Region:Global

Author(s):Shubham

Product Code:KRAA1891

Pages:95

Published On:August 2025

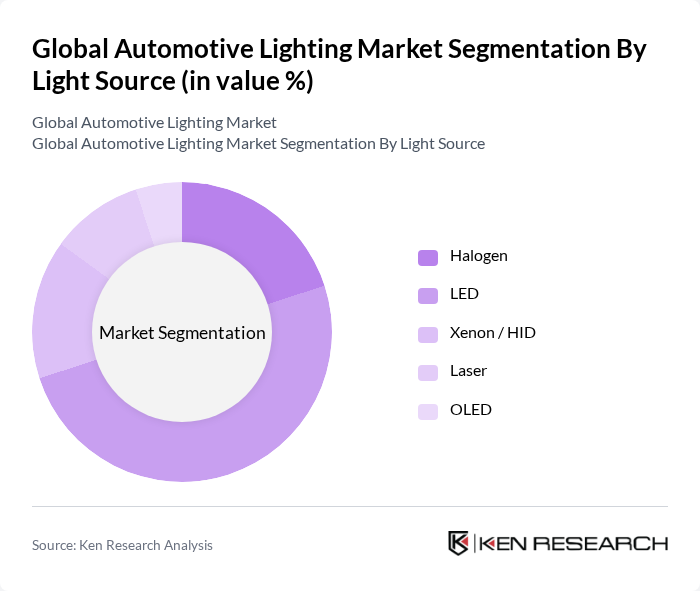

By Light Source:The automotive lighting market is segmented by light source into Halogen, LED, Xenon/HID, Laser, and OLED. Among these, LED lighting has gained significant traction due to its energy efficiency, longer lifespan, and superior brightness compared to traditional halogen lights. The growing consumer preference for LED technology, driven by its cost-effectiveness and environmental benefits, has positioned it as the leading sub-segment in the market.

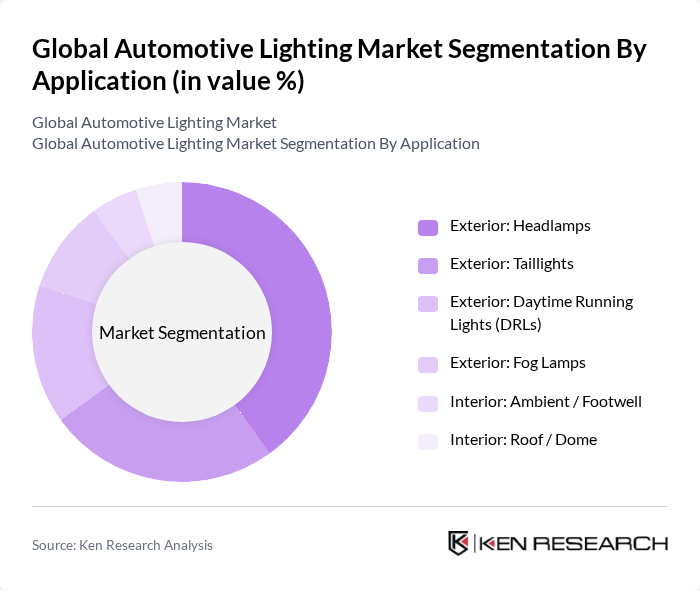

By Application:The market is also segmented by application into Exterior: Headlamps, Exterior: Taillights, Exterior: Daytime Running Lights (DRLs), Exterior: Fog Lamps, Interior: Ambient/Footwell, and Interior: Roof/Dome. The headlamps segment is the most significant due to the essential role of lighting in vehicle safety and visibility. The increasing adoption of advanced headlamp technologies, such as adaptive and matrix lighting, is driving growth in this segment.

The Global Automotive Lighting Market is characterized by a dynamic mix of regional and international players. Leading participants such as KOITO MANUFACTURING CO., LTD., HELLA GmbH & Co., KGaA (FORVIA HELLA), Valeo SE, Stanley Electric Co., Ltd., ZKW Group GmbH, Marelli Automotive Lighting (Marelli S.p.A.), OSRAM (ams OSRAM), Varroc Engineering Limited, SL Corporation (Seoul, formerly Samlip), TYC Brother Industrial Co., Ltd., Nichia Corporation, LG Innotek Co., Ltd., Samsung LED (Samsung Electronics Co., Ltd.), Lumileds Holding B.V., Renesas Electronics Corporation (Automotive Lighting Drivers) contribute to innovation, geographic expansion, and service delivery in this space.

The automotive lighting market is poised for significant transformation driven by technological advancements and changing consumer preferences. As electric vehicles gain traction, the demand for innovative lighting solutions that enhance safety and efficiency will increase. Additionally, the integration of IoT technologies in automotive lighting systems is expected to create new functionalities, such as remote control and diagnostics, further enhancing user experience. These trends indicate a dynamic future for the automotive lighting industry, with substantial growth potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Light Source | Halogen LED Xenon / HID Laser OLED |

| By Application | Exterior: Headlamps Exterior: Taillights Exterior: Daytime Running Lights (DRLs) Exterior: Fog Lamps Interior: Ambient / Footwell Interior: Roof / Dome |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Medium & Heavy Commercial Vehicles Two-Wheelers |

| By Sales Channel | OEM Aftermarket |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range (Aftermarket) | Economy Mid-Range Premium |

| By Technology Feature | Conventional Adaptive / Matrix (ADB) Smart / Connected Lighting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 120 | Product Development Managers, Engineering Leads |

| Aftermarket Lighting Suppliers | 90 | Sales Directors, Product Managers |

| Lighting Technology Innovators | 70 | R&D Engineers, Technology Officers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Automotive Industry Analysts | 60 | Market Analysts, Research Directors |

The Global Automotive Lighting Market is valued at approximately USD 35 billion, driven by the increasing adoption of advanced lighting technologies such as LED, matrix/ADB, and OLED, alongside steady global vehicle production and shifts towards premium and luxury vehicles.