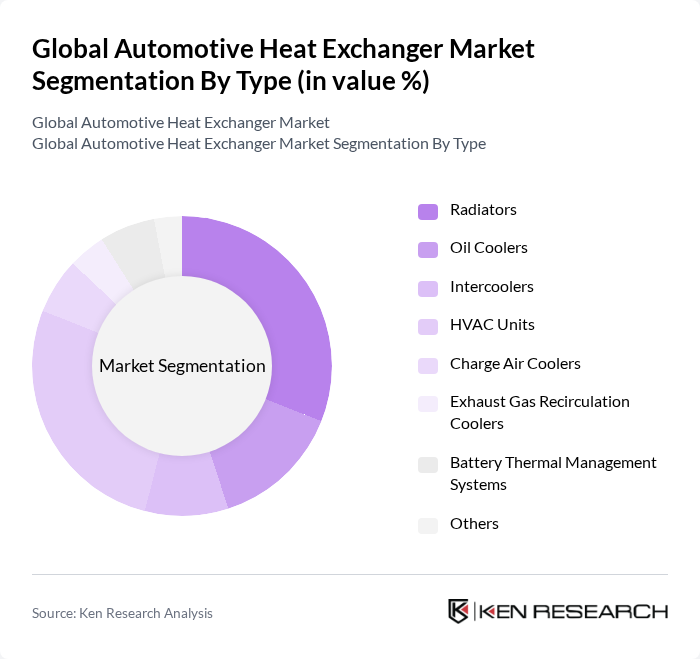

By Type:The automotive heat exchanger market can be segmented into radiators, oil coolers, intercoolers, HVAC units, charge air coolers, exhaust gas recirculation coolers, battery thermal management systems, and others. Among these, radiators and HVAC units are the most prominent due to their essential roles in vehicle cooling and climate control systems. The increasing focus on vehicle efficiency, lightweight materials, and passenger comfort has led to a surge in demand for these components. Battery thermal management systems are also gaining traction with the growth of electric vehicles .

By End-User:The end-user segmentation of the automotive heat exchanger market includes passenger vehicles, commercial vehicles, two-wheelers, electric vehicles, heavy-duty vehicles, off-highway vehicles, and others. Passenger vehicles dominate this segment due to the high volume of personal vehicles on the road and increasing consumer demand for comfort and efficiency. The rise of electric vehicles is also contributing to the growth of specialized heat exchangers designed for battery cooling and thermal management .

The Global Automotive Heat Exchanger Market is characterized by a dynamic mix of regional and international players. Leading participants such as Valeo S.A., MAHLE GmbH, DENSO Corporation, Modine Manufacturing Company, Hanon Systems, Calsonic Kansei Corporation, T.RAD Co., Ltd., AKG Group, Sogefi S.p.A., Continental AG, Behr Hella Service GmbH, Aisin Corporation, ZF Friedrichshafen AG, Alfa Laval AB, BorgWarner Inc., GKN Automotive, Dana Incorporated, Sanden Holdings Corporation, Dura Automotive Systems, Valeo S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive heat exchanger market is poised for transformative growth, driven by the increasing adoption of electric and hybrid vehicles. As manufacturers prioritize energy efficiency and sustainability, innovations in heat exchanger technology will play a crucial role in enhancing vehicle performance. Additionally, the expansion of automotive production in emerging markets, particularly in Asia-Pacific, will further stimulate demand. The focus on integrating smart technologies and lightweight materials will also shape the future landscape, ensuring that heat exchangers remain vital components in modern vehicles.

| Segment | Sub-Segments |

|---|---|

| By Type | Radiators Oil Coolers Intercoolers HVAC Units Charge Air Coolers Exhaust Gas Recirculation Coolers Battery Thermal Management Systems Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers Electric Vehicles Heavy-Duty Vehicles Off-Highway Vehicles Others |

| By Application | Engine Cooling Cabin Heating Air Conditioning Turbocharging Battery Cooling Transmission Cooling Others |

| By Material | Aluminum Copper Steel Composite Materials High-Entropy Alloys Others |

| By Distribution Channel | OEMs Aftermarket Online Sales Retail Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Heat Exchangers | 100 | Product Engineers, R&D Managers |

| Commercial Vehicle Heat Exchangers | 80 | Procurement Managers, Operations Directors |

| Electric Vehicle Thermal Management | 60 | Technical Specialists, Design Engineers |

| Aftermarket Heat Exchanger Solutions | 50 | Sales Managers, Distribution Heads |

| Heat Exchanger Manufacturing Processes | 40 | Manufacturing Engineers, Quality Control Managers |

The Global Automotive Heat Exchanger Market is valued at approximately USD 23.5 billion, reflecting a significant growth trend driven by the demand for efficient thermal management systems, particularly in electric and hybrid vehicles.